Tag: budget 2016

Morrison, O’Dwyer will keep messing with superannuation policy

The Australian

17 September 2016

Judith Sloan – Contributing Economics Editor, Melbourne

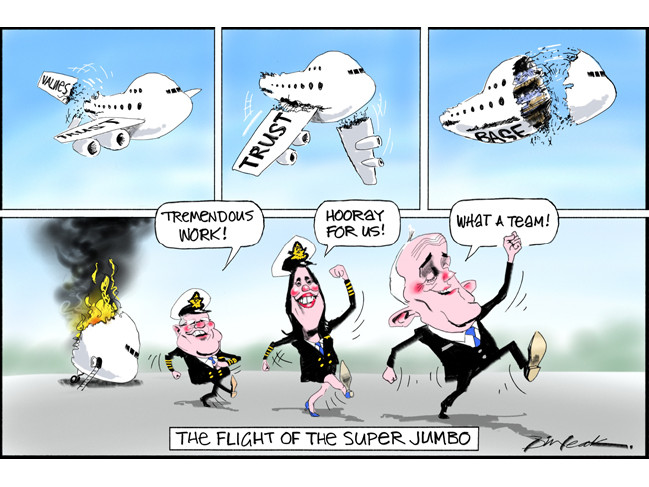

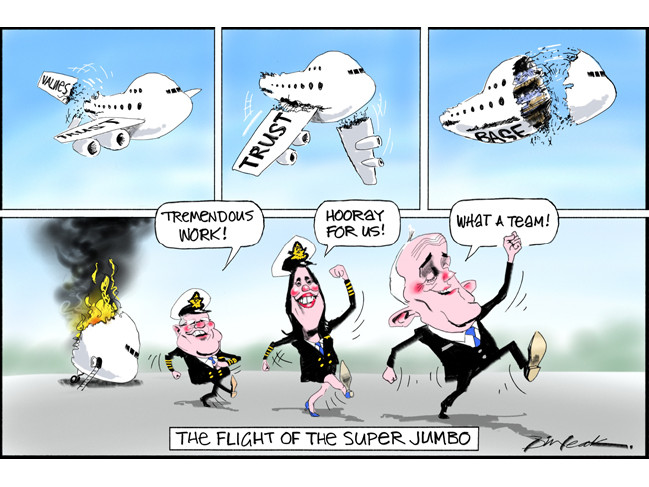

The biggest take-home message from this week’s superannuation changes by the government is that the Coalition can never be trusted on superannuation.

Its leaders say one thing and do another, trying to out-Labor the ALP when it comes to imposing higher taxes on savers who are seeking to provide for their retirement.

And how should we interpret the government’s backflip on the crazy backdated lifetime post-tax super cap? During the election campaign, Malcolm Turnbull was adamant: “I’ve made it clear there will no changes to the (superannuation) policy. It’s set out in the budget and that is the government’s policy.” I guess that was then. What a complete fiasco the superannuation saga has been. Mind you, Scott Morrison and Revenue and Financial Services Minister Kelly O’Dwyer have only themselves to blame. They were hoodwinked by extraordinarily complex and misleading advice given by deeply conflicted bureaucrats. The only conclusion is that they are just not that smart.

How do I know this? Because Treasury has been trying to convince treasurers for years that these sorts of changes must be made to the tax concessions that apply to superannuation. Mind you, these concessions apply because superannuation is a long-term arrangement in which assets are locked away until preservation age is reached.

It was only when the Treasurer and O’Dwyer took on their exalted positions that Treasury was able to execute its sting. Other treasurers (even Wayne Swan) had the wit to reject Treasury’s shonky advice.

But here’s the bit of the story I particularly like: when it came to the proposal that those pampered pooches (the advising bureaucrats) should pay a small amount of extra tax on their extraordinarily generous and guaranteed defined benefit pensions (the 10 percentage point tax rebate will cut out at retirement incomes above $100,000 a year), they baulked at the idea. This is notwithstanding the fact they have been members of funds that have paid no taxes during their careers and they will have also built up substantial accumulation balances on extremely concessional terms. Clearly, no one in Treasury has heard of the rule that what’s good for the goose is good for the gander.

Let us not forget that the superannuation changes announced in the budget represent a colossal broken promise by the Coalition government not to change the taxation of superannuation, a promise reiterated on many occasions by Morrison when he became Treasurer.

While trenchantly criticising Labor’s policy to impose a 15 per cent tax on superannuation retirement earnings of more than $75,000 a year, he made this pledge: “The government has made it crystal clear that we have no interest in increasing taxes on superannuation either now or in the future. Unlike Labor, we are not coming after people’s superannuation.”

When you think of all the criticism Tony Abbott faced, including from the media, about his broken promises on (supposed) cuts to health, education and the ABC — actually the growth of spending in these areas was merely trimmed — it is extraordinary that there has not been the same focus on this unequivocally broken promise of the Turnbull government.

To be frank, I am not getting too excited about the government’s decision to scrap the loony idea of having a backdated post-tax lifetime contribution cap. It was never going to fly.

The fact David Whiteley, representing the union industry super funds, is endorsing the tweaked super package is surely bad news for the government. He has declared “this measure, combined with the rest of the proposed super reforms, will help rebalance unsustainable tax breaks and redirect greater support to lower-paid workers who need the most help to save for retirement”.

Actually, the government does the saving for these workers by guaranteeing them a lifetime indexed age pension. It is the middle (and above) paid workers who need the most help to save for retirement.

It will also be interesting to see Whiteley’s stance when O’Dwyer seeks to push through changes to the governance of industry super funds and default funds. Here’s a tip, Kelly: he won’t be your friend then. My bet is that O’Dwyer will lose again on this front.

In terms of the replacement of the lifetime non-concessional cap, the government’s alternative is extremely complex and potentially as restrictive. Post-tax contributions will be limited to $100,000 a year (they can be averaged across three years), but only for those with superannuation balances under $1.6 million.

The fact the market value of these balances fluctuates on a daily basis makes this policy difficult to enforce. Is the relevant valuation when the contribution is made or at the end of the financial year?

And what about the person who is nearly 65 and is barred from making any further contribution, but the market drops significantly after their birthday? O’Dwyer’s response no doubt would be: stiff cheddar, egged on by her protected mates in Treasury who bear no market risk at all when they retire.

What the government is clearly hoping to achieve is that, in the future, no one will be able to accumulate more than $1.6m as a final superannuation balance. At the going rate of return that retired members can earn on their balances without taking on excess risk, the certain outcome is that there will be more people dependent on the Age Pension in the future. But Morrison and O’Dwyer will be long gone by then.

There is also a deep paternalism underpinning this policy. An income slightly north of the Age Pension is sufficient for old people, according to Morrison and O’Dwyer. After all, Morrison had no trouble describing people with large superannuation balances as “high income tax minimisers”.

We obviously should have been more alert to the possibility of the Turnbull government breaking its solemn promise not to change the taxation of superannuation.

Last year, O’Dwyer described superannuation tax concessions as a “gift” given by the government. I thought at first she must have been joking. But, sadly, her view of the world is that everything belongs to the government and anything that individuals are allowed to keep should be regarded as a gift — the standard Treasury line these days.

The final outcome will be a policy dog’s breakfast that carries extremely high transaction costs and delivers little additional revenue for the government. Superannuation tax revenue has disappointed on the downside for years and there is no reason to expect this to change.

But by dropping just one ill-judged part of the policy, the government thinks it can get away with pushing through the rest of it. The dopey backbenchers clearly have been duped into accepting it, even those new members who maintained a commitment to lower taxation and small government before they were elected.

It’s a bit like a real estate agent who shows you four atrocious houses. The fifth house is slightly better and you take it. The reality is that the fifth house is also dreadful but you have been tricked into accepting it on the basis of the contrived comparison.

There are still major flaws in the government’s policy. If there is an overall tax-free super cap, why have any limits on post-tax contributions at all? The figure of $1.6m is too low. And the indexation of this cap should be based on wages, not the consumer price index. The changes to transition-to-retirement should be dropped and the concessional contributions cap raised to $30,000 a year, at least, for those aged 50 and older.

But I’m not holding my breath. When Morrison said the government had “no interest in increasing taxes on superannuation either now or in the future”, he told an untruth. Just watch out for more revenue grabs in the future.

At last, common sense on superannuation policy

The Australian

16 September 2016

Editorial

Common sense has prevailed; the retrospective superannuation cap is gone. Yesterday, the government said it would substitute a prospective annual cap of $100,000 on after-tax contributions for its unacceptable $500,000 lifetime cap with the clock wound back to 2007. Malcolm Turnbull has achieved a principled compromise on an issue that stoked anger within the Coalition and its base. It was a week of compromise, in fact, as government and opposition found enough common ground to pass $6.3 billion worth of savings measures. We need more of this. Through a lower house with a majority of one and an upper house with a sizeable crossbench, the Prime Minister must articulate a compelling economic narrative and negotiate his way towards the national interest.

In April last year, former treasurer Peter Costello warned of unintended consequences facing policymakers. “Increasing superannuation tax will make negative gearing more attractive again,” he wrote in The Daily Telegraph. Abolition of the $500,000 lifetime cap means we are less likely to see a shift of funds away from superannuation into other more bankable investments. The government went wrong in its budget in May when it approached the rules on superannuation not as retirement income policy but as an ill-considered revenue grab. As such, it was difficult to defend and became one of the reasons for the Coalition’s lacklustre campaign leading up to the July 2 election.

The effect of the superannuation changes would have been to blunt the incentives for self-funding retirees, a class needed to take the pressure off the (already unsustainable) Age Pension. The changes also sent a destabilising message: that governments could change the rules of the long-term investment game that superannuation represents. It was not just the $500,000 lifetime cap that rankled but its retrospectivity. Soon after the budget, a former senior public servant, Terence O’Brien, crystallised the problem in a letter to this newspaper: “A 60-year-old can today expect to live past 90, so superannuation needs to finance a further 30 years of sustained retirement living standards, ideally in a predictable taxation environment. There might be 20 to 25 governments over that 70 years of a typical worker’s saving and retirement, so it is important that there be some sense of fundamental ‘rules of the game’ governing superannuation rule-making and taxation — a ‘superannuation charter’, if you will.”

Paul Keating’s superannuation changes of the 1980s were grandfathered so as not to disadvantage people who had relied on the old rules when making investment decisions. So, too, were John Howard’s 2004 changes affecting the superannuation of MPs. Scott Morrison and Kelly O’Dwyer, then assistant treasurer, failed to convince when they insisted that the $500,000 lifetime cap was not in truth retrospective. Now, at least, there is the basis for restoring trust in the integrity of the system. And, in a political sense, there is the basis within the Coalition for renewed confidence in Mr Turnbull now that the superannuation policy has been shifted from the spurious “fairness” of the centre-left closer to a commonsense position on the centre-right. It was Mr Costello, again, who had put his finger on the problem. “The Coalition is flirting with higher tax on superannuation,” he wrote last December. “The longer it does so, the more it will give ground to Labor on the issue.” Even so, political posturing aside, there should be enough overlap in substance by now for Mr Turnbull to broker an agreement on superannuation with Bill Shorten. Opposition Treasury spokesman Chris Bowen had focused his criticism on the retrospectivity of Coalition policy, a policy to which Labor gave tacit approval by building its savings into its own costings for the election campaign.

In question time yesterday, struggling to be heard above the hyperpartisan ruckus, Mr Turnbull gave the opposition credit for its compromise on Tuesday’s omnibus savings bill. The Prime Minister said he wanted Australians to know that “with a little less grandstanding, a little less name-calling, a little more constructive negotiation, we (in parliament) can achieve great things for Australia”. As usual, the tone of question time suggested anything but consensus. Even so, the Prime Minister has little option other than the path of negotiation and compromise. Politics is the art of the possible and what is possible for Mr Turnbull is heavily constrained by the parliament elected on July 2.

As the Prime Minister put it in a Fairfax Media report yesterday: “The Australian people have elected the parliament that we’ve got and we are determined to work with it.” He suggested that negotiation could allow the passage of the double-dissolution trigger bills — for the Australian Building and Construction Commission and the Registered Organisations Commission — without the need to call a joint sitting of parliament. And the same spirit of compromise may see the government split its $48.7bn company tax package to pass on savings straight away to small business.

Letter from Kelly O’Dwyer, MP to Jack Hammond QC – dated 16 September 2016

Dear Jack,

Dear Jack,

As someone who has contacted me in relation to the Government’s superannuation reforms, I thought you may be interested in an announcement that the Treasurer and I made this week regarding modifications to the superannuation reform package to make it fairer, more flexible and sustainable.

First, can I thank you for your feedback on the policy. It has been very helpful to receive constructive input from local members of my community.

The revised package will provide greater support for Australians investing in their superannuation with the primary objective of providing an income in their retirement.

Kelly O’Dwyer – Minister for Revenue and Financial Services

Specifically, the $500,000 lifetime non-concessional cap will be replaced by a new measure to reduce the existing annual non-concessional contributions cap from $180,000 per year to $100,000 per year from 1 July 2017. Individuals will continue to be able to ‘bring forward’ three years’ worth of non-concessional contributions.

Individuals with a superannuation balance of more than $1.6 million will no longer be eligible to make non-concessional (after tax) contributions from 1 July 2017.

By limiting eligibility to make non-concessional contributions to those with less than $1.6 million in superannuation, it targets tax concessions at those who have an aspiration to maximise their superannuation balance and reach the transfer balance cap of $1.6 million.

Eligible small business owners will continue to be able to access an additional CGT cap of up to $1.415 million.

In order to fully offset the cost of reverting to a reduced annual non-concessional cap, the Government will not proceed with a change to contribution rules for those aged 65 to 74. The Government will instead keep the current arrangements that allow people to contribute to their superannuation up 75 years if they are working. This will encourage individuals to remain engaged in the workforce, which will benefit the economy more generally. While the Government remains supportive of the increased flexibility this measure, it can no longer be supported as part of this package, given the changes to non-concessional contributions.

From 1 July 2018 flexibility will be improved by allowing the ‘catch up’ of unused portions of concessional contributions on a rolling five year basis for individuals with balances under $500,000. This will help people with broken work patterns.

For further information I attach a copy of the Media Release, Press Conference and Fact Sheets on the Government’s superannuation changes.

Again, I very much appreciate the feedback that you provided on the Government’s policy and look forward to staying in touch.

Kind regards,

Kelly

The Hon Kelly O’Dwyer MP

Federal Member for Higgins

Minister for Revenue and Financial Services

A Suite 1, 1343 Malvern Rd, Malvern VIC 3144

P 03 9822 4422 F 03 9822 0319

….

Budget 2016 Proposals and Opposition’s Policies

UPDATE: On Thursday 15 September 2016, the Government announced it had abandoned its proposal for a life-time non-concessional contributions cap of $500,000 on all non-concessional contributions made since 1 July 2007. The Government also made other changes to the Budget 2016 superannuation proposals.

Save Our Super is presently reviewing the implications of those changes and will provide an update shortly.

Save Our Super believes that grandfather clauses must be provided to protect all significantly affected Australians from a number of the remaining Budget 2016 superannuation proposals.

Labor dumped their election superannuation policies and made an increased tax grab on 26 June 2016 despite saying, just over a year ago, “If elected, these are the final and only changes Labor will make to the tax treatment of superannuation”. Labor has not announced any replacement superannuation policies.

Letter to Mr Andrew Gee, M.P., Chairman and Mr Scott Buchholz, M.P., Secretary from Terrence O’Brien – dated 7 September 2016

7 September 2016

Mr Andrew Gee, M.P., Chairman

Mr Scott Buchholz, M.P., Secretary

Coalition Backbench Committee on Economics and Finance

Parliament House, Canberra, ACT

Dear Sirs

Examination of proposed superannuation changes

I am writing to you in your capacities as leaders of the Coalition Backbench Committee on Economics and Finance, tasked (according to recent media reports) with reviewing the Government’s Budget proposals to change the taxation treatment of various aspects of superannuation.

To assist your Committee in its work, I wish to draw your attention to four recent studies bearing on the superannuation changes and the broader challenge of retirement income policy reform. The studies are to form part of the forthcoming edition of the Centre for Independent Studies’ quarterly magazine, Policy. They are attached to this letter for your convenience, and have been released electronically on the Centre’s website (https://www.cis.org.au/commentary/articles/four-solutions-to-the-big-problems-with-superannuation-policy ).

I am the author of the first of the four studies, which I hope might clarify from the last 40 years of history why so many super savers feel betrayed by the Government’s Budget measures; unconvinced by the alleged need for them; and unpersuaded by the Prime Minister’s and Treasurer’s attempted defence of them. Moreover, they fear that if retrospective measures are approved, more will follow in the unprincipled political competition to raise revenue from super savers that was revealed over the election campaign.

Previous significant increases in super tax have been designed to gradually raise revenue over time, but were grandfathered to avoid reducing the living standards of those already retired and living on lifetime savings legally amassed under the previous rules. Similarly, those near retirement (usually, those over 50 years of age, as a rule of thumb) have traditionally been spared the adverse impact on their lifetime savings of tax increases that they were too close to retirement age to adjust to. These traditional practices conform to the grandfathering principles codified in 1975 by the Asprey review of taxation, and successfully applied to tax increases in the 40 years since.

In contrast, the Turnbull/Morrison measures take the opposite approach, instantly penalizing those who trusted in, and acted on, the deliberate, well-researched incentives of the previous law.

The four studies and their main messages for your Committee are:

Grandfathering super tax increases – Terrence O’Brien: The Government’s tax increases would do less damage to trust in super if they were grandfathered, as has been done over at least the last 40 years for other changes adverse to those already retired or near retirement.

How should super be taxed? – Robert Carling: The common claims that super tax concessions are very expensive are wrong, and claims that their cost is unfairly distributed are based on an indefensibly narrow, one-dimensional conception of fairness.

Building a better super system – Simon Cowan: The main problem with the super tax concessions is that they are not reducing reliance on the age pension as much as they could do if better designed.

Don’t increase the super guarantee – Michael Potter: Scheduled increases in the SG from 9.5% to 12% would worsen the budget outcome for many years (because they move income from relatively highly taxed to lower taxed forms); bear inequitably on women and the low-paid; expose households more to the risk of adverse regulatory change; and reduce pre-retirement welfare of the less-well off without much improving their post-retirement income or reducing their dependence on the age pension.

On my reading of the studies, an implicit message emerging across all four is that reforming Australia’s retirement income system will require future well-researched, well-explained, gradual changes that can only be successful if governments retain the trust of the retired and those near retirement.

In my view, the largest cost of the Budget measures to raise tax on super is that, for want of grandfathering, they have destroyed trust in superannuation law-making in a way that will severely damage future prospects of better-considered retirement income reforms to superannuation, the age pension and their important interactions. To be clear: the Budget measures are not about stopping egregious tax avoidance (such as was done through retrospective measures deployed in the 1970s against contrived ‘bottom of the harbour’ schemes); rather, they attack law abiding savers who responded as previous governments wished to the intended purpose of well-deliberated incentives passed into law. They have merely lawfully saved enough money to retire on, after properly paying tax on it in the contributions and accumulation phase. This hardly warrants an attack on their living standards near or after retirement.

Reported Coalition reflection on the measures

I was concerned to read media reports that the Coalition’s focus in reviewing the measures is mainly on the proposed $500,000 lifetime cap on non-concessional contributions to super. Protest against that measure rightly focusses on its retrospectivity, narrowly defined. But as I argue in the first study above, all the Government Budget measures are “effectively retrospective”, in the useful phrase coined by Treasurer Morrison in his address of 18 February 2016. The measures all serve to invalidate retirement decisions and late-career savings plans for self-funded retirement by imposing disadvantageous new rules or tax rates where irrevocable decisions and plans have been induced by, and legally based on, previous rules.

Equally worrying, the reported adjustments being considered to the $500,000 cap are mainly increases to the cap, which misses the central problem: retrospectivity itself, rather the amount to which the retrospective cap is applied. A higher cap backdated the same way is still retrospective and still destroys everybody’s confidence in law-making for super saving.

Recent developments

The four CIS studies were completed shortly after the election. Two subsequent developments should be very worrying to the Coalition, and to all concerned to maintain confidence in superannuation, limit growth in reliance on the age pension, and improve or at least maintain the efficiency with which scarce capital is allocated in the Australian economy.

Firstly, APRA quarterly superannuation performance statistics for the June quarter 2016 are showing marked declines in personal contributions (e.g.the concessional and non-concessional contributions to be further restricted under the Budget measures) as shown in the following table. (Since personal contributions are by far the largest source of overall member contributions, the latter have also declined by about the same percentages as shown in the table.)

Such a dramatic decline after normal growth in previous quarters is easily understood: the Greens and Labor have been promising significantly to increase tax on super since March and April 2015, respectively. The Liberals proposed in effect tripling the Labor tax increases in the 3 May 2016 Budget, providing cover for Labor to triple its original tax grab. So super savers and self-funded retirees knew by May that their retirement living standards from super savings were sure to decline whatever the election result in early July, and through chaotic policy processes likely to lead to further tax raids in future. So they commenced rebalancing their lifetime savings away from super in the June quarter 2016. I suspect the current quarter’s data, capturing a full three months of savers’ reaction to the new super landscape and the election outcome, will confirm and extend the adjustment apparent in the last quarter.

Source: APRA Quarterly superannuation performance, June 2016 http://www.apra.gov.au/super/publications/pages/quarterly-superannuation-performance.aspx

Second, the super policy decision-making process continues to degenerate. The election result confirmed that the attack on lifetime savings would be compounded by protracted political and legislative uncertainty and unpredictable horse trading — a new low in bad policy processes in the area demanding the highest standards of clarity and predictability. In late August, Labor made its third super tax policy iteration in less than 18 months. (Remarkably, Labor still claims to support removing super rule changes from the election cycle and budget night surprises by the creation of a superannuation charter and a new, objective analytical process for evaluating proposed policy change.)

Labor’s first policy announcement in April 2015 was promised to be its last. Its second policy change in June 2016 (tripling its tax grab) was promised to be its last for five years. Labor’s third but doubtless not final change of 24 August 2016 proposes both higher taxes on contributions to super, plus the desirable elimination of the government’s $3 billion in new but largely forgotten and unloved increases in tax expenditures on super. Essentially, this bargaining approach promises Labor’s support to the Coalition, conditional on the Coalition eliminating all ‘winners’ from its Budget measures, and further increasing the tax burden on those aspiring to be self-funded retirees.

I anticipate there will be a further late twist to Labor’s support for the Coalition’s tax increases on self-funded retirement. After Labor has ensured all ‘winners’ from new tax expenditures have been eliminated and all losers multiplied to maximize the damage to Coalition support, its emphasis will turn to its historical championing of grandfathering (such as in the Keating-Hawke reforms of 1983 and 1988 described in my study). It will support the Coalition’s tax increases, but only conditional on the Government accepting Labor’s ideas on grandfathering. This will deny the Coalition the revenue from the tax increases in the forward estimates period that encompasses the life of the current Parliament.

It is easy to script this next stage in the rout of the Government’s super measures: Labor will claim it has been ‘both fair and fiscally responsible’, by ‘securing increased tax on super through sound structural reforms’ for it to spend in its own future terms of government, but ‘only prospectively and not to the disadvantage of two generations of savers who have built their plans on the current rules’. (Those two generations are the current self-funded retirees (say the 60-80 year olds); and those in mid-to-late career savings efforts to become self-funded (say the 40-60 year olds).)

The economic consequences

Why might the trends and possible resolutions above matter (apart from permanently destroying big swathes of voter support among super savers of the 40-60 and 60-80 generations)?

Funds not contributed into super will be used somewhere else: spent, or saved or invested in other ways. Looking to the absolute numbers behind the percentage declines shown in the table above, nearly $1 billion that was flowing into super funds in the June quarter 2015 was flowing somewhere else in the June quarter 2016. Treasury assumes in its revenue estimates for the Budget measures that those alternative destinations will be more highly taxed than superannuation, but that seems unrealistic to me.

More likely, the long-term savings previously destined for super will now mostly flow to the only other forms of long-term saving not heavily penalised by the progressive taxation of nominal income: negatively-geared rental property, and the principal residence. The latter option has the considerable additional advantage of being outside the age pension means test. For those formerly planning to be self-funded in retirement, rearranging their affairs to preserve access to the pension offers three advantages that super-funded retirement lacks: it removes longevity risk (the risk that savers will outlive their savings); it is safe from current and prospective very high market risk of zero or low returns (because pensions are indexed); and it is safer than super (for the moment) from regulation risk – for example, that tomorrow’s governments might restrict negative gearing, or reduce capital gains or pension asset test protection for the principal residence.

For the Australian economy, the costs of these likely reallocations of long-term savings from super into one form or another of property investment ought be obvious: instead of super savings being allocated through reasonably efficient capital markets to finance diversified productive assets such as infrastructure investment, equities, or corporate or government bonds, they will instead increase the demand for property. The supply of property is restricted and prices are inflated by restrictions on land release and other obstructive regulations. Much of any revenue from increased demand for real estate will accrue to State and Territory governments. Real estate may not be able to be confiscated by the Commonwealth in the way lifetime superannuation savings can be, but the potential of such property investments to support increased future national living standards is much lower than from the mix of productive investments financed through superannuation.

The corollary of the adjustments hypothesized above is of course increased future reliance on the aged pension – a real fiscal sustainability threat, unlike the bogus sustainability threat often asserted to arise from the well-researched and carefully implemented Costello Simplified Super reforms of 2006-2007. In effect, every dollar the Government’s measures discourage from going into super will morph to some degree into an increase in the future cost of the age pension.

The budget consequences

Compared to the seriously adverse consequences of the Budget measures for the economy and for confidence in super, the fiscal impact is small and easily made good. As noted in my study, grandfathering will of course delay the buildup of revenue from tax increases, because (depending on details of design) the increases would only apply to those some distance from retirement, and with time to adjust their savings strategies to the new tax regime. That is a fair adjustment of tax parameters that change lifetime savings strategies, in the tradition of previous tax increases on super savings in retirement, such as those implemented in 1983 by the Hawke-Keating government.

For reasons noted above, I doubt the Budget measures would raise anything like the revenue forecast. But let’s accept for argument’s sake that $6 billion over the period to 2019-2020 is the notional target for the urgent priority of fiscal consolidation. I need hardly argue to Coalition members that a better strategy to sustainably improve the budget with improvement to the efficiency with which resources are used is to reduce government spending. Based on a calculation by Mikayla Novak, the required expenditure reduction to make good the revenue forgone by grandfathering the superannuation tax increases would be a cut in the expenditure of each government department of about two-fifths of one percent. (Departments usually live with efficiency dividends of 1-2%, and sometimes as high as 4%.) Can it seriously be argued that any voter would even notice the difference in government services from a 0.4% loading on the efficiency dividend?

In conclusion, I suggest the Coalition should go back to the drawing board on its super tax increases. If it feels it must persist with them, it should comprehensively grandfather them, as was done by the Hawke-Keating Government with its super tax increases of the 1980s. Better that the course of good superannuation policy rule-making be embraced by the Coalition than that it be forced on it by Labor.

Should it be helpful to you or your Committee, I am of course happy to speak with you on the themes of this note.

I am unaware of the membership of your Committee, and so have copied this letter to all Government members.

Yours sincerely

Terrence O’Brien

Declaration of interest: I am a retired public servant who worked for some 40 years in the Commonwealth Treasury, the Office of National Assessments, the Productivity Commission, and at the OECD and the World Bank. I receive a superannuation pension from a fund I joined at age 19. My pension would be more heavily taxed by one of the changes proposed by both Liberal and Labor.

(Address and contact number supplied)

Superannuation changes will condemn middle class to the pension

Media Release

Media Release

The Turnbull Government’s proposed superannuation changes will condemn middle-income Australians to the Age Pension, according to a research paper released today by free market think tank the Institute of Public Affairs.

The paper, Strangling the Goose with the Golden Egg – Why We Need to Cut Superannuation Taxes on Middle Australia, which was written by Rebecca Weisser in collaboration with Henry Ergas, highlights how the government’s desperation for new sources of revenue to fund its spending habits is undermining the integrity of Australia’s retirement incomes system.

“Currently, middle class Australians can only expect income in retirement equal to 58% of their pre-retirement earnings, compared to nearly 90% for low income earners,” said Mr Simon Breheny, Director of Policy at the Institute of Public Affairs.

“The poor have the pension, the rich have alternative investments and the middle class will miss out again. The objective of the superannuation system should be for people to maintain their living standards in retirement, not imply that they should be grateful to be tied to the Age Pension,” Mr Breheny said.

The paper’s recommendations include moving to abolish taxes on contributions and earnings and instead taxing end-benefits in retirement at an individual’s marginal income tax rate, prioritising the reduction of fees and charges, and facilitating the purchase of private, defined benefit pensions for those who wish to purchase them.

“The compulsory superannuation guarantee will not help, given that the proportion of retirees on a full or part pension will remain at around 80 per cent over the next three decades according to the recent National Commission of Audit,” said Brett Hogan, Director of Research at the Institute of Public Affairs.

“Instead of citing ‘fairness’ to criticise people who attempt to provide for themselves, policy makers should acknowledge that private funds put aside for retirement represent deferred consumption, so flat and low superannuation taxes on contributions and earnings for everyone is actually good public policy,” Mr Hogan said.

A copy of Strangling the Goose with the Golden Egg is available here.

For media and comment: Simon Breheny, Director of Policy, Institute of Public Affairs, on 0400 967 382, or at sbreheny@ipa.org.au, or Rebecca Weisser on 0438 645 562, or Henry Ergas on 0419 239 710.

For media coordination, please contact Evan Mulholland, IPA Media and Communications Manager, on 0405 140 780, or at emulholland@ipa.org.au

Super changes will punish those who save relative to pensioners

The Australian

12 September 2016

Henry Ergas

There is a fundamental defect in the government’s superannuation proposals that has been entirely overlooked. Instead of growing in line with average earnings, the $1.6 million “transfer balance” cap, which limits the amount that can be held in the withdrawal phase, is only indexed to consumer prices.

As real wages rise over time, the cap will therefore fall relative to earnings, reducing the system’s allowed replacement rate (that is, the ratio of pre-retirement to post-retirement income) and steadily increasing the effective tax rate on privately funded retirement incomes.

To make matters worse, the age pension is, and will no doubt remain, indexed much more generously, rising in line with the higher of consumer prices or nominal wages. As a result, the government’s proposals ensure that the capped replacement rate under superannuation will fall not only in absolute terms, but also compared to the age pension.

The proposal would, in other words, punish increasingly severely those people who save for themselves relative to those whose retirement is paid for by taxpayers. And the effect is far from trivial, since compounding means even small differences in growth rates soon translate into large differences in outcomes.

Assume, for example, that initially, the $1.6m is sufficient to buy an annuity one and a half times greater than the pension, and that real wages and consumer prices each increase by 2 per cent a year. Within 10 years, the maximum annuity that can be purchased will have fallen to just a quarter more than the age pension, while in 20 years, it will barely equal the pension.

At that point, anyone relying on the withdrawal account will, despite saving for decades, be no better off than a person who did not save at all.

And adding insult to injury, it is of course those self-funded retirees who, during their working life, will have paid the taxes that finance the age pension others are enjoying.

Instead of frankly acknowledging those effects, the government’s claim is that the initial $1.6m is generous, implying that its progressive erosion as a share of typical middle income earnings is of no consequence. To make that claim, its unpublished briefing to backbenchers assumes a return on investment in retirement of 5.5 per cent and compares the resulting income stream to the age pension.

That comparison is nonsensical. The age pension is effectively an annuity that rises in value as the economy expands and incomes grow. While there is some political risk associated with that annuity, experience suggests it is slight, making it close to a sure thing, both in absolute and compared to the uncertainties that plague the superannuation regime.

As a result, the proper comparison is between the value of the age pension and the income stream a superannuant would secure investing the $1.6m in assets whose yield is also a sure thing, i.e. government bonds, net of the fees incurred in purchasing and periodically renewing that portfolio. With the commonwealth bond rate reaching a record low of 1.82 per cent in August, the resulting relativity would look far less favourable to self-funded retirees than the government claims. And of course, as the difference in indexation arrangements played itself out, the relativity would deteriorate further.

In short, it may be that the greatest effects of the proposed changes would initially be on a small number of wealthy retirees, as the government argues.

What is certain, however, is that the indexation arrangements will soon spread the damage to an ever greater swath of middle Australia, in the process redistributing income from those who save to those who don’t.

Unfortunately, the redistribution does not end there. As part of its package, the government intends to recycle a large share of the revenue it collects into subsidising the superannuation accounts of people on low incomes.

However, using the superannuation system, with its high transactions costs, to boost low incomes makes no sense: a carefully targeted increase in the pension some years down the road (when the accounts that would have received the subsidies would have matured) can achieve the same outcome at far lower expense to taxpayers.

But one person’s excess costs are always another person’s windfall income: with that other person being, in this case, the industry super funds, who will largely garner the fees taxpayers subsidise.

Moreover, the recipients of the transfers will also be grateful, although they are likely to thank Labor, which initially put the payments in place, rather than the Coalition, for the largesse. Little wonder then that the government’s proposals are endorsed in whole or in part by its bitterest opponents.

The pity is that instead of using what little political capital it has to address our superannuation system’s myriad weaknesses, the government is squandering it on changes that undermine the system’s ability to serve what ought to be its purpose — facilitating the transfer of income from working life to retirement.

Bringing that missed opportunity into sharp perspective is the great merit of Rebecca Weisser’s paper on superannuation reform released today by the Institute of Public Affairs. As the paper emphasises, these are not solely economic issues: they go to whether we want a society that rewards self-reliance or that punishes it.

So far, for all its statements about the taxed and the taxed not, the government shows no sign of understanding what is at stake.

“Stuff your pension!”, Phillip Larkin famously wanted to shout in his poem Toad.

But despite belittling the aspirations for financial security in old age that he saw as profoundly middle class, even Larkin recognised “that’s the stuff dreams are made on”.

As those dreams take another battering, an efficient and equitable retirement income system seems more distant than ever.

Super cuts “will leave people poorer”

The Australian

12 September 2016

Sarah Martin Political Reporter Canberra @msmarto

Both major parties are condemning middle-income Australians to a dependency on the Aged Pension by targeting superannuation for budget repair, a report from the Institute of Public Affairs says.

As the government prepares to tweak its election commitment to rein in superannuation concessions , the free-market think tank says the government’s “desperation” for new revenue sources, as outlined in its $6 billion superannuation tax package, will undermine future retirement incomes.

The release of the report comes as Scott Morrison seeks to reach a consensus with Coalition backbenchers on the shape of the government’s super reforms, with MPs arguing for the Treasurer to lift the cap on non-concessional contributions from the proposed $500,000 to $1 million.

Mr Morrison has faced a barrage of criticism from backbench MPs about the reform package, including from former prime minister Tony Abbott, who argued that the “deeply unpopular” changes were an attack on aspirational voters and the Liberal Party base.

Institute director of policy Simon Breheny said instead of targeting retirement income to fund spending commitments, the government should cut superannuation taxes of middle Australians to encourage savings.

Mr Breheny said middle income earners could expect to have a retirement income equal to 58 per cent of their pre-retirement earnings, compared with nearly 90 per cent for low-income earners .

“The poor have the pension, the rich have alternative investments and the middle class will miss out again. The objective of the superannuation system should be for people to maintain their living standards in retirement, not imply that they should be grateful to be tied to the Age Pension,” Mr Breheny said.

The paper, written by Rebecca Weisser and Henry Ergas, recommends abolishing taxes on contributions and earnings to give incentive for retirement savings.

It also proposes taxing end benefits in retirement at an individual’s marginal income tax rate, prioritising the reduction of fees and charges and making it easier for people to access private, defined benefit pensions.

“Unfortunately, proposed changes to superannuation from both the government and the opposition worsen, rather than fix the system’s myriad weaknesses,” the report says. “Superannuation reforms should be judged by the effect that they have on helping each individual to accumulate sufficient funds to maintain their living standards in retirement.”

The report also concludes that the government’s proposal to introduce a cap on non-concessional contributions and lower the concessional contribution cap will “make a bad situation worse” .

“What is clear is that governments should not tax retirement savings at rates that make it difficult or impossible for savers to secure reasonable living standards in retirement based on the living standards they achieved during their working life. Nor should government taxes on retirement savings distort consumption decisions , undermining the quality of life in old age and reducing overall economic efficiency.”

The government has released draft legislation for the first tranche of the super package, which excludes the most controversial elements of the proposed changes.

A draft bill for the remaining measures, including a $1.6m cap on tax-free pension accounts and a $25,000 annual limit on pre-tax contributions is expected to be released next month once a compromise position is agreed to by the Coalition partyroom and backbench economics committee.

Hit the breaks. Call to curb MP’s perks

Herald Sun

9 September 2016

Anthony Keane

POLITICIANS are being urged to cut back some of their own superannuation tax breaks before hitting the retirement savings of millions of ordinary Australians.

As MPs argue about restricting how much money people can put into super, a new analysis by financial strategists Marinis Financial Group estimates that more than $1.5 billion a year could be saved if they remove an ”obscene” tax break for retired politicians and other public servants.

Hundreds of thousands of public servants with defined benefit superannuation schemes, which were closed to new members by the mid-2000s, were granted a 10 per cent tax offset on their retirement pension income a decade ago even though members paid no tax on their super contributions or fund earnings during their working years.

“They’re among the most generous schemes in Australia, and probably the world, and they don’t need an extra free kick,” Marinis Financial Group managing director Theo Marinis said.

“The pensions they are getting have never, ever been taxed, anywhere, but politicians want to start clobbering people who have been taxed the whole way.”

Defined benefit pensions typically pay a percentage of a person’s previous salary for the rest of their life, unlike most Australians’ super which is a finite amount that drops as it gets spent in retirement.

“Politicians and public servants in untaxed schemes receiving defined benefit pensions cannot double dip. They automatically receive their pension each fortnight, usually automatically indexed to CPI, with no exposure to market volatility,” said Mr Marinis, a former Treasury official.

Australia’s Future Fund, now worth $123 billion, was created to pay public servant superannuation pensions, but some say it is not large enough to cover the huge future cost.

Finance commentator Robert Gottliebsen has been campaigning against defined benefit scheme “rorts” and last week renewed his call for a parliamentary inquiry.

“The cost of those defined benefit pensions is rising by $6 billion a year and there is a $400bn to $600bn shortfall. That increase in costs is conveniently buried and not included in budget figures but it’s a real cost,” he said.

Public sector superannuation specialist Laurie Ebert said some senior public servants were “avoiding tax from beginning to end” and said the system should be changed.

“I doubt that it would happen,” he said. “They’re not going to give it up easily.”

Mr Marinis said politicians made little mention of these schemes “because it affects them”.

He said the tax concessions could be stopped by a simple change to the Tax Act. “You are not supposed to give tax concessions to somebody who hasn’t already paid tax on their super.