Initially, I viewed, through the narrow prism of my own self-interest, some of the Government’s and Opposition’s proposed changes to the superannuation system. I, and many people like me, will shortly retire and rely, in our retirement almost entirely, if not exclusively, on our superannuation savings built up over many years.

However, my self-interest was quickly overwhelmed by a deep feeling of anger and dismay at what I saw as a breach of trust by the Government.

Over many years, we did what the Government wanted and encouraged us to do with our superannuation savings. We accepted and complied with the superannuation rules which the Government made. We put our savings into superannuation in preference to many other choices which were open to us.

Now the Government, without any notice or consultation with us, proposes to penalise us for the decisions we made at their behest.

On any view, that is manifestly unfair and unreasonable.

I discovered that I was not alone in that feeling. It caused me to form Save Our Super in May 2016. I’ve since discovered that the feeling I felt is uniformly felt by others affected by the proposed Government changes.

It has cost me time, money and lack of sleep to establish Save Our Super. I could have simply shrugged my shoulders and accepted the proposed changes. I could have simply sought good professional advice, paid for it and then gone quietly into retirement, enjoying my other interests and more time with our children and grandchildren. However, the Government’s breach of trust was too important to ignore.

Millions of working Australians are effectively compelled by the Compulsory Superannuation Scheme to put their hard-earned savings into the Government-mandated superannuation system.

They trust, as they must, that every Government of the day will treat them reasonably and fairly when changes are to be made to the Australian superannuation system.

They trust, as they must, that when the Government says, as Scott Morrison said in May 2015, “[t]he Government has made it crystal clear that we have no interest in increasing taxes on superannuation either now or in the future. … unlike Labor, we are not coming after people’s superannuation…” that those promises will be kept and honoured. That their compulsory superannuation savings, whatever the amount, will be respected, and not be subject to the possibility of being depleted by deliberate government action.

But they, unlike me and some others like me, unfortunately do not have the knowledge, skills, time, contacts, influence, and resources to do anything about it if a government breaches their trust.

We do.

I, and some people like me, want to ensure that some of the proposed superannuation changes are grandfathered, if those changes significantly affect Australians who, encouraged by government, have relied on, and acted on the then rules of the day. Australians should not be penalised for having so acted, when a government wants to change the rules later.

That is our modest goal. But that goal, if achieved, will create a precedent which will benefit millions of working Australians, now and in the future. Not only me and people like me.

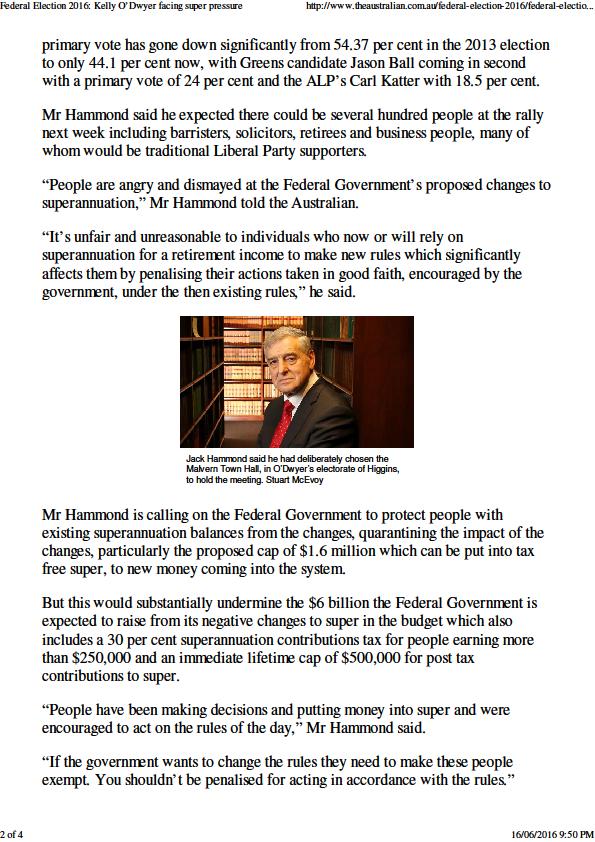

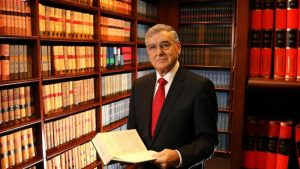

Jack Hammond QC

Melbourne, 13 June 2016

Sunday, July 31, 2016