Author's posts

Revealed: the new SMSF generation

The Australian

13 July 2019

James Kirby – Wealth Editor

For a moment there it looked like the entire self-managed super fund scene was in a tailspin: thriving industry funds, woeful tales of bad financial advice and a deeper sense that for many the entire experiment in self-directed retirement had lost its way.

Yes, growth in the SMSF sector is slowing.

But the SMSF scene is alive and well. Moreover, SMSF operators are getting younger, they are starting funds with less money than previously and importantly they are double-dipping in a very smart way, with almost half of those launching new funds making sure to retain investments in their original employer funds.

Our picture of the sector gets better each year, with better data. The latest Vanguard/Investment Trends survey, which is based on no fewer than 5000 SMSF operators and 300 specialist planners, offers an exceptional snapshot of the market.

There are 20,000 new SMSF funds opening each year (against 40,000 a decade ago). However, there is every chance this number will grow from here now that the Morrison government has been returned and the threat of a pro-industry fund ALP regime has been removed.

More importantly, the big development this year is what might be tagged as the “hybrid approach” — keeping two funds going for different purposes. The new generation of SMSF operators are not “anti-industry funds” — it would seem they are much too smart to take an entrenched position of that sort when there are advantages to having one foot in the APRA-regulated fund sector.

Until very recently, the choice between SMSF and big funds was seen as binary — you went one way or the other. But now it is common to use both formats for different purposes. The survey shows that almost half (49 per cent) of people who started SMSFs last year held on to money inside their former funds as well. What’s more, that figure is climbing fast — it was only 29 per cent in 2017, then 34 per cent in 2018. Investors are holding on to money inside the larger funds primarily to keep their access to cheaper life insurance: big funds get better rates than if you are operating by yourself in an SMSF.

However, Michael Blomfield, chief executive of Investment Trends, also says people are leaving money inside industry funds to diversify, especially to get access to unlisted investments such as infrastructure and private equity.

“It’s what you might call a core and satellite approach,” says Blomfield.

Indeed, this trend has been exploited by industry fund Hostplus, which has just launched a range of funds that SMSFs can access without actually becoming members of Hostplus.

If this so-called self-managed option experiment at Hostplus succeeds, no doubt a string or rival industry funds will copy the initiative in the years ahead.

Younger and younger

Separately, the survey shows a median SMSF commencement age of 47 (down from 52 in 2010) and a median starting amount per capita (per trustee) of $230.000.

This is surely a healthy development and suggests the sector is going to become more mainstream and less heavily identified with wealthier, older Australians than it has been in the past.

Just to look at the trend a little closer, the median amount trustees have when starting a new fund has dropped consistently — it was $420,000 before the global financial crisis and $320,000 in 2014. So much for analysts suggesting you need $500,000-$1 million to start a fund. SMSFs are for people who want to control and manage their own money.

This new research also attempts to answer one of the most commonly asked questions about SMSFs, which is how much time do they take to run? The easy response might be “how long is a piece of string?” After all, the more complex a portfolio the longer it is going to take to manage. Nonetheless, it is suggested on average the whole business takes eight hours a month (we’ll assume the survey did not try to measure that most elusive figure — time spent “thinking” about investment allocation).

Among the most obvious developments in the area is the steady and welcome diversification away from Australian shares and cash — though notably the average cash holding is still a whopping 25 per cent and it has barely changed even as rates have slid to historically low levels. Indeed, the allocation increased slightly over the past 12 months.

In terms of where the diversification is taking place, it is in the exchange-traded funds market, which is emerging as the key gateway to the wider world for private investors. There are 190,000 investors using or planning to use ETFs, up from 140,000 a year earlier.

There is also a consistent lack of confidence in the financial advice sector shown in the survey, which may improve in the months ahead as new standards are introduced in relations to educational qualifications for advisers.

Similarly, it would seem confidence levels on market returns are low, too. “Investors’ outlook for market returns is very low at 1.4 per cent, far below the expectations of many economists, including our own,” says Robin Bowerman, head of market strategy at Vanguard Australia.

One last thing: despite the gloom and doom among SMSFs, it looks like there has been a lot more talk than action. Examining the intentions of SMSF operators for the future, the survey found one in five had considered closing their funds over the past year — a fourfold increase on the numbers in 2013. But in reality, the actual figure was less than 10,000.

Boomers, this battle ain’t over

Weekend Australian Magazine

13 July 2019

Bernard Salt – Columnist

My fellow baby boomers. I know that many of you are feeling pleased with yourselves, having at the federal election staved off an attack on the benefits associated with your recent or imminent retirement. I’d like to report that thanks to this collective effort the issue of franking credits has receded into the annals of history, never to be spoken of again.

That is what I would like to say – but of course that wouldn’t be the truth. The truth is that the franking credits issue, and the angst over a range of other retiree benefits and entitlements, will never disappear. It’ll merely hibernate before bursting back into life. The reason is obvious: politicians will see populist opportunity in finding ever more inventive ways to limit public spending on retirement.

It is foolhardy for any political party to launch a full-throttle attack on middle-class baby boomers now. Those born between 1946 and 1964 are currently aged 55 to 73 and straddle both full-time work and retirement. They are fit and healthy (for their age) and many are still at the top of their game, which means that if attacked they can inflict lethal damage on an aggressor. And that is precisely what happened at the May election.

Dark forces that seek the curtailment (or demise) of the self-funded retiree say we can no longer afford to keep these privileged Australians in the manner to which they have become accustomed; we must wipe away some – some – of the egregious benefits that coddle their pampered retirement. And those dark forces have an unassailable advantage over their ageing quarry. They are younger. They are leaner. They are hungrier. All they need to do is wait. The next assault on the reserves of the well-off baby boomers will come as their numbers diminish, as their herd frays. Some time in the next decade, the stalkers of self-funded retirees will re-emerge, take aim at the by then wearied and bedraggled boomers, and release – with glee – their slings and arrows of discontent. Strike the weakened: that is the brutal law of the jungle, and of politics. Future tribes of self-funded retirees may well huddle together for protection, but the assailing forces will be too strong, and intoxicated by the promised spoils.It was always going to end this way for the self-funded retiree life form: their numbers afford a measure of protection early in retirement, but later it’s a different story.

By the 2030s the great retirement reorganisation will have taken place and the once vast herds of roaming, roaring baby boomersaurus will have diminished. And, of course, as the thinning progresses, and as the savannah’s resources are recovered and redistributed, a new generation of retirees will present itself.

Enter the Xer retiree, born 1965-1982. This is the get-on-with-it generation, the Quiet Generation, the generation that for a lifetime was besieged from above and below by louder and more opinionated voices. A lifetime of access to a national superannuation scheme will deliver Xer retirees into a kind of promised land, largely free of bothersome baby boomers and totally disconnected from the mutterings of the infernal Millennials.

And here is the irony. The vast number of boomers in retirement forces a rethink about the benefits bestowed upon retirees. But when Xers get to retirement’s promised land, it’ll be time for politicians to loosen the purse strings. Boomer retirees do the heavy lifting; Xer retirees reap the rewards. Is this karma or is this luck? I suspect the answer depends on which generation you were born into.

Context needed ahead of super guarantee rate changes

The Australian

11 July 2019

John Durie – Senior Writer/Columnist

The federal government is committed to increasing the guaranteed superannuation level from 9.5 per cent to 12 per cent and arguments against the move continue but for the wrong reasons.

The Grattan Institute is leading the charge. It concedes that its modelling will produce the outcome it wants, based on the inputs that, at the right levels, support its view that superannuation robs workers’ wages.

The facts are somewhat different when the system is measured from a more holistic economic view and looking at people’s income in both work and retirement.

The think tank acknowledges its work is based on assumptions, which could be questioned.

Next year, Treasury is due to hold its next intergenerational review, which every five years looks at the sustainability of present policies, and using its MARIA model will map out long-term pension needs.

This, too, should provide some context for the coming changes.

Still, Grattan’s latest missive met with the expected torrent of arguably self-interested abuse from the superannuation industry, which was so loud in its protest against the claim that super robs people of wages that it almost invites suspicion.

The reality is when the system started in the late 1980s and early 1990s, one aim was to provide retirement income and another was to offset inflationary wages.

Such a claim can hardly be supported today.

Another reality is that national savings and retirement income have not been studied in depth since Vince Fitzgerald’s report in 1993, which is why it makes sense to look at the issue again before the contribution rate rises and after some obvious low-hanging fruit in the industry is cleaned up.

The Productivity Commission report was centred on the efficiency and effectiveness of superannuation, not incomes policy.

The Productivity Commission comes at the issue from a different view, arguing that increasing the superannuation guarantee may have an impact on employment levels, because a boss faced with high costs won’t employ someone.

The impact of the minimum wage on employment was addressed in its 2015 workplace relations report.

That is why it wants the government to have a look at the issue as part of its inquiry into retirement income.

It doesn’t agree with the Grattan view on super robbing people of wages, but is not sure about the impact on employment, a debate that obviously extends to the minimum wage.

The low-hanging fruit being acted on includes closing so-called zombie funds, which are multiple accounts held by people moving jobs but costing them collectively something like $2.7 billion in fees.

There is the default debate that links wages awards to superannuation, which should be cut and the issue is just how.

One version being kicked around Canberra is an extension of the PC’s best-in-class 10 funds from which employers can choose to including 20 funds but rotating five of them each year as a natural selection process.

The governance issue is overblown, but in theory there is no reason to keep bad governance alive just because some super funds are performing well right now.

Like its sometimes banking industry parents, the superannuation managers have not complained about this windfall.

Another issue is default fund portability, which is what to do with money contributed as you change funds.

One often forgotten answer is member choice, which means any worker can choose whichever fund they like.

There are allegedly some award defaults that cannot be transportable, which is obviously dumb.

The contribution rate is scheduled to increase by 0.5 per cent a year from 2021, taking it from 9.5 per up to a maximum 12 per cent in 2025.

This means there is plenty of time to decide the level of increases and make the appropriate reforms ahead of the present legislated timetable.

The Grattan report was conflicting because not so long ago it was arguing that the increase in the guaranteed rate would not have an impact on pensions. Now it is saying an increased rate means less pension.

This, of course, is what industry consultants Rice Warner and others are arguing, saying it’s actually good for the overall budget and economy. People save more through super than they do outside the system because the money is managed better.

It argues that, over time, any losses in income tax are more than offset by the tax collected long-term from super and the extra savings are spent in retirement while also saving pension payments.

But the debate is a sensitive one, as the last election showed, with a strong vote against the Labor Party’s franked income tax policies.

NAB has added more grist for the mill yesterday with its updated economic forecasts showing this year’s tax cuts will add 0.1 per cent to GDP growth, as opposed to the RBA rate cut, which will add 0.8 per cent to 2.8 per cent.

This puts the government’s arguments about enough fiscal stimulus into a new light, because it basically says the tax cuts will have no real impact on the economy, but the much-maligned interest rate cuts will.

For the record, NAB is tipping 1.7 per cent average growth this calendar year, increasing to 2.3 per cent next year.

In contrast, the RBA has the economy growing by 2 per cent this year and by 2.8 per cent for the rest of our natural lives.

On the other side, the age pension costs the economy about 2.6 per cent, which is relatively low by world standards. But if the super increase was scrapped, the increase in the cost of the pension, to about 4.6 per cent, would be meaningful. In an ageing economy, that is a big hit.

Tech giants to testify

Representatives of four tech giants will appear before a US congressional antitrust committee as part of a review into their market power and impact on private lives.

The review comes as Josh Frydenberg prepares to release the Australian Competition & Consumer Commission report into the power of platforms, which could be as soon as next week.

The Treasurer has yet to decide whether to release the report of its inquiry into Google, Facebook and Australian news and advertising with a formal government response.

The Wall Street Journal reports the US House antitrust committee has summoned representatives from Google, Facebook, Apple and Amazon as part of a review into “online platforms and market power”.

The hearing comes ahead of a major debate in Washington about whether to limit the influence of tech giants over Americans’ lives, and how. Australia is in some respects ahead of the US, with the ACCC having studied the issue for 18 months, including its impact on media.

The issue is not restricted to the Western world, with the China Skinny newsletter reporting a big slump in the appeal of tech giant Baidu, due to concerns over the way it operates. Chinese authorities are also cracking down on practices that Google and others have faced in the West, including directing advertisements from its own pop-ups.

Google is banned from operating its search unit in China.

The report said digital ad spending in China is forecast to grow 22 per cent this year.

While Baidu’s share is shrinking, Alibaba’s ad revenue is forecast to be $US27.3bn ($39.4bn) — 63 per cent greater than total ad spending on TV. According to eMarketer, digital ad spending is expected to account for 69.5 per cent of total media ad spend this year, and Alibaba’s digital advertising revenue will be more than double that of Baidu’s.

China Skinny reports Baidu’s market share has fallen from 86 per cent in August 2015 to 64 per cent in May this year. Baidu reported its first net loss in the first quarter.

Retirement income expert Michael Rice argues case for 12pc super rate

The Australian

3 June 2019

Michael Roddan – Reporter

The age pension will be the “primary source” of income for most Australians if the government ditches plans to force workers to hive off more of their wages into superannuation, according to research from the nation’s top retirement income expert.

Michael Rice, chief executive of actuarial firm Rice Warner, will today present a paper to the Actuaries Institute annual summit in Sydney urging the government not to derail the planned increase in the super guarantee from 9.5 to 12 per cent.

The paper, prepared by Mr Rice, Australia’s foremost actuary, and Rice Warner head of superannuation Nathan Bonarius, will be launched as the government prepares to build a case to potentially scrap the scheduled increase in the guarantee rate with a wide-ranging review of the adequacy of the $2.7 trillion super system, as recommended by the Productivity Commission.

An inquiry will also focus on generous tax concessions built into the system, which are projected to cost the federal budget more in foregone revenue than the system saves in age pension outlays until at least 2070.

There has already been fierce resistance from the funds management sector and the ACTU, which have been campaigning for a rate of at least 15 per cent.

Josh Frydenberg says the government has “no plans” to freeze the rate, while Labor has been vocal about any attempt to stop the planned increase in the amount of money Australians are forced to put away until retirement.

“If the SG was left at the current 9.5 per cent the age pension, rather than the SG, would be the primary source of income for most Australians,” the Rice Warner paper said. “An SG below 10 per cent would not be an optimal solution.”

According to analysis of different contribution rates, Mr Rice said a rate of between 10 and 15 per cent would provide a standard of living in retirement that was adequate “for most while not being excessively generous to too many”.

However, a higher rate would need to be paired with lowering some of the tax concessions for wealthier Australians.

Under their scenario, about 15 to 20 per cent of the population would be supported by welfare and social security while between 35 and 40 per cent would have enough savings to allow them to partly supplement their income with the age pension until later in life, when they would become more reliant on the government payment.

Wealthier retirees, accounting for between 40 and 50 per cent of the population, should be self-sufficient, Rice Warner said.

“An SG below 10 per cent would result in median income earners relying on the age pension for most of their retirement income,” the paper said.

“While this would provide a comfortable living standard for middle-income Australians, it’s not a desirable result if we want people to be self sufficient in retirement. Further, many people living on a full age pension (particularly renters) are living in poverty, indicating the age pension by itself is not enough.”

The Grattan Institute has found that, by the time it is fully implemented in 2025-26, a 12 per cent super guarantee would strip up to $20 billion a year from workers’ wages, or nearly 1 per cent of GDP.

The think tank has argued a higher super rate would mostly benefit wealthier Australians, punish poorer workers and cost the budget an extra $2bn a year in tax concessions.

Michael Roddan – Reporter

Michael Roddan is a business reporter covering banking, insurance, superannuation, financial services and regulation.

Goyder questions independence of industry super fund boards

The Australian

3 June 2019

Ticky Fullerton – Business Editor

In two years, Richard Goyder has transitioned pretty seamlessly from managing one of Australia’s biggest businesses, Wesfarmers, to the most senior positions in Australia’s boardrooms.

He is now chair of Qantas, Woodside and the AFL Commission. In a broad-ranging interview, what stood out was less his views on the election or the RBA rates decision, and more his experience with investors, in particular some of the industry superannuation funds.

To be clear, Goyder sees industry super as playing a vital investment role, helping to build Australia.

After all, the industry funds now manage billions of dollars in retiree savings. And he scoffs at warnings that company directors should fear industry super on the register as predators in waiting.

“Not at all. Industry super funds should be long-term investors and should be very supportive shareholders but also hold companies to account for what they’re doing in the environment and with all stakeholders in an appropriate way,” he says.

Where Goyder does have a concern is on independence of the boards of industry super.

It’s no secret that many in corporate Australia remain sceptical of the role of these union-backed funds, with major stakes in listed companies.

Their indisputable track record of returns and low-fee reputation have lured hundreds of millions of dollars in retiree savings away from retail funds.

But calls by union leaders like the ACTU’s Sally McManus to use the funds’ financial muscle to influence ASX-listed boards with activist agendas, including wage hikes for employees, have rattled business. “Just as directors’ obligations are pretty clear, I think the obligations of trustees of superannuation funds are pretty clear as well and their obligations are to the members of the fund,” says Goyder.

His own experience has caused him to question whether industry fund directors are living up to their obligations.

“Interestingly, as a CEO, when I would go and see shareholders, including superannuation, they want to talk about how the company was going and performance and outlook and investment.

“Now that I’m a non-executive director, I spend more time talking about remuneration, climate change and other factors.

“One of the things that struck me is that these funds want independent directors, but when I go and see them, they actually don’t want us to be independent, they want us to do their bidding for them.

“And at the end of the day, directors will be independent. And we’d expect them to fulfil their roles as trustees as well.”

The re-elected Morrison government says it will bring back, from the dead and buried basket, its campaign to make industry fund boards independent, which is sure to be a good stoush; the current dual representative model is strongly defended by both the unions and employer organisations.

The campaign looks to have Goyder’s support.

“Independence a two-way street and I smirk a bit when I go into some of these meetings and they talk and they say, are your directors independent? And then ‘this is what we want you to do’. There seems to be some sort of conflict there.”

With Labor so roundly beaten, one business leader suggested privately that business had dodged a bullet on industrial relations, but Goyder sees this as harsh.

Business like almost everybody had been planning for a Shorten government and the boardroom chief says Labor would have been quick to pick up the phone to corporate Australia had it won. But clearly a clean Coalition victory is welcome news.

“Business will work with whoever, but I do think Josh Frydenberg handed down a really good budget and I feel like the table is set and we can get on with things,” he said.

It is true that the surprise result delivered a boost of confidence for business, but there one notable exception: energy.

Here Goyder has a battle on his hands. During the election campaign at Woodside’s May AGM, he lobbied hard on behalf of the gas sector, calling for leadership from the next government on a comprehensive energy policy, including emissions.

On the Monday after the surprise Morrison victory the market rallied strongly, but the energy sector fell.

Since then, Energy Minister Angus Taylor was sworn in again with emissions in his new portfolio, and he was straight out of the blocks claiming a “silent Australian” mandate to shut down any thoughts of a carbon pricing policy.

Resources Minister Matt Canavan doubled down at the APPEA annual gas conference last week accusing resource companies of taking unfortunate positions in their calls for a generic price on carbon.

At the same conference Conoco’s global chief Ryan Lance made it clear that investment certainty in Australia on energy was in question and that his investment capital was footloose. Goyder’s gas challenge is just beginning.

“Woodside is looking with our partners in investing millions of dollars in the northwest of the country in the coming years with Scarborough and Browse and we want certainty around what emissions regime we will be in and how we’re going to look at meeting our Paris obligations.

“These are 20 and 30-year projects. These aren’t small deals — they’re big deals employing thousands of people.”

Compounding the pressure for Woodside is the Western Australian EPA’s proposal for zero emissions from resource companies.

“Nowhere in the world is there full abatement on the sort of projects we’re looking at,” Goyder says. Energy aside, Goyder sees better times ahead for business and welcomes the prospect of an interest rate cut by the RBA tomorrow.

“Presumably there’s issues around currency, there’s issues around the housing market and consumer confidence.

“Post the election, there is an opportunity to inject some confidence into the economy and that would be a really good thing.”

He says he’s hopeful the big banks will pass on a rate cut to customers and certainly Commonwealth Bank CEO Matt Comyn in his first speech to a market event last week acknowledged that the battle to restore trust will be top of mind when he reacts to a cut in the cash rate.

I ask Goyder what on earth he makes of the quiet Australians and whether the new government hands business an opportunity to reset the relationship between them and business.

“I’ve always felt that business is a part of the solution, not part of the problem.

“The reputation issues that came from the royal commission — business does have to make sure that we operate sustainably, we operate looking after all our stakeholders, but on balance I think businesses in Australia do a pretty good job on that front and there is an opportunity to reset.

“People say actually what matters to them is their own security, their personal financial security, and business, particularly large business, employs many millions of Australians, so there is an opportunity to embrace those employees and our suppliers and our customers so they understand the really good things business does, whether it’s Woodside or Qantas, I think we do amazing things in the community.”

Shrinking financial advice sector in turmoil

Australian Financial Review

2 June 2019

Adele Ferguson – Investigative journalist and columnist

There will be a lot of pain as the industry transitions. But winning back trust doesn’t come cheap.

There are few industries facing as many apocalyptic events as the country’s 24,000-plus financial advisers, who look after billions of dollars of their clients’ money.

There are also few industries grappling with as many trust issues after being at the centre of a string of financial scandals over the past decade, which has prompted a clean-up.

For the newly appointed Financial Services Minister, Jane Hume, it will be a lot to get her head around as she is lobbied from all and sundry.

There are those calling for the current timetable to be extended to meet tougher education requirements and a code monitoring program, those wanting grandfathered commissions to remain as well as the preservation of commissions on life insurance products.

As the sector recalibrates, and some of the bigger players including Westpac and ANZ abandon the sector, she will need to think about how the new Financial Adviser Standards Ethics Authority (FASEA) works. FASEA is an independent body set up by the government in April 2017 after a series of scandals.

According to the current timetable, advisers have to comply with the new FASEA code of ethics from January 2020, code monitoring bodies need to lodge their applications with the corporate regulator by June 30 for the regime to be in place by mid-November and grandfathered commissions come to an end January 2021.

It means some big decisions will need to be made soon.

Against this backdrop, Peter Johnston, executive director of the Association of Independently Owned Financial Professionals, emboldened by the success of mortgage brokers fighting off changes to the industry, is fighting to preserve the status quo.

He is threatening to challenge the grandfathered commission legislation in the High Court when it is passed in the Senate. He told The Australian Financial Review he was looking to raise $3 million under an independent entity called the Adviser Remuneration Challenge (ARC) Fund to mount a legal argument that the changes are unconstitutional.

According to research house IBISWorld, the industry generates about $5 billion a year in revenue and a third of that comes from grandfathered commissions.

Shrinking industry

Since Hayne’s second round of hearings on financial advisers, licensees have been falling like tenpins, sometimes on a weekly basis.

On Friday Freedom Insurance Group became the latest licensee to call it a day. In a statement to the ASX it said it would close its Spectrum Wealth Advisers business. It said it would notify its authorised representatives that it was terminating their agreements and therefore not advisable to write any new business as they would no longer be covered under the agreement.

It follows other high-profile departures, including Aon, which announced last month it was exiting its Aon Hewitt Financial Advice in a management buyout. Westpac announced in March it was abandoning financial advice and before that ANZ sold its advice business to IOOF and Dover Financial pulled the plug on its advice business in June 2018 after its founder collapsed on the stand after a grilling at the Hayne commission. The sudden abandonment left 500 advisers, representing more than 50,000 clients, needing a new home.

Then there are licensees who have had their financial services licence cancelled by the Australian Securities and Investments Commission, including Bristol Street Financial Services, Financial Circle, Jade Capital Partners and Evermore Money Management.

The turbulence has prompted industry speculation that CBA might take a similar scorched-earth approach to Westpac after announcing in March that it had puts its wealth demerger on hold to prioritise the recommendations of the royal commission, including remediating customers.

It has created unprecedented turmoil in the sector as advisers seek a new home. It has also created uncertainty for clients. When a licensee no longer exists and a customer has received poor advice, how will they be remediated?

The loss of trailing commissions, or grandfathered commissions, is one of a series of big events facing the advice sector in the next five years. The second key event is the introduction of compulsory exams for advisers from January 2021, and the third event is making advisers degree-qualified by 2024.

The industry estimates that such transformative events will shrink the industry by a third or even half – equivalent to the loss of between 8000 and 12,000 advisers – by 2024 as some retire, sell up or close down. The shrinkage could even be higher if the banks continue to withdraw funding in this area.

Given the reforms taking place, the market is flooded with advice businesses for sale. According to CountPlus boss Matthew Rowe, three years ago for every one advice firm for sale there were 12 buyers. Now there are eight sellers for every one buyer.

In the past four months the ASX-listed CountPlus made three acquisitions to bolster its network of accounting and advice network as converged accounting and advice firms become more active players in the financial advice sector in Australia. Its plan is to invest in more advice and accounting firms through equity partnership rather than outright ownership.

AMP biggest advice army

On Friday online industry magazine Professional Planner’s Tahn Sharpe and team released its annual list of licensees. It said the largest licensee owner remains AMP with 2412 advisers registered on ASIC’s financial adviser register, losing 143 in 2018 and another 216 in 2017. IOOF jumped to second place with 1802 advisers after bulking up with the transfer of 700 ANZ advisers into its growing army. The third highest is NAB with 1515, followed by CBA with 1414.

After that it gets interesting, with National Tax and Accountants Association ranking fifth with 1021 advisers, followed by Easton Investments with 855, reflecting the trend towards limited licensing arrangements for accountants who offer advice to SMSFs.

According to Professional Planner, the National Tax Accountants Association sole licensee the SMSF Advisers Network had 33 advisers in 2016, compared with 853 in 2018 and 1021 in 2019.

Westpac ranked number seven with 632 advisers and ANZ ranked 10 with 385 advisers, reflecting their extrication from the industry.

But there are other changes taking place, including the emergence of new user pays models for licensees and their authorised representatives, which was previously heavily subsidised by the licensees.

Under the traditional model, largely dominated by vertically integrated operators, namely the banks and AMP, which at one time controlled up to 80 per cent of the financial planning industry, licensees subsidised the costs of authorised representatives in return they sold the licensees financial products.

But as the vertically integrated model loses its dominance, the industry will shift to a user-pays model.

To put it into context, the industry estimates the true cost of authorised representative services are up to $45,000 a year per adviser, plus professional indemnity insurance. It is understood that the average cost being charged under the subsidised model was $12,000 a year per adviser.

In March, listed licensee and advice services firm Centrepoint kicked it off when it flagged a new pricing arrangement for its authorised representatives from July 1. Centrepoint, which is ranked number 11 on the Professional Planner list, will increase the prices it charges to authorised representatives to better reflect the true cost.

Others will follow suit. There will be a lot of pain as the industry transitions. But winning back trust doesn’t come cheap.

Gaps exposed in super, franking credits structure

The Australian

30 May 2019

Robert Gottliebsen – Business Columnist

Chris Bowen’s foolish plan to bash struggling retirees has highlighted significant gaps in our superannuation and franking credits structure.

Now is a very good time to tackle those issues for the benefit of all Australians.

Treasurer Josh Frydenberg is examining superannuation and I invite him to consider the issues highlighted by the Bowen mistake.

The first issue is the poor disclosure from most publicly-available funds. And the risks of class actions like that being mounted against the AMP would be lowered with better disclosure by all funds.

It’s time to impose on all publicly-available funds—both industry and retail – the same disclosure rules. The Coalition government keeps worrying about industry fund board structures, which hinders concentration on the main issues.

All superannuation funds hold their assets in trust for members who are entitled to know the details of where money is invested; who is managing it and at what cost; what commissions are being paid; whether members’ money is spent on promotion or sent to owners, plus an array of other matters.

The rules for all funds must be the same.

And this is particularly important because the franking credit morass aroused suspicions that there was a hidden story.

Every major superannuation fund (retail and industry) remained silent when they knew that what Chris Bowen was doing in allowing retirees in big superannuation funds to receive their cash franking credits while others would not, was simply wrong in every sense of the word.

Strangely, had one or two of the big funds spoken out they might have caused the ALP to modify their policies and therefore possibly win the election.

When people know that a political action is wrong and are silent it usually means that there is something to hide.

The unfair Bowen proposal confirmed that a new set of approaches is required for franking credits.

All franking credit entitlements should be irrevocably attached to the beneficial owner of the shares that generate that entitlement. Again it looks like there is a hidden agenda.

I suspect that banks and some big superannuation funds are playing naughty games with overseas holders of shares. Overseas holders are not entitled to franking credits but, at least on paper, sometimes “ownership” is transferred from an overseas entity to a superannuation fund or a bank with the real owner retaining the right to get their shares back after an extended period.

The benefits of the franking credit are shared in a side deal between the overseas beneficial owner and the institution, whose name appears to the register.

Making sure that franking credits are the entitlement of the person or body who is the real beneficial owner of the shares will stop those games.

I suspect when we put the microscope on various advice practices we may find bad things are happening. I hope that is not case but the royal commission never looked in this area, so we simply don’t know.

But we need to go further.

It is clear from the Bowen fiasco that the big funds have not separated out those of their members that are in pension mode and those that are in employment mode That’s why under the Bowen plan the retirees in industry and big retail funds could get their franking credits by sponging on the tax paid by others.

All superannuation funds should run their pension mode operation separate from their non- pension operation, so those sort of stunts can never be repeated.

Although people have a degree of choice in how their investments are structured in a big superannuation fund the strategies that apply to retirees are usually different to those of 20 and 30 year olds. The same rule should apply to self-managed funds.

The Senate rejected the government’s plan to increase the number of people who can be members of a self-managed fund from four to six. The ALP and the Greens traditionally have hated self-managed funds and the government did not work hard enough on the crossbenchers.

That issue needs to be readdressed by the new parliament. I would like to see the number of allowable members increased to eight.

The beneficial owners of the assets in self-managed funds are getting older and in many cases it will make sense to bring in family members.

Self-managed funds are huge in the retirement arena and there is no doubt their members played a big role in the government’s re-election.

I would hope that the ALP has learned the lesson, albeit the hard way, and will support the government in increasing the number of people who can be members.

If it has not learned then the issue is worth pressing with the crossbenchers, who will usually act in the national interest.

There is a place for industry retail and self-managed funds and the parliament should recognise this and not favour one sector over the other.

Australians don’t want a Dickensian retirement

Australian Financial Review

30 May 2019

Martin Fahy

Australians want to have a high standard of living in retirement, and they are prepared to pay for it via a 12 per cent super guarantee.

The Grattan Institute is making the same mistake unsuccessful pundits made with respect to the federal election, by making assumptions about what Australians want.

Grattan’s modelling of our retirement is selling Australia short. More specifically, it is using misleading fiscal projections and costings to decide public policy rather than listening to people.

Based on a flawed interpretation of the data, its modelling envisages an austere future that stymies aspiration and refuses to redefine retirement to meet the changing expectations of Baby Boomers and working Australians.

Superannuation is about lifting living standards in retirement and it does this on a cost-effective basis.

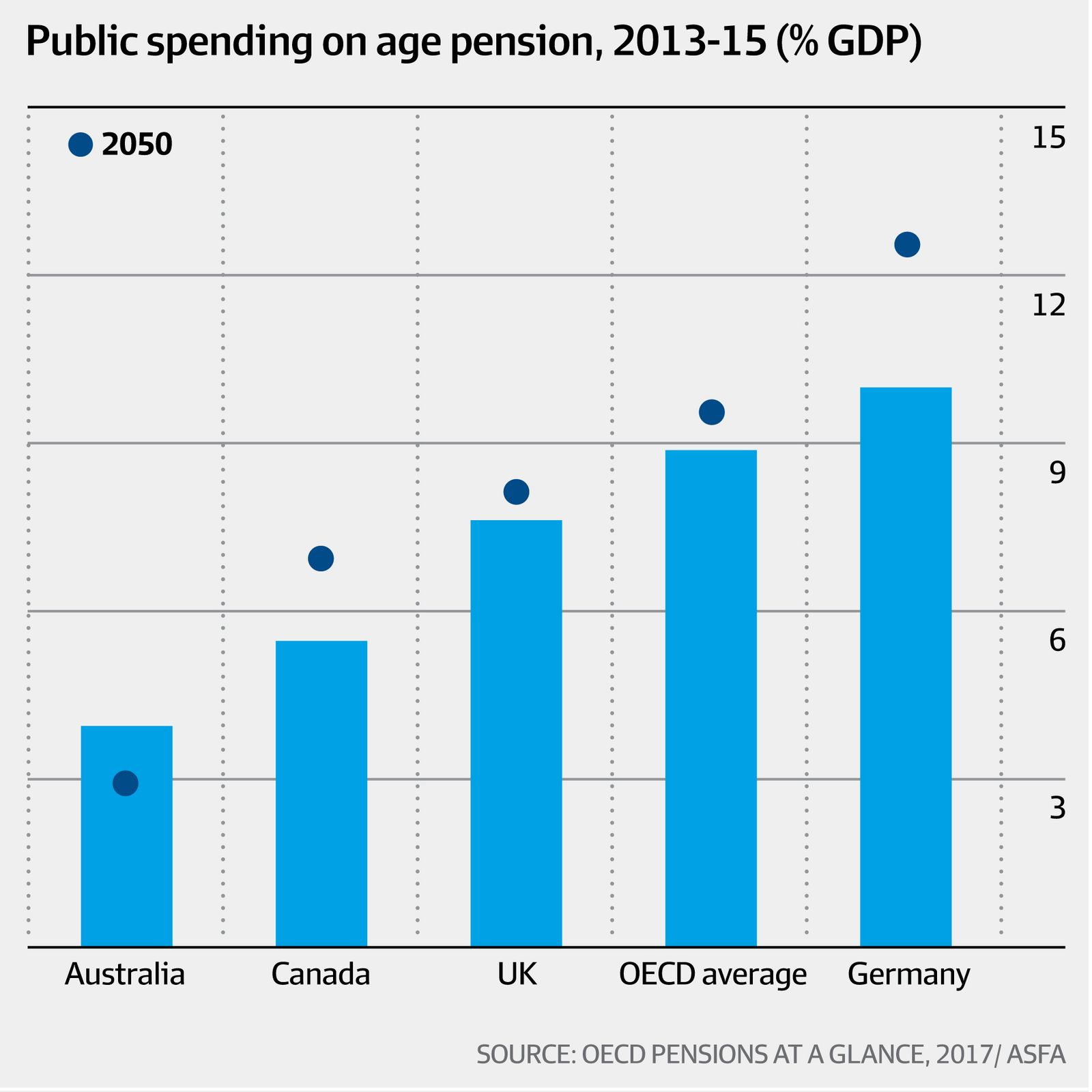

We know that Australia beats most other countries when it comes to reducing the fiscal impact of the age pension. Even when tax concessions for superannuation are factored in, it is well below the current OECD average and will be even more affordable by 2050. We currently spend 2.6 per cent of GDP on the age pension, down from 4 per cent in 2015 and significantly below the OECD average of 8.9 per cent. We spend less than Canada, Germany and the UK. The only countries that have a lower fiscal burden are Mexico and Korea.

We need to recognise that the Grattan definition is not what Australians aspire to. We know that Australians would rather their retirement be substantially self-sufficient and reserve the full age pension for those who need it most.

Retirement is the new chapter in the emerging narrative of Australian life: 30 or more years of retirement, punctuated by the joys of travel, children and grandchildren, as well as adequate aged care and health care.

We cannot think of retirement in binary terms. The reality is people will continue to work on a flexible basis as they move into their later years, in order to stay healthy and productive.

Australians have been shown to be remarkably responsible about saving for retirement and are willing to delay gratification to achieve this. In fact, a new ASFA survey released today conducted by CoreData, found 90 per cent of people supported compulsory superannuation and 80 per cent supported lifting the Superannuation Guarantee to 12 per cent from its current 9.5 per cent of wages.

Further, the survey found that 80 per cent of people would like to be able to spend at least the amount defined in ASFA’s comfortable Retirement Standard for home owners. That’s $61,061 per year for a couple, and $43,255 per year for a single person. In fact, nearly 40 per cent want to be in a financial position to spend even more than that.

The Household, Income and Labour Dynamics in Australia Survey has also investigated retirement expectations. It found that the view of people aged 45 years and over of what they need for retirement aligns closely with ASFA’s comfortable Retirement Standard.

With increased longevity, people look forward to a rewarding retirement, with the ability to choose the right balance of work, community and recreation to enjoy a full and active life. And they’re happy to pay for it.

Increasing the super guarantee to 12 per cent is a way of ensuring the best future for all Australians. Refusing to move to 12 per cent condemns nearly 70 per cent of Australians to dependence on the age pension during retirement. For people to properly prepare for the future, they need to be able to plan with certainty. For government, that means resisting the temptation to constantly tinker with superannuation settings.

The election result has clearly shown that Australians aspire to a better retirement than their grandparents or their parents. They don’t want to be a burden to the state, or their children, and they take pride in their financial independence. The changes that were made to the age pension in 2016 have made the system sustainable from a fiscal point of view and the time is right to move to a 12 per cent super guarantee now.

Superannuation means we’re not mortgaging our kids’ futures with ever-increasing age pension costs. Compulsory super means that our retirement income system is affordable for both individuals and future governments.

We cannot allow the story of Australian retirement to be the Dickensian misery that the Grattan Institute would foist upon us. It should instead be a vision for Australia’s bold and prosperous future.

Dr Martin Fahy is chief executive of the Association of Superannuation Funds of Australia.

Class warfare shifts to super as campaign grows to clip industry funds’ wings

The Australian

28 May 2019

Ticky Fullerton

$3.8 billion. That is the latest lump of retiree savings that AustralianSuper has awarded to IFM Investors to look after and grow. How good is industry super!

In the post-Hayne, post-Fox- and-the-Hen-House era of nationwide cynicism towards financial services, the profit for members sector is luring literally billions of dollars across from the retail funds.

IFM Investors is itself owned by the industry funds and the latest mandate takes its funds under management to a cool $130bn.

IFM’s chief Brett Himbury is a type for the times, low key with the pitch perfect message of workers’ savings driving investments for the benefit of the people: Main Street, not Wall Street money, driving impressive returns, much of it from infrastructure.

“Often understated, but motivation is a critical ingredient in driving superior net returns,” Himbury explains.

“If you are motivated solely by the returns to investors and not confused or distracted by any other motive, that has to help.

“Then it’s about your asset allocation, then it’s about your manager selection and then it’s about your fees, and so those funds that have performed superior have got a terrific unrelenting motivation on member returns.

“They have had an asset allocation which has accessed, among other things, the illiquidity premium in unlisted markets. They have been really focused on a smaller number of relationships so they can use their scale to drive fees down.”

Worrying for retail active managers is that increasingly industry funds are choosing to bring investment management in-house.

AustralianSuper recently sacked three managers and their loss would seem to be IFM’s gain.

But this development is symptomatic of a much bigger political issue because with money brings power and influence.

Critics of industry super see two clear threats to business: the first is a push for broadscale wage hikes from within the boardroom driven by union activists like the ACTU who have already declared this to be their agenda; the second is that industry funds with so much money and a mandate to grow have major listed companies in their crosshairs to take private.

John Howard on election night called the result a vote to end class warfare pushed by Labor but, ironically, since the result there has been a concerted campaign from the right side of politics warning government of the risks of union-backed industry super spreading its wings and demanding those wings be clipped.

They see the Keating legacy of industry super now delivering huge and unrepresentative union power right into the boardrooms of ASX companies. Class warfare is shifting to the super sector.

Reaffirmed Treasurer John Frydenberg has already committed to a review of super, and we can all expect a good stoush on whether the Productivity Commission’s recommendations on single default super for new employees and a top-10 best in show are carried.

Himbury says he simply wants political and business leaders to get on board. “It would be lovely if governments and companies and chairmen absolutely scrutinise the challenges, but really better understood us and, in so doing, looked at the opportunity as well as the risks of embracing IFM, the industry funds sector.

“Because there is a magnificent opportunity for members, for participants and for the country.”

Himbury promises to be active, not activist, on a register. He proffers a now familiar line that pressure for environment, social and governance changes are not just good for society, but good for the enterprise long term and hence good for long-term returns.

Whether this argument also extends to pressure for wage hikes is one of those known unknowns, but like industry super leaders Heather Ridout and Greg Combet, Himbury does not see unions riding roughshod.

“Let me be clear — the industry super fund on the (shareholder) register is working for working people and that’s it. There’s the unions and the employers that sit on the boards of industry super funds,” Himbury says.

“There’s clearly a lot of discussion about the role of unions, but it is a dual representative model that has worked so well.

“Look, I acknowledge the debate and it’s not going to go away, but I would really love to try and evidence — and we can — how our form of capital has really helped enterprises improve their proposition to customers and drive up superior enterprise value, which has driven superior returns to our members. If we could shift that thinking that would be fantastic.”

There’s is a big leap of faith required from business that unions will not influence industry super to the detriment of a company’s growth and profitability.

Some see the dual representative model as far from balanced, with the typically middle-ranking employer representatives a pushover for unions, and as keen to entrench a current system that ain’t broke. Interesting then, that the new Morrison government is to reignite the battle for independent boards. The shock Morrison victory was a clear blow for industry fund leaders: the faces said it all. Himbury was flying back from the US as the result came through.

I put it to him that Labor’s controversial changes to franking credit policy would have benefited industry super with yet more funds pouring in from self-managed super.

“No and it hasn’t happened for a range of reasons, but I think the growth of the system, super all up and the growth of industry super will still be strong and continued because of the broader proposition that has otherwise delivered for working people. It’s a wonderful asset.

“We’ve got other assets that we dig out of the ground. How about mining, for want of a better word, the super pool? We, the industry funds sector and the super sector more broadly, whatever the government of the time, are really looking forward to a much more collaborative and co-operative relationship, so we can do some great things together.”

Well, perhaps Himbury would say that wouldn’t he, talk up collaboration, especially given the surprise turn of events in Canberra? One way or another, IFM needs asset growth and higher returns. Super savings in Australia have already reached 140 per cent of GDP.

“Growth in the country and around the world is coming off and we’ve got to look at productivity measures to sustain and improve the growth prospects, and again I think there’s an exciting opportunity for the private sector and the public sector to really look at how we might engender and sustain greater productivity growth.”

Yet this exciting opportunity Himbury talks about is the other contentious area for boards. AustralianSuper is reported to have plans to take at least one ASX listed company private a year, and given the well aired conflicts that emerged in both the failed Healthscope takeover and the successful Navitas play, does Himbury think boards should fear having industry super or IFM as a stakeholder on their register? “Absolutely not. I think they should question, and they should critique, but I would hope that they don’t fear. This is a large, growing pool of capital that would love to work with enterprises, respect the role of boards, respect the role of management, but provide a long term source of sustainable capital to enable them to invest in their business to grow the enterprise, to impact society, to improve the service to their customers and enhance the returns to members.

“I hope and believe that the more discerning companies and boards are clearly looking at some of the risks but opening up and embracing some of the opportunity to work with a different long-term form of capital that can help them.”

There you have it chaps, this won’t hurt a bit.

Ticky Fullerton is the Sky News Business Editor

Combet calls for a super ceasefire

The Australian

27 May 2019

Michael Roddan

Greg Combet has called for the “traditional battlelines” over the union- and employee-backed industry superannuation sector to be “put aside” in the best interests of members, signalling his desire to work with Scott Morrison over looming reforms to the $2.7 trillion retirement savings system in the wake of Labor’s unexpected election loss.

In comments made to a closed-door briefing last Wednesday for industry fund executives, Mr Combet, a former Labor minister and current chairman of Industry Super Australia, said the sector needed to take a leading role in overhauling the default super sector and “properly” meeting the recommendations of royal commissioner Kenneth Hayne, which is likely to break the ties between the super sector and the industrial relations system.

“We want to work with the government,” Mr Combet told the executives, according to speaking notes obtained by The Australian. “I want to make clear. I think this is a very important case for collaboration.

“It is just so important that some of the traditional battlelines over industry super are put aside. Can we please just put it aside and work for the benefit of people in this country who depend upon the superannuation system for their retirement savings? The principal thing that we need to continue focusing on, and engaging in discussion about, is essentially member outcomes.”

The comments were made as the re-elected Morrison government geared up to take aim at the superannuation system, after a series of legislative speed bumps over the past two terms of parliament.

Josh Frydenberg has indicated the government is likely to pursue a wide-ranging review of the superannuation system, as recommended by the Productivity Commission, which will potentially examine whether the compulsory contribution rate should be lifted from 9.5 to 12 per cent of wages, as planned. An inquiry was also likely to focus on generous tax concessions built into the system, which are projected to cost the federal budget more in foregone revenue than the system saves in age-pension outlays until at least 2070.

The government will also act on the royal commission recommendation to dismantle the current default system enjoyed by the industry fund sector that allocates the savings of the least engaged members to funds anointed through the enterprise bargaining system. Mr Hayne recommended “stapling” savings to a member in order to end the proliferation of multiple accounts in a system where one in three super accounts are unintended multiples, which, when combined with a significant degree of poor performance, is costing savers almost $3 billion a year in lacklustre returns and fee gouging.

The Treasurer has hinted at reviving legislation limiting the number of union or employer-group appointees on super fund boards, which has repeatedly faced a Senate roadblock.

Mr Combet said it was time to start “sorting through the system” to ensure workers were being tipped only into “high-quality, good-performing products”.

“We need a set of performance benchmarks that start to provide a greater focus on the … chronically underperforming funds, so no matter what they are, they start to be weeded out of the system,” Mr Combet said.

Michael Roddan – Reporter

Michael Roddan is a business reporter covering banking, insurance, superannuation, financial services and regulation.