Author's posts

Eugenia Mitrakas – An Open Letter

The proposals that were announced in the Budget Papers in May of 2016 are, in my view, very unfair to people who, like me, have worked hard to fund their own retirement.

An Open Letter from Eugenia Mitrakas to Malcolm Turnbull

Budget Superannuation Proposals

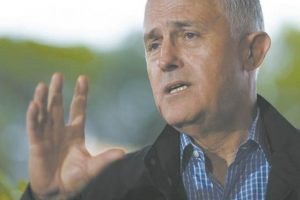

Australian Prime Minister Malcolm Turnbull. PHOTO: AAP/LUKAS COCH

22 Jun 2016

EUGENIA MITRAKAS

Dear Mr Turnbull,

I am a Greek born solicitor in private practice in South Melbourne. I migrated to Australia as a young child with my family in the mid 1950s. I attended all the local primary schools. I have lived and practiced in the South Melbourne/Albert Park area for most of my life. I currently live in Albert Park. I have been in private practice (since 1972) running a small legal business for all my working life employing from time to time 2-5 persons.

I have worked extremely hard for more than four decades and I carefully planned for my retirement. I have, to date, used Superannuation as the main vehicle to fund my retirement. My family was brought up on a hard working ethic and having a government funded retirement benefits or pension in my family was looked upon as an indication of failure in your chosen profession and in small business.

I worked in the family businesses (running boarding houses and running the family fish and chips shops in my younger years during my student years and for a few years, as a young lawyer. I was brought up to believe that any hard work, no matter how menial was honourable and where hard work was considered an asset and, that one is always rewarded by their hard work. I continued to work in my parents’ fish and chips shop for the first few years of running my legal practice. My parents instilled in me a pride in hard work so long as it was honest work. This modest work moulded and helped in building my hard work ethic.

I have worried a lot in recent years about the fate of my county of birth, Greece and the desperate and sad financial position that Greece and the Greek people are faced with.

I have been a proud Australian and considered myself lucky to have had the opportunity to grow up in Australia and have an excellent education. I have indeed been very grateful for the many opportunities that Australia has given me, and in return, I have endeavoured to give back to the general community in Australia in order to repay my “debt” to Australia and to the community at large for giving me this great opportunity. At the same time, I have retained my Greek identity and pride in my Greek background, history and culture. I have an immense passion for the Glory of Classical Greece and its contribution to law health and justice of the modern day. I am a product of a multicultural Australia. I married an Australian who became a multicultural Greek. He read widely on modern and classical Greece and on the glory of Greece. He was the “Australian Skippy”. I brought up two Australian step children who are also proud of their Greek connections. This is a success story in Australia’s multicultural policies.

I do not have any sense of entitlement and have worked extremely hard to reach and achieve my goals. Australia is a country that rewards people who are prepared to work hard to achieve their goals, no matter how ambitious or modest.

I have at all times planned for my retirement and have used Superannuation as a vehicle in achieving this. I do not want to, nor do I expect the Australian people or the Australian government to fund my retirement.

I am currently on a transition to retirement. I have been very interested in the current debate about the changes to the policies about our superannuation.

I have, in the last few years, preached to my friends and relatives in Greece about their attitude and views to their retirement and to their sense of entitlement, which I believe has been a major contributing factor to the current financial crisis in Greece. I informed them of our policies and how our government planned to eliminate old age pensions and promote a community of self funded retirees.

I am, accordingly very disappointed with the proposed changes and the effect that these will have on hard working responsible Australians. I invested funds after tax into my self-managed super funds (SMSF) to fund my retirement and ensure that I was able to maintain my same lifestyle in retirement. I have worked in the family businesses since the age of nine and deserve to be able to enjoy my retirement. I came from a very humble background, encountered all the known and well documented prejudices but through hard work and determination, I was able to overcome them.

The proposals that were announced in the Budget Papers in May of 2016 are, in my view, very unfair to people who, like me, have worked hard to fund their own retirement.

In recent weeks, I have been forced to review my plans to retire and have taken active steps to continue working for an additional 5-10 years to enable me to fund my retirement goal.

The persons who will be caught by the new proposals are innocent hard working members of the community who have worked very hard to grow assets in super strictly within the confines of the law. They should not be penalised for saving in accordance with such laws. These people were actively encouraged by the government to plan and fund their retirement in order to reduce the welfare burden of the government in the future. They have done so with the encouragement and support of the law of past and present governments, both Labour and Liberal/National Parties.

If the government persists with their proposals to change the policies relating to our super, then there must be a grandfathering clause to ensure that persons who have worked hard to fund their retirement in accordance with the law, are not unjustly penalised.

I have followed closely the debate in the media about the new proposals of the Liberal National government. I have read the article which appeared in The Australian Newspaper on 8 June 2016 on page 7, outlining an interview with Mr Jack Hammond QC who has spoken against these proposals.

I fully agree and support the Proposals of Save Our Super that are set out on their web-site: www.saveoursuper.org.au which calls for bipartisan superannuation policies from Australian major political parties. They call for the following actions; which will grandfather the following Budget 2016 superannuation proposals:

– the introduction of a transfer balance cap of $1.6 million on amounts into the tax free retirement (pension) phase from 1 July 2017.

– after commencement, if individuals already in retirement as at 1 July 2017 retain balances in excess of the $1.6 million cap and do not transfer the excess out of the retirement phase account, a similar tax treatment that applies to excess non-concessional contributions will be applied to that excess at the top marginal rate of tax (ie: 49 per cent for the 2014 to 2016 income years);

– establishment from 3 May 2016 of a life-time non-concessional contributions cap of $500,000 on all non-concessional contributions made since 1 July 2007.

– after commencement, if individuals make contributions that cause them to exceed their life-time non-concessional contributions cap do not withdraw their excess after notification by the Australian Tax Office, the tax treatment that applies to excess non-concessional contributions will be applied to that excess at the top marginal rate (ie: 49 per cent for the 2014 to 2016 income years);

– introduction of commensurate measures to defined benefit arrangements;

– removal of the tax exemption on earnings which support Transition to Retirement Income (pension) streams; which will grandfather the following

Opposition’s superannuation policies;

– reduction of the tax-free concession available to people with annual superannuation (pension) incomes from earnings of more than $75,000. From 1 July 2017, future earnings on assets supporting (pension) income streams will be tax-free up to $75,000 a year for each individual. Earnings above the $75,000 threshold will be taxed at 15 per cent. Note: under the proposal, capital gains are to be grandfathered;

– similar concessions reduced for defined benefit superannuation schemes by removal of the 10 per cent tax offset for defined benefit income above $75,000; which will protect all Australians against any legislation which changes the rules of the game for existing superannuation savings and actions taken in reliance on those rules and savings, by including appropriate grandfather clauses.

I am fully cognisant that the government has to “balance the budget” in order to reduce our ever growing debt, but we should not punish innocent persons along the way.

Penalising hard working and responsible members of our community is an unfair way of trying to ‘balance our books’ and encourages people to live on welfare. These persons who have accumulated assets in super are also running a small business and employ a small number of employees. This policy, if implemented, will have a detrimental effect on small business.

I have sent a copy of this letter to the press for publication.

Please let me have your response on or before 27 June 2016 to assist me and my family in making our decision on how to vote at the General Election on 2 July 2016.

Yours faithfully,

Eugenia Mitrakas BA. LLB. OAM”

Federal election 2016: Liberal Curtin members’ super revolt

The Curtin division of the Liberal Party — the wealthiest and most powerful in Western Australia — has passed a motion condemning the Turnbull government’s controversial changes to superannuation which will hit the retirement savings of many in the blue-ribbon electorate.

The motion means the issue will be debated at the Liberal Party’s state conference in August and will put pressure on Curtin MP and Liberal deputy leader Julie Bishop to defend the unpopular changes against claims by party members that they are unfair.

Liberal members in Curtin hope the motion will form part of a backlash against the moves that will ultimately force the Turnbull government to back down before the changes come into effect in July next year.

It is understood that Ms Bishop and other Liberal candidates are regularly receiving complaints on the campaign trail from traditional Liberal voters about the issue.

Some supporters are so angered by the measures — including a $1.6 million cap on accounts — they are refusing to donate to the Coalition’s re-election campaign.

Ms Bishop told The Australian yesterday that the superannuation changes had been raised at an “ideas night” for the Curtin division.

She said only 4 per cent of super account holders across Australia would be affected.

“I look forward to reassuring branch members that the Coalition’s proposed changes to superannuation will mean 96 per cent of Australians will be unaffected or better off as a result,” she said.

The Foreign Minister struggled to explain the detail of the plans when she appeared on Melbourne radio earlier this month.

The Institute of Public Affairs think tank has claimed the number of people affected would be far higher than 4 per cent of the population and has criticised the government for being unable to explain its policy.

Liberal members who attended the Curtin meeting this month said superannuation was nominated as the most important of three issues the division decided to take to the state conference.

They said the division included scores of members who were nearing retirement and now faced a changed financial landscape.

The Curtin division is the most influential in WA and boasts about 1000 members across Perth’s wealthy western suburbs, including Claremont, Cottesloe, Dalkeith, Nedlands, Peppermint Grove and Subiaco.

Under the super changes, the government will cap tax-free retirement accounts at $1.6m and introduce a $500,000 lifetime cap on non-concessional contributions as well as cutbacks to the Transition to Retirement Scheme.

Ms Bishop holds Curtin with a margin of 18.2 per cent, making it the state’s safest seat.

Federal election 2016: Treasury may frown on ALP booking Lib savings

The Australian

12.00am June 29 2016

David Uren – Economics Editor

Labor’s plan to shelve its own superannuation policy while booking savings from the Coalition’s proposal would face difficulties with Treasury if it were elected, and might also be rejected by the Parliamentary Budget Office.

Costing guidelines and budget practice require policy be spelt out in detail before it is included in budget estimates.

Former deputy secretary in the Department of Finance, Stephen Bartos, said Treasury and Finance would have difficulty incorporating savings from the Coalition’s superannuation plan if a newly elected Labor government put it up for review.

“Unless they have a plan they haven’t revealed to do something equivalent, I think that they are in a difficult spot,” he said. “If things are put up for review and not formal policy decisions, then they have to be taken out of the estimates and that would make the estimates worse.”

At the National Press Club yesterday, Bill Shorten emphasised his concern with the claimed retrospectivity in the Coalition’s plan to cap non-concessional contributions to superannuation at $500,000, backdated to 2007, but was unable to say how a Labor government would deal with a funding shortfall if it decided not to go ahead with that.

“I think that the mess that this government’s thrown the whole superannuation system into can be best resolved when Labor forms a government and we talk to people.”

Labor Treasury spokesman Chris Bowen and superannuation spokesman Jim Chalmers have said a Labor government would conduct a review in the second half of this year to report in early 2017, for next year’s budget preparation.

However, Mr Bowen has also promised to bring forward the traditional end of year budget review to September, which would force Labor to crystallise its budget position on the Coalition’s budget proposals.

An added difficulty is that the proposal to which Labor objects most strongly — the cap on non-concessional contributions — actually took effect on budget night, May 3. Excess contributions after that date have to be withdrawn or incur penalty tax.

Deferring the measure would invite wealthy superannuation fund members to maximise contributions before it took effect.

The uncertainty left by Labor’s superannuation retreat is drawing fire from self-managed superannuation funds, with a lobby group saying people needs to know how Labor would affect retirement savings before voting.

“The government estimated its superannuation measures in the budget would result in a net gain to revenue of $2.9 billion. Labor is now proposing to tax superannuation savings to the same extent but is not saying how this will be done,” said executive director of the SMSF Owners Alliance, Duncan Fairweather.

Mr Bowen said he believed the superannuation sector would sit down with a Labor government to come up with a solution “quickly”, to ease the uncertainty.

Whether Labor wins or not, the Parliamentary Budget Office must conduct a review of all party policy costings within 30 days of the election. It might reject Labor’s claim to the budget savings on superannuation but not the policy that delivered them.

Federal election 2016: $3bn dodge dismantles credibility

The Australian

12.00am June 28 2016

Judith Sloan -Contributing Economics Editor Melbourne

Superannuation is one policy area that means a lot to certain people, particularly those in retirement and those heading for retirement. It is a potential vote-changer.

Until Labor’s release of its costings on Sunday, many people would have taken the view that Labor’s superannuation policy had more to commend itself than the government’s raft of superannuation changes announced in this year’s budget.

After all, Labor’s policy, which was released some 18 months ago, had fewer moving parts and there was no intention to make any change to the annual concessional cap or to introduce a backdated, lifetime non-concessional cap.

To be sure, there was the 15 per cent tax on retirement superannuation earnings over $75,000 a year, although there are serious question marks over the workability of this proposal. But it is not too different from the government’s policy of limiting tax-free superannuation accounts to $1.6 million.

After Sunday, however, Labor’s superannuation policy is completely up in the air. It wants to take the budget savings of the government’s superannuation changes — close to $3 billion a year — but won’t be bothering to release any details of its policy before the election.

Opposition Treasury spokesman Chris Bowen could only make this weak statement: “Given Labor’s concerns about the government’s superannuation changes, including retrospective elements, Labor would consult with stakeholders and take a broader examination of all these measures on coming to government.”

This is as clear as mud. Labor won’t be telling anyone what the superannuation measures will be, leaving it to some vague examination and stakeholder consultation, were Labor to win government. So much for the positive policy on superannuation released more than 18 months ago — voters are being told to ignore that and just hang on to their hats.

But there’s more. Under pressure from public sector unions, Labor has also ditched the government’s efficiency dividend announced in the budget. But again, it wants to count the savings, which are around $1.4bn over the forward estimates.

Evidently, removing public sector waste and reducing the use of outside consultants will get Labor there without the loss of a single public sector job. Again, pull the other one. Counting the savings and making vague references about how you might get there just doesn’t cut it.

Labor is really plumbing new depths when it comes to putting up policies for voters’ consideration — assume the same budget savings but don’t worry about outlining any of the details.

For those with a keen interest in superannuation, it really now boils down to the devil and the deep blue sea when it comes to choosing between the Coalition and Labor.

Federal election 2016: no plan but Shorten takes super savings

The Australian

12.00am June 28 2016

David Crowe – Political Correspondent

Bill Shorten has sparked a furious brawl over budget repair by banking $4.9 billion in Coalition savings on superannuation and public service cuts without revealing how he will achieve the gains, while admitting he cannot restore all the “brutal and cruel” hospital cuts he has railed against for two years.

Australians will go to the polls without any certainty over the Opposition Leader’s plans for superannuation, as he claims the $3bn saving included in last month’s budget, but at the same time vows to “revisit” the changes by consulting experts after the election.

The cloud over retirement savings deepened the dispute over election policy costings after Labor also claimed a $1.9bn saving from Coalition cuts to the public service, while rejecting the specific “efficiency dividend” meant to produce the gain.

With only four days until the election, Labor and the Coalition are in an escalating dispute over the budget as Mr Shorten promises to reduce the deficit without “smashing household budgets”, while Scott Morrison warns of higher deficits, debt and taxes if Labor takes power on Saturday.

The row has extended to health as Mr Shorten fends off questions about whether Labor would restore all the state hospital funding that was removed in the Coalition’s 2014 budget — a cut he has campaigned against ever since. While the Opposition Leader denounced the Abbott government’s $57bn cut to state hospital funding over a decade as “brutal and cruel” when it was unveiled, he conceded yesterday he could not return the spending to its old trajectory. This was despite Labor Treasury spokesman Chris Bowen telling the ABC in November 2014: “We want to see the $80bn cut to health and education scrapped.”

Labor’s election costings confirm it will offer about $2bn in hospital funding over four years on top of the $2.9bn boost outlined by Malcolm Turnbull in last month’s budget, making it clear that Mr Shorten’s commitment falls short of restoring all the lost funding over a decade.

“I can go to every hospital in Australia and say vote Labor because we’ll provide for more funding for hospitals,” Mr Shorten said yesterday.

“I can go to every Australian who is currently on an elective surgery waiting list for hip replacements, for knee reconstructions and say vote Labor because we’re actually going to make it more possible for you to have your surgery more quickly.”

Labor financial services spokesman Jim Chalmers vowed on May 26 to reveal the opposition’s policy on super before July 2 in response to the budget changes, which raise $6bn but use about half of this by funding more generous rules while using the remainder to improve the budget bottom line. “People will know by the time they go into the polling booth where we stand on superannuation,” Dr Chalmers said four weeks ago.

Mr Shorten stared down requests for detail yesterday, arguing Labor would need to consult industry experts and senior officials before deciding which of the Coalition’s policies it would adopt. “When we form a government, if we win the election, we will revisit these measures to see their workability, to fully understand if they can actually be done,” he said. “There’s plenty of people who are saying that these changes will be very hard to implement.”

The Labor stance throws doubt over changes including a $1.6 million transfer cap that imposes an earnings tax on super accounts over that limit, a cut in the concessional contribution cap to $25,000 and controversial changes to the Transition to Retirement Income Stream rules.

Mr Bowen said he had “grave concerns” about another change, a $500,000 “lifetime cap” that is backdated to 2007 and is at the centre of a dispute about whether it is retrospective, while Labor assistant Treasury spokesman Andrew Leigh said the Coalition’s policies were a “dog’s breakfast” and needed to be fixed.

“We’ve committed, if we win office, to using the resources of Treasury, consulting quickly on that, coming up with a measure which achieves the same impact on the budget bottom line, but ideally without the retrospectivity of the government’s changes,” Mr Leigh told Sky News.

Labor’s approach has frustrated industry experts who want certainty over the competing policies before polling day, particularly after Mr Shorten and Mr Bowen had launched a broadside against the Coalition earlier in the election campaign.

“We have urged Labor to adopt the same or similar measures as the government, which would achieve the same savings or more,” said Ian Yates, chief executive of the Council of the Ageing.

“There are other measures that you could take to make super more effective.”

Others said voters deserved to know the detail of Labor’s changes to super rather than being told they would be decided after the election.

Save Our Super joins superannuation policy ginger group

28 June 2016

The newly-formed lobby group Save Our Super has joined an alliance of investor and superannuation associations who are urging the Coalition Government and the Labor Opposition not to proceed with their proposed superannuation changes.

Save Our Super is led by Melbourne lawyer Jack Hammond QC who is campaigning to have superannuation savings made before the 3 May Budget ‘grandfathered’ so they do not adversely impact people who saved for their retirement under the previous rules.

Save Our Super joins the Australian Shareholders’ Association, The Australian Investors Association, the Small Independent SMSF Funds Association and the SMSF Owners’ Alliance in calling for the Government and the Opposition to review their policies if elected on Saturday.

The Budget decisions have caused dismay among many retirees and those close to retirement because they impose new limits and a new tax on earnings from superannuation accounts.

“Save Our Super adds a new voice to the chorus of concern over the policies of both major parties that will impose a new tax on superannuation earnings and restrict the opportunity for people to save enough to be financially independent in retirement,” according to Duncan Fairweather, Executive Director of the SMSF Owners’ Alliance which is co-ordinating the campaign.

More on Save Our Super can be found on their website: www.saveoursuper.org.au

Jack Hammond can be contacted at: jack.hammond@saveoursuper.org.au

And on: 0400 862 865

Contact:

Duncan Fairweather

Executive Director

SMSF Owners’ Alliance

0412 256 200

Australians “… spooked out of… their [superannuation] investment” – Scott Morrison

Treasurer Scott Morrison, 18 February 2016

One of our key drivers when contemplating potential superannuation reforms is stability and certainty, especially in the retirement phase. That is good for people who are looking 30 years down the track and saying is superannuation a good idea for me? If they are going to change the rules at the other end when you are going to be living off it then it is understandable that they might get spooked out of that as an appropriate channel for their investment. That is why I fear that the approach of taxing in that retirement phase penalises Australians who have put money into superannuation under the current rules – under the deal that they thought was there. It may not be technical retrospectivity but it certainly feels that way. It is effective retrospectivity, the tax technicians and superannuation tax technicians may say differently.

Source: http://sjm.ministers.treasury.gov.au/speech/001-2016/ :

http://sjm.ministers.treasury.gov.au/speech/001-2016/

I’ll have what’s she’s having: Labor’s superannuation policy

For many people, superannuation is a key issue in terms of determining how to vote. The Coalition clearly broke a clear and solemn promise not to increase taxation on superannuation and has come up with an over-engineered, unworkable dog’s breakfast, most of which will never be enacted.

For many people, superannuation is a key issue in terms of determining how to vote. The Coalition clearly broke a clear and solemn promise not to increase taxation on superannuation and has come up with an over-engineered, unworkable dog’s breakfast, most of which will never be enacted.

For some, this is a line in the sand that has been crossed and we should expect the Liberal’s primary vote to be affected significantly in some electorates.

Most of thought that Labor’s superannuation policy was done and dusted but it now seems that all the net savings of the budget in relation to superannuation have been taken on board by Labor and the party is simply refusing to say which of the changes (and there were many) will be its policy and those that won’t.

There is just this reference in the Labor’s costings document:

Given Labor’s concerns about the Government’s superannuation changes, including retrospective elements, Labor would consult with stakeholders and take a broader examination of all these measures on coming to government.

So who knows? If super is your thing, hang on to your hat.

Morrison has developed a very unpleasant inflexibility when it comes to discussing superannuation – he knows that he has stuffed up (thanks Martin Parkinson) but it is just too hard to admit it.

My guess is that Morrison will never lead the Liberal Party after this misstep.

Source: http://catallaxyfiles.com/2016/06/26/ill-have-whats-shes-having-labors-superannuation-policy/

A plucked superannuation goose will not yield tax reform

- Terry McCrann

- The Australian

Separated by three centuries, the timeless quotes of Jean-Baptiste Colbert and Willie Sutton capture in the first the essence of true tax reform and in the second the inevitability of tax reality.

They therefore identify what should be the ambition of Joe Hockey’s ‘conversation’ on tax; but also the likely outcome of what he has unleashed with the release of the Treasury tax paper: in brief, a replay on a bigger and likely more permanent scale of his disastrous first budget.

Colbert, a finance minister to the 17th century’s ‘Sun King’ Louis XIV, elegantly advised that: “The art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest possible amount of hissing.”

Generally considered to highlight only the ‘efficiency’ objective of tax collection, when considered more holistically, it really also encapsulates what should be the parallel objective of an optimum tax system — equity. For a loudly hissing goose — geese — would suggest an absence of both.

While the quote from Sutton — who in the early decades of the 20th century was embarked on a less formally acceptable form of ‘plucking’ than Colbert and all his successors in all the countries around the world — might have lacked in elegance, it more than compensated in powerful logic.

Asked why he robbed banks, Sutton replied: “Because that’s where the money is.” Ah, the inevitability of tax: reformed or otherwise. And “where the money is” in 21st century Australia is in the near $2 trillion superannuation pool.

That is to say, it’s the last big pool of lightly taxed money, the ‘plucking’ from which — especially if you are targeting that amorphous category of ‘the rich’ — will likely cause the least amount of not so much audible but acceptable (to the chattering classes) hissing.

Who could possibly deny the ‘equity’ of ending the ‘rich’s’ super tax rorts; and for that matter, let’s throw in the dividend imputation rort, negative gearing and the capital gains discount.

Well the case is actually nowhere near as self-evidently clear-cut as claimed. At core it rests on the casual assumption that the neutral rate of tax is 100 per cent and anything less is a tax concession or expenditure.

Superannuation is taxed at two levels: at contribution and subsequently in earnings. Yes, both are taxed at lower levels than other forms of income; but there is a very huge price to be paid for that — you lose access to the money for decades.

Lost in Joe’s ‘conversation’ this week was also the fact that the super contributions of ‘the rich’ are already taxed at a higher rate. Introduced by Treasurer Wayne Swan in 2012, anyone earning more than $300,000 now pays 30 per cent tax, everyone else is still at 15 per cent.

Yes, that’s less than the 47 per cent — ‘temporarily’ hiked to 49 per cent by Joe last year — to be paid if the money was paid as salary. And yes, the earnings on the 70c in every dollar left will then only be taxed at 15 per cent.

But to repeat, the taxpayer cannot access that money, as against the 53c (51c) in the dollar of ordinary earnings. Further, the taxpayer can redirect money coming directly to him or her into low tax or no tax or even tax-loss generating alternatives. Or more simply be spent, with an eye to a taxpayer-funded pension in retirement.

Simply and clearly, superannuation should be taxed at a lower rate than ordinary income on both equity and efficiency grounds. Equity, as a fair trade off for the inflexibility it imposes; efficiency, otherwise no money other than mandated would flow into super.

With both equity and efficiency served by the central objective of our universal super scheme — that in time the tax concessions will be effectively repaid by a retiree not getting the old-age pension or at least not a full pension.

A casual assumption of utter stupidity hung over much of the ‘conversation’ in the idea that a super balance of more than $2 million was ‘more than enough’; that it would finance a ‘high income’ in lifetime perpetuity.

Yes it might, in the context of the 10 per cent-plus income returns of the last two decades. But not if we are entering a future of 2-3 per cent returns — especially in fixed interest securities which should form the bulk of super balances in retirement pension mode.

While a $2 million ‘balanced’ portfolio is vulnerable to being cut 20-30 per cent in another GFC. Suddenly a ‘rich’ self-funded retiree might be struggling to live on $45,000 a year.

While that might sound reasonable right now, what of a return of inflation? Even modest 5 per cent inflation cuts the value of a super balance in half after 14 years.

By then an income of effectively $22,500 a year would no longer sound quite so ‘rich’. It would also almost certainly see such a ‘rich retiree’ back on the pension — somewhat defeating the purpose of the exercise.

Perhaps our good treasurer would have been best advised to have had a ‘conversation’ with himself before unleashing his ‘good idea’, which will inevitably turn ‘tax reform’ into tax increase, neatly replicating last year’s budget. Back then Hockey had the ‘good idea’ of the ‘temporary’ high income levy as the sop to the ABC, Fairfax et al for the other budget cuts.

Apart from earning exactly zero credit — indeed he was flayed for breaking the ‘no new taxes’ promise — what did we get? The high income levy and precious little of the rest.

His tax ‘conversation’ is headed the same way. We are likely to see increased taxes on the rich/ high income earner super and precious little of any real tax reform. Thus does a Liberal treasurer become the instrument of a higher tax ‘consensus’.