Author's posts

Implications of the Retirement Income Review: Public advocacy of private profligacy?

17 March 2021

Terrence O’Brien

Download the Analysis Paper (AP19) as a PDF

The recent Retirement Income Review (RIR) implies policies that would reduce after-tax returns to super saving, encourage faster spending of life savings and of equity in the family home, and minimise bequests. Its approach would incline each generation towards consuming more fully its own lifetime savings.

This paper demonstrates the RIR relies on contested Treasury ‘tax expenditure’ estimates that use a hypothetical benchmark that is biased against all saving, but particularly against long-term saving.

The AP reports that the effective tax rate on superannuation earnings is already much higher than the statutory rate. It also presents credible alternative Treasury measures that use a neutral benchmark. These estimate ‘tax expenditures’ that are only one-fifth the size the RIR claims, essentially flat over time rather than rising strongly, and thus do not unduly favour self-funded retirees compared to Age Pensioners.

The RIR implies policies should encourage faster and more complete consumption of superannuation capital and housing equity in retirement to prevent some retirees’ wealth rising and ending in bequests. But with savers’ equity in their houses typically about double their savings in superannuation, no prudent acceleration of super spending is likely to overtake inflation of housing prices in an era of fiscal and monetary stimulus and asset price inflation.

The RIR proposes that a retirement income of 65-75% of the average of after-tax incomes in the last 10 years of work would be “adequate” for all, and estimates most (except some retiring as renters) are already saving more than enough for such a retirement. But it would be unwise and unnecessary for government to set its policies to constrain citizens’ choice of the self-funded living standards they want to work and save towards. Policies to crimp voluntary saving and accelerate retirement spending would create more uncertain retirements and a more fragile economy, more dependent on international lending and investment.

Remarks to the COTA Australia National Policy Forum on Retirement Income

26 February 2021

Senator The Hon Jane Hume

To see the speech on Jane Hume’s website, please click here

Acknowledgements

Thank you for that introduction. The Council on Aging has shown great initiative bringing this event together. It is such an important policy area, and it’s terrific to be part of a national forum dedicated to retirement income.

This venue has witnessed countless debates – many which have guided policy and spurred progress. Contributing to this broader conversation is a privilege and not something I take on lightly.

But before I go on – in keeping with the Press Club’s traditions – I would like to acknowledge joint panellist the Shadow Assistant Treasurer and Shadow Minister for Financial Services and Superannuation, Stephen Jones MP.

Introduction

The measure of society is how it treats its most vulnerable members and our retirement income system is one of the greatest indicators of the values our society holds dear. It is a system that bolsters Australians’ financial security, peace of mind, quality of life and wellbeing in their retirement.

As the system matures, Australians are retiring with more retirement savings than ever before, which has enabled us to have one of the most sustainable, viable and fair retirement income systems in the world.

By the recommendation of the Productivity Commission, the Government established an independent Retirement Income Review that would look into, not just superannuation, but the three pillars of Australia’s retirement income system including the Age Pension, compulsory super and voluntary savings.

The Review confirmed our system is delivering adequate retirement incomes for the majority of Australians, and will be viable for generations to come.

Australians should be reassured that our retirement income system is ‘effective, sound and its costs are broadly sustainable’.

Indeed, across the world, Australia’s system is a front runner, ranking higher than most other international retirement income models. And during the pandemic, we saw first-hand that our system is well placed to handle economic volatility and as well as an increasingly aging population.

However, as robust and effective as our system is, the review confirmed there is room for improvement.

Indeed one of the key observations within the Review was that the system more generally could benefit from clearer direction and a better framework for measuring its performance.

And it also found that higher standards of living can be achieved in retirement with more efficient use of all three pillars of our system.

Superannuation and SG

A key theme of the Retirement Income Review was adequacy of the retirement income system. In measuring adequacy, the review used a benchmark of 65-75 per cent of working life disposable income and found most people who start work today would be at or above the benchmark once they retire – even if the SG rate were to remain at 9.5 per cent.

But the crucial information for policy makers is in the detail. The Review found that ‘more efficient use of savings in retirement can have a bigger impact on improving retirement income than increasing the SG’.

The key evidence for this finding was that many retirees live solely on the returns generated from their super balances and eventually die with – on average – 90 per cent of their savings still intact.

Of course, decisions taken by the current generation of retirees are their own. But as policymakers considering what is the appropriate level of SG going forward, we must have consideration for our current workers who are our future retirees.

Indeed the Review found if people currently in their working lives and currently contributing to super via the SG were able to use their superannuation more efficiently when they get to retirement in the future, they would have higher replacement rates and better retirement outcomes than if the SG was lifted to 12 per cent.

And of course, they’d have the benefit of more money in their pocket during their working lives, to boot.

This is the point the superannuation industry lobby never mentions. Ever increasing amounts of superannuation contributions for your future retirement savings come at the expense of slower wage rises in your working life. Whether we are talking about the rise to 10 per cent scheduled for July this year, or 12 per cent per future legislated rises, or even the 15 per cent that Stephen Jones will surely confirm the Labor party is committed to. It represents wages foregone today.

In the context of the SG, which is a compulsion to take todays’ wages and defer them for 40 years, that’s where the question comes in. As a Government with this knowledge we must consider the implications of compelling people to sacrifice more during their working lives – by forgoing the wages they could be taking home today – that they could spend today – that they could use to pay off a home today – the forgo all that so that their balances are larger at retirement.

Because the trade-offs are real. The evidence is incontrovertible that increases in the rate of SG – deferred wages – lead to a slower rate of wage growth over time. There’s no magic pudding. The Retirement Income Review said it. Grattan has said so. The RBA has said it. Heck, even the ISA’s own economist has said it.

Now, the Prime Minister has consistently noted that the planned increase in the SG to 12 per cent is already legislated, and if there was to be a decision to change this, it would be made much closer to the time, and in the context of economic circumstances at that time.

So much of the discussion around retirement is about accumulation – and that’s been understandable in an industry that has spent the last thirty years growing and maturing. But very soon we will have as many dollars in decumulation phase as in accumulation phase.

Let me be clear here – we want more people to have better standards of living in retirement. But the retirement income review notes that much of that hinges on flexibility of retirement income stream products, improved understanding and confidence.

The Morrison Government salutes the thrift and responsibility of retirees who have worked during their economically active years and who have been able to accumulate savings in voluntary savings vehicles and through compulsory superannuation contributions.

This is why as a government and as an industry more broadly we must turn our minds to more flexible, and more efficient products that allow retirees to use their super for a higher standard of living in retirement.

But let’s be clear; under the Morrison Government, these products will never be prescriptive. This is not about forcing retirees – current or future – to draw down on savings through rigid policy settings and punitive regimes that restrict choice and agency.

This is about navigating the barriers that are preventing people from doing so. Which, more often than not, comes down to fear and inaccessibility.

We know the inherent complexity of our retirement income system – combined with low levels of financial literacy – can make it difficult to effectively use retirement income streams to improve outcomes.

In fact, COTA’s submission to the Review noted:

There is a need for the retirement income system to be structured and communicated so that people are better able to understand and navigate the system to plan and access optimum and appropriate benefits. (COTA, 2020, p. 6).

And COTA is right. Our system is complicated and difficult to navigate which discourages engagement.

But there is also this all important issue how superannuation is being used. How do we help people have confidence to use their superannuation more efficiently to focus their planning on income streams as opposed to balances

We all have roles to play here.

The private sector can better innovate and develop flexible products- an area that we are already seeing a significant uptick in – as well as providing financial advice, guidance and information.

And the Government needs to create an environment that encourages the market to develop retirement income products and provide guidance to deliver better outcomes for members.

Retirement Income Covenant

Increased access to income stream products will play a role in managing longevity risk by paying a regular income stream, giving people greater confidence to spend their retirement savings.

To enable this, the Government progressed reforms to superannuation regulations and means test rules to support the development of products that can provide more income – and more certainty – to retirees.

But there was still room for improvement in encouraging the growth of this sector to give retirees – and those nearing retirement – the certainty they need.

As it stands, superannuation fund trustees have no obligation to consider how they deliver the primary function of the retirement income system for their members: providing income in retirement.

The Retirement Income Covenant will change that. At its core it will require trustees to have a strategy to generate higher retirement incomes for their members.

The Covenant allows super funds the flexibility to tailor their retirement income strategy to their specific membership base, while allowing them to deliver solutions they think will work best for the particular cohorts of members in their fund.

Many trustees are already taking action in this area, and those ahead of the curve should rest assured that the Covenant will be principles based and not prescriptive. Innovation in financial services is a competitive strength in Australia and one we are not prepared to lose and we want to see the proverbial thousand flowers bloom.

With proper accountability and frameworks, trustees of super funds are best placed to manage their funds and develop the best products for their members. Very few organisations represent the interests of super fund trustees. And that’s why this Government is still moving forward with a body to represent super fund members and a body that we would expect COTA to share common cause with. The body will be independent and properly resourced to become the voice of consumers in policy debates about super.

The Age Pension

Our Retirement Income System is much bigger than superannuation. In discussions about retirement outcomes, we need to be thinking of our system as a whole – and that includes the Age Pension and savings outside of superannuation.

The fact is our system is designed to enable retirees to access both super and a variable amount of the Age Pension, with the pension scaling up as super balances are drawn down.

Retirees can have confidence to use their retirement assets knowing that the Age Pension will always be there to support them should their savings not last as long as they planned.

The Age Pension is far from being just a social safety net. It is a retirement income pillar of its own — received by around 71 per cent of Australians over 65.

The Age Pension provides an important form of insurance against longevity risk and sequencing risk for retirees.

Increasing system equity

Before I finish up, I want to make some final remarks about increasing equity in our super system.

The superannuation system largely supports intergenerational equity. It encourages people to rely on their own savings to meet their retirement income needs.

The maturing of the superannuation system will mean more Australians will have higher retirement savings and the proportion of the eligible population receiving the Age Pension will decline.

This is expected to reduce the cost of the Age Pension borne by the next generation through tax in their working lives.

That said, we know inequity in our system remains. We know that women retire with significantly less superannuation than men.

This is an inherent structural feature of the system designed 30 years ago. By men.

Superannuation balances will always be a reflection of a person’s working life. Women have more gaps in employment than men – often to take on caring responsibilities, or work in – on average – lower paid industries.

This is why the Morrison Government enabled more opportunities for Australians to contribute to their own superannuation savings voluntarily with catch-up contribution provisions.

But the single greatest contributor to equal superannuation balances is equal employment and pay.

We have always focussed on assisting more women into the work, reaching record breaking female participation in the workforce prior to COVID-19 and under this Government the national gender pay gap has declined 4.5 percentage points since 2014, to 14 per cent in 2020.

As a society we should be proud of the progress we have made, and this Government is determined to continue the momentum.

Closing remarks

On that note, I would like to thank COTA for hosting today’s forum.

I know that COTA is committed to improving understanding of the retirement income system and had ‘long called for a review’.

Indeed, the purpose of the Retirement Income Review was always about informing public policy debate, and it is terrific to see that in action today.

All Australians — regardless of age — should be confident about the sustainability of our retirement income system.

Address to the COTA Australia National Policy Forum on Retirement Income

26 February 2021

The Hon Josh Frydenberg MP

To see the address on Josh Frydenberg’s website, please click here

Thank you Ian and the Council on the Aging (COTA) for hosting today’s national policy forum on retirement income.

I would like to acknowledge the constructive role that COTA has played – both prior to the Review being commissioned and since its completion. I especially want to recognise that COTA approaches these issues in a calm and considered manner – not seeking to sensationalise but rather seeking a balanced discussion based on the facts.

I also want to acknowledge that the Royal Commission into Aged Care Quality and Safety is due to be released imminently and it too will make an important contribution to policy development in this area.

Australia’s population is ageing.

We are living and working longer.

And the nature of retirement is changing.

It was against this backdrop that I commissioned the first holistic review of the retirement income system since the early 90s.

The Review was conducted over a 10 month period by an independent panel: Mr Michael Callaghan, Ms Carolyn Kay, and Dr Deborah Ralston.

It received more than 430 submissions and produced a report in excess of 600 pages.

I want to thank the panel for their comprehensive assessment of our retirement income system. It is a body of work that will inform policy direction in this area for years to come.

I also note that the next Intergenerational Report will be released in the middle of this year. With the last IGR having been handed down in 2015, this year’s IGR will be especially important in highlighting the wider impacts of COVID-19. No doubt it will also contribute to our continued assessment of the effectiveness and sustainability of our retirement income system.

Today, however, I want to outline my perspective on the Review:

- first, the significance of the Review and why it matters;

- second, the Review’s evidence base and what it found; and

- third, the challenging policy trade-offs the Review identified as being at the core of the system and which we must get right if we are to improve Australians’ quality of life – not just during their retirement.

As many in this room will know, the Review examined the three pillars of the retirement income system: the Age Pension; compulsory superannuation; and voluntary savings, including home ownership.

It looked at each pillar individually and at the system collectively. In doing so it has provided a comprehensive assessment of the system and the outcomes it is delivering for all Australians.

This is vital because it has allowed proper consideration of each pillar within the context of the wider retirement income system. Until now, each pillar was typically assessed in its own right and without consideration of the contribution being made by the other pillars of the system.

It means questions such as adequacy and sustainability can correctly be considered in the context of the system as a whole rather than looked at in isolation.

Establishing a fact base – what did the review find?

The core task of the Review was to establish a fact base of the current retirement income system to improve understanding of its operation and the outcomes it is delivering for Australians.

What then did the Review find?

1 – The system achieves adequate retirement outcomes.

The Review found the three pillars of the system, the Age Pension, compulsory superannuation and voluntary savings deliver adequate incomes in retirement for most Australians and will be viable for generations to come.

In measuring the adequacy of retirement incomes the system delivers, the Review considered that income in retirement should “replace” around 65 per cent to 75 per cent of disposable working life income. This balances living standards over a person’s lifetime, and is in line with the standard used around the world, including by the OECD.

The Review’s evidence suggests that current retirees meet this benchmark, and that future retirees are also projected to meet it – and in many cases exceed it.

The results are consistent across men and women, different incomes, different work patterns and different savings behaviours. The current retirement income system provides an adequate retirement for a wide range of people.

This is a key finding that should reassure the vast majority of Australians that our retirement income system is working to ensure that their living standards in retirement will broadly reflect their living standards pre-retirement.

In the words of the Review: “Most recent retirees are estimated to have adequate retirement incomes”, and for future retirees, “replacement rates are projected to exceed or meet the [adequacy benchmark] for all income levels when considering employees regardless of relationship status or gender.”

2 – The Age Pension is central to our system and is working effectively.

The Review also found that the Age Pension plays a central role in our retirement income system. It is both a safety-net and a supplement. It allows Australians to more confidently use their own savings during their retirement in the knowledge that that Age Pension is there as a back-stop later in life as their savings are drawn down.

Importantly, the Review also finds the Age Pension plays an important role in improving equity by reducing income inequality among retirees, as low-income retirees receive the largest Age Pension payments.

In adequacy terms, the Review finds that 11 per cent of retirees are in financial stress, lower than the working-age average. To quote the Review, “the Age Pension combined with other support provided to retirees, is effective in ensuring most Australians achieve a minimum standard of living in retirement in line with community standards.”

Notwithstanding the strong endorsement by the Review of the vital role played by the Age Pension, research commissioned by the Review shows that most young people do not think the Age Pension will be there when they retire.

Clearly we must do more to reassure all Australians that this concern is unfounded. The Review’s findings could not be clearer. The Age Pension is well targeted and sustainable and will remain a key pillar of our system for generations to come.

This leads me to the next key finding of the review which is that the retirement income system is both sustainable and robust.

3 – The retirement income system is sustainable and robust.

In the words of the Review, “the Australian retirement income system is effective, sound and its costs are broadly sustainable.”

The cost of the Age Pension is projected to decline from 2.5 per cent of GDP in 2020 to 2.3 per cent of GDP in 2060. And while the cost of superannuation tax concessions will grow from 2 per cent of GDP to 2.6 per cent over that time, the overall cost of the retirement income system will continue to be relatively low by international standards.

This is remarkable given our ageing population. But the cost-effectiveness of our system is not an accident. It is the product of sound design and prior reforms that have enhanced its sustainability. That includes this Government’s reforms to the Age Pension assets test and the introduction of the transfer balance cap for superannuation.

This means, unlike a lot of other countries around the world, we have a retirement income system that is both sustainable today and well into the future.

Along with being sustainable, the Review also showed that our system is resilient. That is, it can continue to provide adequate outcomes for retirees through economic shocks and downturns – including COVID-19.

By way of example, the Review found that even if the market fell by 25 per cent just before they retire, the income for the median earner would only drop one per cent across their retirement, because the Age Pension is available to support them when they need it.

4 – Superannuation plays an important role in the system.

Evidence commissioned by the Review shows compulsory superannuation has increased total household savings. Without compulsory superannuation, many Australians would not save enough for retirement.

The superannuation system also gives people the flexibility to save more if they can. Voluntary contributions to superannuation also provide those outside the compulsory system with an opportunity to contribute, such as the self‑employed and people with interrupted work. Around a quarter of Australians make these voluntary contributions to superannuation.

The benefits of superannuation will grow as the system matures. Median balances for people entering retirement today are around $140,000 but by 2060 are projected to be around $450,000, in real terms adjusted for changes in living standards.

With effective use of those savings, Australians will be increasingly well-placed to achieve financial security in retirement.

5 – Home ownership is critical to quality of life in retirement.

The Review found home ownership was the most important factor for avoiding hardship in retirement. For example, 6 per cent of couples that are homeowners in retirement report being in financial stress. This compares with 34 per cent for couples that rent.

Home ownership lowers living costs and provides financial security in retirement. The Review also found that the home makes up the largest share of wealth for older Australians. This wealth gives retirees peace of mind, and can help retirees cope with spending pressures that they may face.

The Government recognises the importance of home ownership to the financial security and wellbeing of Australians in retirement. To that end, we are continuing to deliver measures that will allow more Australians to buy their first home sooner, including through the First Home Loan Deposit Scheme, First Home Super Saver Scheme and HomeBuilder Scheme.

We are also leveraging the retirement income system to improve supply through the downsizer contribution, which allows people aged over 65 to contribute up to $300,000 to superannuation if they sell their home.

6 – The system is complex and we all need to do more to help Australians make better decisions

While these key findings are overwhelmingly positive, the Review also found that complexity, low financial literacy and limited guidance means too many Australians don’t plan for their retirement or make the most of their savings when in retirement.

Further, many are also not aware of the extensive support they receive from Governments once in retirement, such as through health and aged care services.

The Review considers these factors to be a driver of conservative spending behaviours and misconceptions around how much savings Australians need in retirement to sustain their standard of living.

Improving retirees’ understanding of the retirement income system can assist them to make better use of their retirement savings and improve their living standards in retirement – without sacrificing their living standards during their working life.

This will continue to be an area of focus for the Government.

This is also why the Government’s Retirement Income Covenant is an important reform to the system. The Covenant will establish a requirement for superannuation trustees to develop a retirement income strategy for members. In doing so, the Covenant will require superannuation funds to consider the retirement income needs of their members and how they can assist them to get the most out of their accumulated savings over the course of their retirement.

It is a system that must carefully weigh a series of trade offs

While the Review’s key findings should rightly give us all confidence about the outcomes that the system is delivering as a whole, it also makes clear the difficult trade-offs that are at the core of the system.

These trade-offs represent the key choices that both individuals and Governments must make. And like all trade-offs, there are competing interests that need to be weighed.

The retirement income system is by definition, designed to provide retirement incomes. But the system cannot solely be about maximising income in retirement. Were it to seek to do so, it would clearly come at considerable expense to individuals during their working lives.

The Review rightly outlined that the system should help people balance their lifetime income. This means balancing the trade-offs between income in someone’s working life and in retirement.

In this respect, the Review highlighted the trade-off between the superannuation guarantee and wages.

Drawing on overwhelming international and Australian evidence including independent analysis from the ANU, the Grattan Institute and the RBA, the review conclusively stated that a higher superannuation guarantee means lower wages for employees.

Specifically, the Review stated “the weight of evidence suggests the majority of increases in the superannuation guarantee come at the expense of growth in wages.”

No-one should be surprised by this or find it controversial. It was part of the original policy design of the superannuation system.

As I have said previously, this is not rocket science, anybody who denies that there is a trade-off is effectively a “flat-earther”.

The Review found that increases to the superannuation guarantee boost retirement income, but that this comes at the expense of working-life income.

For a median earner, increasing the superannuation guarantee could increase their retirement income by $33,000, but lower their working-life income by around $32,000.

Given the compulsory nature of superannuation, this is a trade-off that the system imposes, not one which individuals can choose for themselves.

Were it not for compulsion, it would be a matter for each individual to decide how much of today’s income they are prepared to save for their retirement.

It is simply not true, as some would have us believe, that there is virtually no limit to how high the superannuation guarantee can be increased in the name of delivering ever higher retirement incomes.

Indeed, for some, there isn’t a problem that cannot be solved through a higher rate of compulsory superannuation.

These myths do nothing to help Australians plan for retirement, to feel more confident or to be more secure in their retirement.

Indeed, as the Review noted, the people most affected by high default settings are not the most-well off: “People with lower incomes are particularly vulnerable when compulsory savings rates are set too high”, noting that it “could increase pressure on lower‑income earners during working life through lower incomes”.

This important observation sits alongside a key finding of the Review with respect to superannuation, which is that “If people efficiently use their assets, then with the SG rate remaining at 9.5 per cent, most could achieve adequate retirement incomes when combined with the Age Pension. They could achieve a better balance between their working life and retirement incomes.”

This is why, as the Prime Minister and I have said, we must rightly carefully consider the implications of the legislated increase to the superannuation guarantee before 1 July this year – even more so at a time when our economy is recovering from the largest economic shock since the Great Depression.

The Review also identified the trade-off between flexibility and compulsion.

The Review noted that our system has considerable flexibility if you want to save more for your retirement. But there is very limited flexibility if a person needs to save less to maintain their quality of life today.

The COVID-19 early release of superannuation scheme was an example of how greater flexibility can benefit those that need it.

Recognising the trade-offs, we gave Australians the choice of increased flexibility, allowing them to access their savings when they needed them most.

And the scheme improved their lives. The ABS Household Impact survey showed that for around 80 per cent of people, the main use of the funds was to pay for bills, mortgages or add to savings.

Early release of superannuation in many cases allowed people to stay in their homes, keep their kids in school and provide for their families during an exceptionally challenging period in their lives.

And, as the Review found, because of our robust multi-pillar system even a person who accessed the maximum $20,000 today will still have an adequate income in retirement.

While compulsion will remain an important part of our system, providing Australians with more flexibility should not be seen as an attempt to undermine the system overall. Far from it.

The earlier Australians interact with the system the more engaged they will be and the more ownership they will feel over their own savings.

More flexibility also means better accommodating the many different circumstances Australians finds themselves over the course of their lives – whether it be their working patterns, taking time off to raise children or deciding to make catch up contributions at a time that their financial circumstances allow.

This is why we have introduced several changes over recent years to provide greater flexibility and allow Australians to make the most of their circumstances and better balance their working life income and their retirement income.

These changes have included allowing Australians with balances under $500,000 to make ‘catch-up’ contributions, enabling the self-employed and others to claim tax deductions for their personal superannuation contributions, and allowing Australians aged 65 and 66 to make voluntary superannuation contributions without meeting the Work Test.

The Government will always be very sceptical of those who, in pursuit of their own self-interest, would seek to restrict the legitimate choices Australians should have about how they choose to save for their own retirement.

Better use of superannuation savings critical to higher retirement incomes

The Review made clear that how retirees use their superannuation savings in retirement has a significant impact on their retirement income and therefore their quality of life in retirement.

Overwhelmingly, retirees currently do not spend all their superannuation before they die. This is despite the fact that retirees today have not benefitted from a mature superannuation system their whole working life.

The Review shows that if nothing changes, by 2060, one in every three dollars paid out of superannuation will be part of a bequest. This raises the question as to whether the answer to lifting the retirement incomes of Australians is more superannuation savings or better guidance about how to maximise their superannuation savings during their retirement.

This question is all the more important given the trade-offs from higher contributions I have outlined above.

Drawing from the analysis in the Review, Treasury has estimated that at the current superannuation guarantee rate, using superannuation efficiently could increase the median person’s income in retirement by over $100,000 compared to how people typically draw down on their superannuation now.

To illustrate how significant this finding is, the Review also assessed the impact on retirement incomes of the superannuation guarantee rate increasing to 12 per cent, but the same median income earner only drawing down on their superannuation at the current typical rates. In this scenario, the person would only receive $7,000 in additional retirement income over their retirement despite having foregone more of their working life income.

It is clear that giving more confidence and guidance to retirees to assist them in drawing down on their superannuation savings more effectively is critically important.

This is perhaps the key challenge that the Review has highlighted and which we must collectively solve. There are few more effective ways to improve the quality of life for Australians in retirement than to help them make better financial decisions. This is an area that the Government will look to do more and I look forward to engaging with all of you on this critical task.

Continued superannuation reform key to higher retirement incomes

The efficiency of the superannuation system is vital to the retirement outcomes it delivers Australians. Under a compulsory system supported by important tax incentives, it is incumbent on the Government to ensure that members and taxpayers are getting value for money from the system.

The Government has successfully implemented major reforms to the system over recent years that will see substantial savings flow to Australians.

These reforms have included fee caps on low balance superannuation accounts, banning exit fees and requiring insurance to be offered on an opt-in basis in certain circumstances where it would otherwise result in an unwarranted erosion of member balances.

The Government has also legislated reforms to allow the ATO to proactively reunite lost and unclaimed super balances held by the ATO with an individual’s current active account. As of December 2020, the ATO has proactively consolidated $3.7 billion held in unintended multiple accounts on behalf of almost two million Australians.

As the Review highlights, adequate retirement outcomes are also a product of the returns Australians earn on their savings. Those returns are a function of the performance their superannuation fund delivers and the costs of delivering that performance.

That is why the Government is focussed on ensuring Australians’ hard earned superannuation savings are working harder for them. As many in this room will be aware, the Your Future, Your Super reforms announced in the Budget stand to boost the retirement savings of millions of Australians, with Treasury estimating a total benefit to members of $17.9 billion over 10 years.

Treasury estimates young workers entering the workforce could be up to $98,000 better off at retirement because of these reforms.

Eliminating expenditure that is not in the best financial interests of members, preventing the creation of unintended multiple accounts, driving down fees and holding funds to account for poor performance represents the only “free lunch” when it comes to increasing the retirement incomes of all Australians.

Closing remarks

To conclude, the comprehensive review of Australia’s retirement income system tells us that we have much to celebrate.

Our system produces adequate retirement incomes for the vast majority of Australians, and it does so in a way that is fiscally sustainable in the long term.

As our population ages, as we live longer and our retirement patterns change, I am confident that the pillars of the system will continue to provide effective support to Australian retirees.

But as the Review highlights, there is scope to improve the system and to continue to challenge ourselves with respect to the key trade-offs at the core of the system.

The work of the Review now provides the evidence base to have these discussions and to consider what more we need to do to improve the system and ultimately help more Australians more effectively balance their lifetime incomes.

Hume shoots down ‘retiree tax’ budget pitches

The Australian Financial Review

12 February 2021

Ronald Mizen

Proposals to tax retiree savings to pay for aged-care services and remove tax concessions for balances over $5 million have been shot down by the Morrison government, with Superannuation Minister Jane Hume saying she did not plan to introduce more taxes.

Speaking at an Association of Superannuation Funds of Australia conference on Friday, Senator Hume rejected the two proposals put forward by ASFA and the Australian Council of Social Services.

“We have no intention of burdening Australians with a retiree tax,” she said.

In a pointed critique of opponents of the government’s suite of changes to the $2.9 trillion superannuation sector, Senator Hume also said the retirement income system was not perfect and should not be mythologised.

And in a thinly veiled swipe at former prime minister Paul Keating, Senator Hume said the debate about super had been treated as an opportunity to shout about philosophy or legacy rather than the merits of reform.

“Every single reform we have proposed has been met with resistance,” she said. “Indeed, superannuation has proven to be the most frustratingly partisan sector of financial services.”

Earlier in the conference, Mr Keating slammed the Morrison government and Treasury for an “anti-super” bias and said the Reserve Bank was in cahoots with Liberal backbenchers.

The government faces a two-front battle over super: the first, whether to increase the contribution rate; and the second over new “your future, your super” legislation containing sweeping industry reforms.

Industry Super Australia, the lobby group for the union-linked super sector, has been a vocal opponent of the reform package and proponent of proceeding with the increase SG rate from 9.5 per cent to 12 per cent.

Senator Hume said Labor had a right to be proud of the compulsory superannuation system, but it was giving vested interests a platform to oppose sensible reforms that were in members’ interests.

“We’ve seen in numerous examples over recent years, too often, the super industry’s lobbyist leviathan has spoken with a megaphone on the floor of our Parliament in opposing efficiency reforms,” she said.

“Having seen behind the curtain, and worked in multiple sides of the industry, I’ve come into the Parliament as a strong supporter of compulsory super, but someone not blind to its faults.”

Also at the conference, prudential regulator chairwoman Helen Rowell called for fund trustees to make the hard but necessary decisions about mergers and acquisitions and call out poorly performing players.

Ms Rowell said it was the Australian Prudential and Regulation Authority’s position that fund trustees had a responsibility to look broadly at what was in the best interests of the sector as well as of members.

“You all know who the poorly governed, poorly performing funds are that are making poor decisions, and so what is it that the industry can do about that, for example, so that we don’t [have to]?” she said.

“But also just acknowledging the issue more publicly, and that it is needing to be tackled and helping us in our work in cleaning the industry up and getting improvements made.”

Problem is the tax on our super is too high

The Australian

Henry Ergas and Jonathan Pincus

12 February 2021

Released by the Treasurer in the midst of the pandemic, the report of the Retirement Income Review has received far less attention than it deserves. While the report covers a great deal of ground, it is disappointing and dangerous in important respects.

To begin with, its discussion of the tax burden on superannuation — which endorses Treasury’s claim that superannuation receives highly favourable tax treatment — is seriously misleading. As a moment’s reflection shows, the primary impact of taxes on savings is to alter how much consumption one must give up today so as to consume more tomorrow. The proper way to calculate the effective tax rate on savings is therefore to assess the impost savers face for deferring a dollar of consumption from the present into the future.

Examined in that perspective, the tax rates on compulsory superannuation are nowhere near as generous as the report suggests. Consider a person who earns $50,000 a year and is planning to retire in 20 years. As things stand, she will be required to put $4750 into superannuation this year, paying a 15 per cent contributions tax on that amount. If her fund earns 3.5 per cent a year — also taxed at 15 per cent — those savings will grow to $7300, spendable in 2041.

However, in the absence of taxes on contributions and on earnings, steady compounding would have increased today’s $4750 to about $9500. As a result, the actual tax rate, which reduces $9500 to $7300, is not the notional or statutory 15 per cent but, at 30 per cent, twice that.

Moreover, every dollar of superannuation reduces our saver’s entitlement to the Age Pension and to aged-care subsidies. And just as marginal effective tax rates on an additional dollar of income from working are properly calculated taking reductions in transfer payments into account, so must the reductions in eligibility be included in the effective tax rate on superannuation.

Factoring the means testing of those payments into the calculation pushes the effective tax rate on compulsory superannuation towards 40 per cent or more, which no one could sensibly describe as unduly low.

Unfortunately, none of this is reflected in the report. Instead, it simply assumes that superannuation savings should be taxed as if they were ordinary income and on that basis asserts that they benefit from a massive tax “concession”.

Perhaps because it doesn’t realise it, the report seems untroubled by the fact that were compulsory superannuation actually taxed on the basis of its chosen benchmark — a comprehensive income tax — our hypothetical saver would face a 93 per cent effective tax rate on her retirement income.

Given how distorting, unreasonable and politically unsustainable such a tax rate would be, its use as the standard for evaluating the current arrangements is indefensible.

The errors in the report’s tax analysis don’t end there — its discussion of dividend imputation is also deeply flawed.

What is significant, however, is the unstated inference its analysis leads to: that superannuation savings are so heavily subsidised as to really be the property of taxpayers as a whole, making it perfectly appropriate for the government, rather than savers themselves, to determine their use.

That matters because the report repeatedly claims that superannuants do not spend their savings “efficiently”. Precisely what it means by “efficient” is never explained; it can nonetheless be said with some confidence that it is using the word in a sense entirely unknown to economics.

Rather, the report treats “efficient” as a synonym for “what we, the reviewers, think ought to happen” — or to put it slightly differently, as what Kenneth Minogue, a fine scholar of government verbiage, called a “hurrah word”, with “inefficient” being the corresponding “boo/hiss word”.

In this case, the “hurrah” goes to savers who completely run down their savings; the “boo/hiss” to savers who leave bequests. It is, in the report’s strange reasoning, “efficient” for retirees to devote their savings to wine, gambling and song, but “inefficient” for them to leave an inheritance to their children and grandchildren, no matter how great their preference for the latter over the former may be.

That the contention is absurd on its face scarcely needs to be said; the only justification the report provides in its support is the claim that it is not the “purpose” of the system to allow savers to leave bequests — which is merely a convoluted way of saying that the report’s authors don’t believe they should.

We are therefore left with a paradox. The reason repeatedly advanced for compulsory superannuation is that people of working age save much less for retirement than they ought to; now we are told that at retirement the bias is dramatically reversed — from then on, it seems, they save much more than would be desirable.

Quite how or why this miraculous transformation occurs is clearly a mystery that can be penetrated only by greater minds than ours; what is certain is that savers shouldn’t rest easy.

On the contrary, they should feel government coercion coming on: more specifically, a requirement to buy annuities or in other ways exhaust their savings, regardless of their preferences — or be driven to do so by some combination of higher taxes on any remaining savings and harsher means testing of social benefits.

Of course, it may be that the review is right: perhaps savers are utterly clueless, as one government report after the other appears to believe, and thus have to be forced to act “efficiently” by layer upon layer of regulation.

But if savers neither know what they want nor are capable of achieving it, what possible justification can there be for continuing to rely on a superannuation system based on individual decision-making — and every bit as important, in which individuals bear all the risks?

Why wouldn’t we simply shift over time to a government-run contributory pension scheme, possibly along Canadian or Scandinavian lines, that provides middle-income earners with an assured income in retirement — and does so fiscally prudently and at resource costs far lower than those of our current arrangements?

Or has it become the real goal of our superannuation system to force middle-income earners, who depend on that system most heavily, to subsidise an ever-expanding finance industry — including, should this review have its way, the suppliers of high-priced annuities?

These are serious issues; they merit serious analysis. If the government is genuinely interested in that analysis, the Retirement Income Review won’t help it.

Call for $5m cap on super balances

The Australian

Glenda Korporaal – Associate Editor (Business)

10 February 2021

The Association of Superannuation Funds of Australia has called for a $5m cap on the amount of money that can be saved in superannuation, with retirees being forced to withdraw funds above $5m.

In its pre-budget submission, which comes ahead of its annual conference on Wednesday, the association argues that $5m is more than enough to allow people to live a comfortable life in retirement.

It argues that people over 65 should be forced to withdraw any amounts in super above $5m, from July next year.

ASFA chief executive Martin Fahy said last year’s Retirement Income Review had highlighted the inequities in the superannuation system, with the largest benefits in terms of tax concessions going to people on high incomes or with large super accounts.

“There is a very strong justification to discontinue the tax concessions that those with very high balances are getting,” Mr Fahy told The Australianon Tuesday.

The Retirement Income Review found there were 11,000 people in Australia who had super balances of more than $5m.

ASFA argues that a balance of $5m in concessionally taxed superannuation “cannot reasonably be justified as necessary to support a comfortable lifestyle in retirement”.

The submission also argues that the low income tax offset should be expanded to apply to people earning up to $45,000 a year — up from the current level of $37,000 a year.

It says this is needed to ensure they are treated equitably and do not pay more in terms of tax on their super contributions than the tax rate on their income.

“While the superannuation system is well designed and working for the majority of Australians, ASFA acknowledges there is merit in addressing a number of the concerns highlighted in the RIR about fairness in the system in regard to individuals with high incomes and/or relatively high account balances,” it says. “Superannuation is about ensuring people are comfortable in retirement, it is not about excessive wealth transfers.”

But it says it is also “crucial to ensure that superannuation is delivering for low to middle income earners”.

The earnings from money in superannuation are taxed at 15 per cent for accounts in the accumulation mode. Once the fund is paying out pensions, the earnings from the fund are tax-free for amounts below the $1.6m transfer balance cap.

While the transfer balance caps limit the amount of money a member can put into pension phase, where earnings are tax-free, the ASFA submission argues that the current system means people on 45 per cent tax rates can have money above the $1.6m transfer balance cap in super taxed at 15 per cent — a 30 per cent tax rate advantage.

“This tax concession can be substantial for large accounts,” it says. “While current caps on superannuation contributions limit the ability for members to build up excessive balances in the future, there is a real question regarding the appropriate treatment of high balances achieved in the context of more generous contribution caps in the past.”

The submission argues that people should be forced to withdraw funds above $5m from super once they reach 65.

The recommendation comes after other superannuation lobby groups have argued against major changes to superannuation tax concessions on the basis that constant change will undermine confidence in the system.

The ASFA submission concedes that the need to remove “excess balances” from super funds could have some liquidity implications for some small super funds, especially those with illiquid assets such as property.

It says this could be addressed by allowing a transitional situation for small or self-managed super funds that could see earnings from balances above $5m taxed at the top marginal tax rate.

ASFA is also recommending that the current $1.6m transfer balance cap not be indexed as currently planned.

Rising tensions plague some retirees

The Australian Business Review

Robert Gottliebsen – Business Columnist

9 February 2021

Many sectors of Australia’s retirees are now enjoying the prosperity that comes from higher sharemarkets and property markets.

But two groups are encountering new levels of tension. The first are those who own a dwelling but have most of their money in the bank. Their wealth is rising but they are becoming income-poor.

The second agitated group are holders of large superannuation balances who are suddenly being declared by young people as “spongers on the system” and “rent-seekers”.

I have encouraging news for both groups.

As people get older they often embrace more conservative investment policies and the bank deposit content of their portfolio rises. In previous years, bank deposits earned reasonable rates of interest, but today there is not much income difference between depositing your money in a bank and putting it under the bed. Banks are merely offering a safe place to store your money.

And so while the wealth of many Australians is rising with the value of their houses, their non-government pension income is falling. Their bank money hits their government pension entitlement and they have less income when their cost of living is rising faster than the CPI, given the high medical content.

There are a number of home loan products on the market, but one that is not often considered is the “Government Pension Loan Scheme”, which dates back to the Keating era but has fallen into disuse. Only about 3000 people took it up last year.

What the government is prepared to do is lend people starting in their 50s — but especially 70-year-olds and above — amounts of money that are not limited by your assets or income. The loans are secured on real estate, usually the family home. They are delivered fortnightly and the amount that is allowed is capped at 1.5 times the aged pension. The percentage of the value of a house that can be borrowed depends on people’s age. It gets very high in the nineties.

The loans are repaid when the family home is sold. While that does lessen later flexibility, many older people who are reluctant to borrow on their house are living in virtual poverty despite their wealth. A clear weakness in the loan scheme is the interest rate has not been adjusted to today’s world and is still 4.5 per cent, but my guess is that before the year is out it will be reduced.

A large number of people have seen a 10-20 per cent rise in the value of their dwelling in recent times. The government scheme supplements income but it does mean that there is less money for children to inherit. But I think it’s reasonable that some of the wealth that is being created in the housing boom is shifted into older people’s living standards.

Big super balances

The second group are in an entirely different situation.

Over a period of years there has been a switch in attitudes to the large amounts of superannuation held by older people. For a long time superannuation rules encouraged people to invest large sums in superannuation. This ALP and Coalition government policy deliberately created some very large superannuation balances, which are very difficult to achieve under today’s rules. The policy of maximising the amount of money people held in superannuation continued right through the Abbott/ Turnbull Coalition years.

Indeed, one of the most successful policies to retain the large superannuation sums was a Coalition government brainchild to freeze many superannuation plans issued prior to 2006-07, and allow the frozen money to be released via retaining large superannuation balances.

The Coalition’s policy was therefore to encourage people to use their personal money and leave large sums in super. That’s not today’s agenda, so one of the controversies in superannuation is how much people should withdraw in their 60s and 70s.

Current Superannuation Minister Jane Hume thinks that not enough money is being withdrawn and people’s living standards are suffering.

While this is might be true, many people are nervous about the amount of money they will need in their 80s given the rising costs of medicine, etc. And of course people in their 80s and 90s are required to take large sums out of superannuation. The level of under-withdrawal of superannuation money by people under 80 depends on what graph you look at. If all superannuation is counted, including zero balances, it is clear that people do withdraw their money. But if you take out the zero balances then there is a conservative rate of withdrawal in the 60s and 70s.

It’s important for the government to honour its election promises and not make major changes in this area — especially given its recent policies to actively incentivise the retention of large sums in superannuation.

But on an overall community basis, people have the fitness to spend money on travelling and other areas in their 60s and 70s, which they might not have in their 80s and beyond.

Do retirees hoard their superannuation?

Jim Bonham* saveoursuper.org.au

On 22 January 2021, the Australian Financial Review featured a front-page article by John Kehoe and Michael Roddan headed “‘Ever more’ super gets hoarded: Hume”. 1

In the same issue, Jane Hume (Minister for Superannuation, Financial Services, and the Digital Economy) provided an op-ed “Safety nets let frugal retirees spend savings without a super rise”. 2

On 23 January 2021, Kehoe followed up with an article entitled “Push for seniors to dig deep into super nest egg” in which he wrote:

“Superannuation Minister Jane Hume kicked off a national debate about retirement incomes this week …

“She said people needed to be more confident to spend – not hoard – retirement savings to improve living standards throughout their lives …

“The government’s retirement income review led by former Treasury official Mike Callaghan identified that many retirees died with most of their wealth intact and did not run down their super or tap equity in their home, so they might be saving too much”. 3

It is clearly an important national question. Wealth includes the home and other assets as well as super, but because the regulatory, financial, market, liquidity, and social issues in relation to housing differ so much from those applying to super, this article focusses only on super.

Is it true that retirees hoard their super? The answer is in three parts:

- Yes, in nominal terms, in some cases,

- No, in real terms (indexed to wages),

- No, when considered as an average across all retirees.

The Minister’s view, as presented in the op-ed2 and reported in the articles mentioned1,3, is rather different, but it is strongly supported by the Retirement Income Review – Final Report (20 November 2020), chaired by Michael Callaghan4 (“RIR Report”).

A couple of quotes give the flavour of the RIR Report’s attitude (page numbers refer to the pdf version4):

page 23, “Most people die with the bulk of the wealth they had at retirement intact.”

page 56, “The evidence suggests that retirees tend to hold on to their assets … Alternatively they need not have saved as much …”

It seems the way is being paved towards downgrading the level of compulsion applying to super contributions for pre-retirees and tightening the requirements for withdrawal in retirement. Such changes may be damaging to retirees if they are not soundly based on facts and understanding.

The counter-arguments to the claim that super is being hoarded by retirees need to be fleshed out:

- Nominal hoarding

Superannuation kept in an allocated pension account, as is typical for retirees, is subject to minimum annual withdrawal limits. Those rates have been halved for 2019-21 because of Covid-19, but normally they are: 4% below age 65, 5% for ages 65-74, 6% for 75-79, 7% for 80-84, 9% for 85-89, 11% for 90-94 and 14% over 94.

Provided that investment returns can keep up with the minimum withdrawal rates from an allocated pension it is possible, with care, to leave the capital (in nominal dollars) untouched and take only the investment returns as income.

However, this becomes increasingly difficult beyond age 80 as the minimum withdrawal rates increase well beyond 7%, or at much younger ages if investment returns are low.

Hoarding of nominal superannuation capital throughout retirement is therefore possible, but only for those who die early or invest well.

- Real hoarding

Nominal dollars provide a poor base for comparison across long time periods. Real values, indexed to wages, relate much better to community living standards. If the super account maintains its nominal value for 15 years, it will have lost almost half its real value (assuming 4% p.a. long-term wages growth).

Successfully hoarding real capital between 65 and 74 years of age would require nominal investment returns, net of fees, consistently above 9%. This is possible during good times, but almost impossible in bad times, and it becomes far harder as the superannuant ages further.

There is a simple reason for that: the minimum drawdown rates are designed to prevent long-term hoarding, whilst enabling those who live a long life to continue to benefit from their savings.

- Average hoarding

It is easy to trot out simple examples to show that capital can or cannot be preserved in various scenarios. From a policy point of view, however, what matters is the true average behaviour of all retirees.

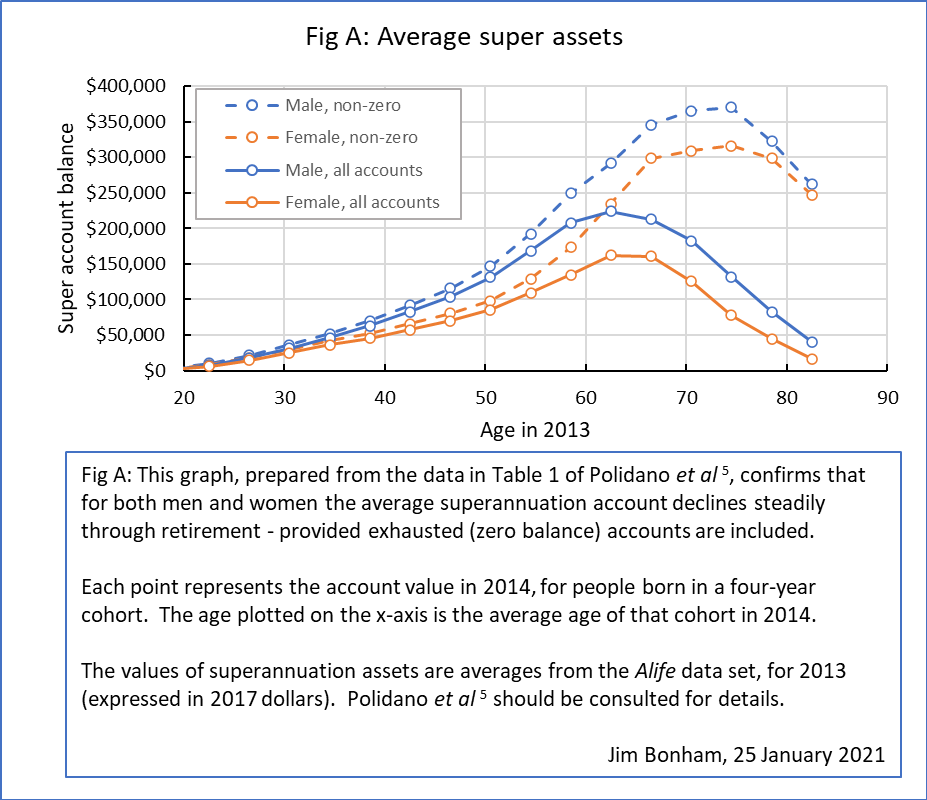

In support of the claim that retirees do not consume their capital, the RIR Report4 cites a paper by Polidano et al 5, and re-plots Fig 2 of that paper as Fig 5A-12 on page 434 (pdf version). That graph shows average superannuation account values at a point in time, as a function of age, thus neatly dodging the inflation issue.

At first sight, that graph seems to confirm the hoarding thesis – although some drop-off in account value can be seen for ages in the late 70s.

On page 434 (pdf version), the RIR Report4 states: “Superannuation assets have tended to grow in retirement (Chart 5A-12), instead of declining as would be expected if assets were funding retirement”.

Polidano et al 5 similarly state that they find “little evidence that people, on average, run-down superannuation balances after reaching the preservation age (Figure 2).”

Both comments support the hoarding hypothesis, but closer inspection reveals that the graph pertains only to the average of non-zero-balance accounts. In other words, those accounts which have been totally withdrawn have been excluded.

This is an example of “survival bias”. A similar situation can arise when back-testing share investment criteria against past data, if consideration is limited to companies that are still in business. Ignoring those that have failed can be an expensive mistake.

In the present case, the survival bias may or may not matter, depending on one’s purpose; but when the purpose is to establish that retirees hoard their super, it matters a great deal.

Fortunately, Table 1 of Polidano et al 5 provides valuable additional data: average account balances are listed there both for accounts with non-zero balances, and for all accounts – segregated further by gender. That allows the survival bias effect to be both quantified and eliminated. It is substantial: roughly 80% of males are shown as having exhausted their accounts by age 80.

To make the impact of the account survival bias easier to see, Fig A below plots the Alife data from Table 1 in Polidano et al 5, for all accounts and for non-zero-balance accounts.

A discussion about how fast, if at all, people consume their superannuation in retirement must include all accounts to be meaningful.

As shown in the two solid all-accounts curves in Fig A – blue for males and orange for females – there is a strong and steady fall-off in the average all-accounts value throughout retirement, at least to the early 80s, by which time most or all of the average balance has gone.

Conclusion

The notion that retirees, averaged across the population, hoard their super is thus contradicted by the facts.

That is an important conclusion when considering superannuation policy.

[1]John Kehoe and Michael Roddan, “ ’Ever more’ super gets hoarded: Hume”, The Australian Financial Review, 22 January 2021, pages 1,2 https://saveoursuper.org.au/wp-content/uploads/ever_more_super_gets_hoarded_hume-afr-22Jan2021.pdf

[2] Jane Hume, “Safety nets let frugal retirees spend savings without a super rise”, The Australian Financial Review, 22 January 2021, page 35 https://saveoursuper.org.au/wp-content/uploads/safety_nets_let_frugal_retirees_spend_savings_without_a_super_rise-afr-22Jan2021.png

[3] John Kehoe, “Push for seniors to dig deep into super nest-egg”, The Australian Financial review, 23 January 2021, page 2 https://saveoursuper.org.au/wp-content/uploads/push_for_seniors_to_dig_deep_into_super_nest_egg-afr-23Jan2021.png

[4] https://treasury.gov.au/publication/p2020-100554

[5] Polidano, C. et al., 2020. The ATO Longitudinal Information Files (ALife): A New Resource for Retirement Policy Research, Working Paper 2/2020, Canberra: Tax and Transfer Policy Institute, available at https://taxpolicy.crawford.anu.edu.au/publication/ttpi-working-papers/16448/ato-longitudinal-information-files-alife-new-resource .

A final version of that paper, in which some errors are corrected, has been published in The Australian Economic Review, September 2020, vol 53, No 3, pp 429-449.

* Jim Bonham PhD, BSc, Dip Corp Mgt, FRACI is a retired scientist and manager with a professional background which was initially in academic physical chemistry, and subsequently in applied research and development in the paper industry. He has been running an SMSF since 2003 and has a keen interest in the retirement income system.

25 January 2021

****************************************

On 28 January 2021 an abridged version of this article was published by SuperGuide (https://www.superguide.com.au/how-super-works/do-retirees-hoard-their-superannuation).

Postscript

On 31 January 2021 Senator Jane Hume, Minister for Superannuation was reported as saying, amongst other things, that “[retirees are] passing away with most of their retirement savings intact” ; see “Hume urges retirees to use super capital, rather than just returns” by Emily Chantiri, Sunday Age, https://www.theage.com.au/money/super-and-retirement/hume-urges-retirees-to-use-super-capital-rather-than-just-returns-20210129-p56xv8.html

Superannuation fund savers set to end year in the black: SuperRatings

The Australian Business Review

16 December 2020

David Ross

Australian super funds are on the track to end the year in positive territory, with returns buoyed by a 4.9 per cent sharemarket boost in November.

The dramatic turnaround in retirement savings follows rising optimism around the success of COVID-19 vaccine trials coupled with record rock bottom interest rates which has lifted the market from the March sharemarket collapse after COVID-19 hit the global economy.

Figures from super research group SuperRatings shows the median balanced fund – the most widely held investment option – has delivered a 2.3 per cent return since the start of 2020, despite the.

New data suggests funds may be on track to close the year as much as 3 per cent up on where they started, despite the first months of the pandemic sending balance fund down as much as 10 per cent.

The eighth consecutive month of positive returns meant the median balanced option was “on track to finish the year in positive territory”, SuperRatings said.

Super funds have bounced back strongly, booming 7.5 per cent since July, reversing falls through February and March as the pandemic rocked markets.

According to SuperRatings figures equities-exposed median growth options delivered an estimated 6.2 per cent return in November and 2.4 per cent over the calendar year.

The median capital stable option, which includes defensive assets such as bonds and cash, returned only 2 per cent in November and 1.7 per cent for the year.

Chant West, a consultancy which also tracks super funds, said current trends looked set to deliver a 3 per cent market return by year’s end, in what could prove an “excellent outcome” for fund members after the “disruption and economic damage caused by COVID-19”.

Chant West investment manager Mano Mohankumar said the recent recovery in funds had been “surprisingly sharp” after the shuddering halt of lockdowns imposed in the first half of the year.

“If we look back to the end of March, the world was in chaos. We were facing a frightening health crisis which saw most countries introduce some form of lockdown. Whole industries ground to a halt, countless jobs were lost and the global economy was heading rapidly into recession,” Mr Mohankumar said.

The market has seen a wild year since the coronavirus pandemic struck in January.

After rising to a record high of 7197.2 points by late February as investors initially switched out of Chinese assets when the pandemic took hold in the city of Wuhan, Australia’s S&P/ASX 200 share index dived almost 40 per cent to a 7.5-year low of 4402.5 points in just four weeks as the pandemic went global and the world faced unprecedented shutdowns of economic activity.

SuperRatings noted that capital stable options – which skew to bonds and cash – proved far more defensive for investors seeking to weather the pandemic, only falling 1.6 per cent by July.

Compared to that median balanced options were down 5.1 per cent in July.

But the fastest-ever bear markets in US and Australian shares were followed by the fastest ever bull markets, with Australia’s S&P/ASX 200 index bouncing more than 50 per cent as governments and central banks responded with unprecedented fiscal and monetary policy stimulus.

Australia’s federal government moved quickly to introduce a highly-effective income support scheme in the form of its JobKeeper program, later extended from September to March.

The turnaround in the markets marks a break with past trends, with markets tumbling 36 per cent in the wake of the 2008 global financial crisis, followed by a further 12.7 per cent crash in 2009.

The fiscal stimulus in the October federal budget shored up consumer and business confidence in the face of a damaging second-wave of coronavirus and strict lockdowns in Victoria which were subsequently lifted along with many state border closures.

The Reserve Bank started quantitative easing in November with a bigger-than-expected $100bn commonwealth and federal government bond buying program while also cutting interest rate targets including the overnight cash rate and the three-year bond rate target to just 0.1 per cent, providing a major leg of support to asset prices including shares and property.

The development of highly effective COVID vaccines proved much faster than expected with UK and US vaccinations starting in November and Australia giving emergency use authorisation for the AstraZeneca-Oxford vaccine from January.

A narrower-than-expected US presidential election win for Joe Biden helped fuel a surge in the US share market by lessening the chance of tax hikes while potentially still allowing greater US fiscal stimulus, and the US Federal Reserve has retained a bias to do more asset buying if needed.

Damian Graham, the chief investment officer of the $130bn Aware Super, said government support and the interest rate environment would go to driving market movements in 2021.

“When there’s such limited return in defensive assets it’s pushing people into growth assets,” he said.

“We think the market is reasonably priced but an expensive market is not the only requirement to see a correction.”

SuperRatings executive director Kirby Rappell said November had delivered a “watershed” month.

“Given the world is battling a pandemic that has resulted in large sections of the economy being placed in lockdown, the results are remarkable,” he said.

“This is the year super proved its worth once again and reminded us why it is so critical to our economic success.”

Mr Rappell said Australia’s success in containing the pandemic had put the economy in an “enviable position”, but significant risks still haunted the broader market.

“The pandemic is not yet defeated and there are geopolitical issues weighing on the outlook.

“Members should be optimistic but prepare themselves for potential surprises as we head into 2021,” he said.

The Chant West analysis found that despite the wild swings that had hit the market in recent decades super fund holders invested in median growth funds remained well ahead.

It noted that since the introduction of compulsory super in 1992 the median growth fund had delivered a 5.7 per cent real annual return, well above the 3.5 per cent target.

Mr Mohankumar said 2020 demonstrated the need for super fund members to maintain a long-term focus.

“Those who panicked and switched to cash or a more conservative option back in March would not only have crystallised losses, but as markets rebounded so sharply they would have missed out on some or all of the rebound,” he said.

APRA heat maps put performance of super funds under spotlight

The Australian Business Review

16 December 2020

Glenda Korporaal – Associate Editor (Business)

The federal government’s push for more mergers in the superannuation industry and weeding out underperforming funds takes another step forward this week, with the release of the second annual “heat map” on performance by the Australian Prudential Regulation Authority.

Friday’s announcement will focus on the $750bn MySuper sector with the release of the latest heat maps, which will assess more than 80 MySuper funds by their investment performance, fees and “sustainability” for the financial year to the end of June.

This week will be the second year in which APRA has released the so-called heat maps (which colour-code funds in terms of how good or bad they have ranked) in the three areas.

More specifically, the maps will cover a fund’s investment performance over three and five years, administration and total fees and a fund’s sustainability, including net cashflow.

There is also speculation that APRA might include other measures of investment performance, possibly to support the proposed eight-year performance metric to be used in the upcoming Your Future, Your Super comparison tool announced in the October budget.

Rice Warner superannuation specialist Steve Freeborn says the new heat map details will reflect funds’ investment performance that includes the first months of COVID-19, when markets suffered a sharp downturn before recovering.

They could also provide insight into whether funds have been able to reduce their fees in the year since the last heat maps.

Rice Warner has observed that a number of funds that were highlighted as having relatively high fees in last year’s heat map have undertaken reviews of fees.

But as they have only implemented them after June 30, changes will not be reflected in the latest heat map results.

A number of other larger funds, Freeborn notes, have continued to promote the benefits of their scale and cut their fees, particularly their MySuper investment fees.

In theory, heat maps are supposed to provide guidance to super fund trustees on how their funds are performing relative to other funds in the market.

Together with member outcome statements that need to be produced by super funds, they are supposed to provide the basis for conversations between APRA and the funds over their relative performance.

But critics argue that the maps provide no accountability for risk.

A fund could achieve good returns in one year, with some risky investments in a rising sharemarket, while other investors may decide to opt for lower performance but ones that make safer investment bets.

Higher returns can be correlated with higher risk (think bitcoin), which is not something that all super fund members wish to bear.

The now annual APRA heat maps are just the start of the super fund battle ground between the industry and regulators of the $2.9 trillion super sector.

The first few months of next year will see if the federal government decides to move to overturn legislation that would result in the compulsory superannuation guarantee levy rising from 9.5 per cent to 10 per cent in July.

The Morrison government has paved the way for an argument against it, on the grounds that it could cost workers wage rises that are better off in their own hands than locked up in super savings.

But there is also a realisation that despite the relief-driven optimism of the closing months of 2020 as Australian borders open up, 2021 is not going to see wage increases for many workers.

The argument now gaining ground, particularly with the union movement, is that it’s better to see a 0.5 per cent guaranteed increase in super contributions than no wage increase at all next year.

While the super levy has stayed steady at 9.5 per cent for the past few years, it has not been accompanied by rising wages.