Author's posts

Super too complex: Costello

The Australian

6 November 2016

Damon Kitney | Victorian Business Editor | Melbourne | @DamonKitney

Future Fund chairman and former federal treasurer Peter Costello says Australians are right to baulk at making voluntary contributions to their superannuation because of the extreme complexity that now plagues the nation’s retirement savings system.

Almost two months after the government released its revised super reform package for public consultation, Mr Costello said he was worried about the complexity of the system.

“With growing complexity, extreme complexity, people will shy away from (the super system). And I think they are right to shy away from it because you never know what the rules will be,’’ he said.

In an interview with The Australian following a private breakfast address in Melbourne hosted by Hamilton Wealth Management, Mr Costello also warned about the dangers for global trade of a Trump or Clinton presidency in the US and played down the move by the Future Fund to reduce its property exposure during the September quarter.

Mr Costello, who also chairs Nine Network owner Nine Entertainment, said the opposition of both Donald Trump and Hillary Clinton to the Trans-Pacific Partnership — the latter despite her huge support for the trade pact when she was previously US secretary of state — was concerning for Australia.

He reiterated that the prospect of Australia being downgraded by global credit ratings agencies because of the commonwealth budget deficit should “galvanise’’ the nation to change its ways.

“I think the prospect of a downgrade can and should be used to galvanise public opinion to know that international people outside Australia are registering concern about our financial position,” he said. “This should be taken as a message to the public that we need to change our ways.”

In July, two of the three global ratings agencies warned that the prospect of a deadlocked parliament stymieing budget savings put the nation’s AAA credit rating in danger.

Australia’s credit rating was downgraded twice in the 1980s, before being restored to AAA again by Moody’s in 2002 and Standard & Poor’s in 2003 on the back of a string of budget surpluses during the Howard government when Mr Costello was treasurer.

In an effort to reduce the budget deficit, the government has cracked down on super tax concessions to ensure they are not used to build tax-incentivised estate planning vehicles for wealthy Australians.

Instead it wants to support more Australians maximising their super balances in retirement.

On the complexity in the super system and voluntary contributions, he said: “In the voluntary sector … I think people will take the view that you should be much, much more cautious … This might be what the government wants, we don’t know.”

In August the nation’s biggest wealth manager AMP claimed the government’s proposed super shake-up was a major factor in weak retail and corporate super platform cashflows.

The government has moved to water down the proposed changes in its latest reform package with the contribution caps and the reforms to the non-concessional cap less comprehensive than the changes put forward in the May budget.

But Treasurer Scott Morrison has claimed the revised package would save the budget $180 million over the next four years and $670m in the medium-term.

During the three months to September 30, the Future Fund scaled back its exposure to property as it recorded a 1.5 per cent return, pushing its funds above $124bn.

The breakdown of its asset allocation at the end of the quarter showed the Future Fund’s share of property assets fell 0.5 percentage points to 6.5 per cent.

But Mr Costello cautioned against reading too much into the change. “Its gone from 7 per cent to 6.5 per cent. It is true it has moved but I wouldn’t read too much into it,’’ he said. “I wouldn’t see that as a major tilt.’’

The Future Fund has asked the government to consider lowering the inaugural CPI plus 4.5 per cent to 5.5 per cent real investment target for the fund, given bond markets have been signalling prolonged subdued returns.

Mr Costello declined to comment on the progress of negotiations with the government, but noted that for several years the risk-free rate (of bonds) had been closer to 2 per cent.

“The fact that 10-year bonds are closer to that number and have been for several years, and around the world there are other sovereigns that are even less,” he said.

“It tells you that 7 per cent nominal historically has changed.

“The government has just started issuing 30-year bonds at close to 3 per cent. The long-term risk-free rate of return is different now to what it was historically. There is no reason to think it is going to go back to the historic number any time soon.’’

After the Future Fund was a key player in the $9.7bn purchase of a lease of the Port of Melbourne in a consortium with QIC and Chinese sovereign wealth fund CIC Capital, Mr Costello said infrastructure was “a good asset’’.

“If we can find an asset which will give us a reliable return, we are very interested,’’ he said. But he rejected suggestions the Future Fund should be investing more in rural property amid a push by Chinese and other offshore investors to acquire local farming land.

Earlier this year Mr Morrison rejected a Chinese bid for the Kidman family’s cattle assets.

They were subsequently snapped up by mining magnate Gina Rinehart.

“The Future Fund is told by the government that it has to get a return 5 per cent real, 7 per cent nominal. If investment opportunities can’t give us those returns, we can’t invest in them,’’ Mr Costello said.

Super changes tipped to enter lower house next week

STAFF REPORTER

Tuesday, 01 November 2016

With Parliament expected to consider superannuation reforms as early as next week, one trustee lobby group has

urged the government to slow down the pace of its reforms and take time to carefully consider the legislation.

SMSF Owners’ Alliance (SMSFOA) executive director Duncan Fairweather says the draft legislation should be

referred to parliamentary committees for review.

Mr Fairweather said submissions should be taken from Australians whose retirement savings will be affected,

the associations that represent them and superannuation experts.

“The government’s consultation on the draft legislation released so far has been hasty with just a few working

days allowed for comments on three tranches of complex new law,” he said.

Mr Fairweather added that the legislation introduces a new definition for superannuation, new structural

concepts, new rules on contributions and new tax applications.

“They are the most significant changes to superannuation in a decade since the reforms Peter Costello made in

2006,” he said.

“They will have an impact not just on the 4 per cent the government says will be directly affected now, but on

many more who are in mid-career and aiming for a financially independent retirement.”

Mr Fairweather said the Senate especially needs to consider whether it is prepared to pass tax law with

retrospective effective when it has been reluctant to do so in the past.

“The changes take many pages of legislation to explain. There is a risk of unintended consequences if the

legislation is rushed,” he warned.

As well as giving Parliament the opportunity to give proper consideration to the new superannuation laws, the

government should consider extending the start date of the legislation.

“Superannuation fund trustees, including the trustees for half a million self-managed funds, face important

decisions. Their financial advisers, accountants, lawyers and auditors will have to quickly get across the detail of

the legislation. That’s not to mention the task of modifying systems that faces the major funds and the ATO,”

Mr Fairweather said.

“We appreciate there will be a revenue cost if the start date is pushed back. However, it is important to make

sure the new law will be workable and that Australians are given reasonable time to understand what the law

means to them.”

SMSFOA Members’ Newsletter – 161027

SMSFOA Members’ Newsletter

# 15/2016 27 October 2016

In this newsletter:

- Annual general meeting – 16 November

- SMSF Owners’ Chairman lambasts Government over super changes

- Tranche 3 of the draft legislation is released

- Complexity will increase compliance costs

Disclaimer: The observations made in this newsletter are based on our reading of complex draft legislation and what we think it means. It will be some time before the draft legislation becomes law and there may be changes. SMSF Owners does not give investment advice.

Annual General Meeting

SMSF Owners’ Alliance Limited will hold its 2015-16 Annual General Meeting at:

4pm, Wednesday 16 November

Level 4 Boardroom

37 Bligh Street

Sydney NSW 2000

All members are invited to attend, however only Principal Members are entitled to vote.

After the formal meeting, there will be a general discussion about the future direction of SMSF Owners.

If you’d like to come along, please email info@smsfoa.org.au and let us know.

Our Chairman hammers the Government on superannuation changes

In his annual review, SMSF Owners’ Chairman, Bruce Foy, strongly criticises the Government for the complex and retrospective changes it is making to superannuation and the way it has gone about it with minimal consultation. Mr Foy says:

“What Morrison has done is to give himself and every following Treasurer a licence to claw back our retirement savings to make up for over-spending by government. We can be sure the current round of changes won’t be the last. The temptation for governments that can’t run a surplus budget, or at least a balanced one, will be to dip into the superannuation lolly jar again and again.”

And he questioned the Treasurer’s motivation:

“A disturbing aspect of Morrison’s changes is that they directly link superannuation to the state of the budget. At least he made no secret of his intention saying ‘above all else, this contributes to getting the budget back into balance’.

It strikes us as very poor economics to use savings to meet recurrent spending on welfare and other government programs rather than invest them to produce reliable income in retirement.

From when he became Treasurer, Morrison has often stated that superannuation is not for tax minimisation or estate planning. He has included this phrase in each tranche of the draft legislation. This is not appropriate in our view.

There is nothing wrong in maximising your savings by taking advantage of concessions to the extent allowed by the law. In fact this is precisely the intent of superannuation. It is wrong to imply that people who do so are tax dodgers.

Nor is there anything wrong in maximising your savings so you can have confidence that you will have enough to last through a comfortable and hopefully lengthy retirement. Where is the line to be drawn between prudent saving for an independent retirement and estate planning?”

You can read the full version of the Chairman’s Review here: https://www.smsfoa.org.au/media-release/news-updates.html

Government forces the pace on new super laws

The Government is pressing ahead with its swag of new superannuation legislation in spite of widespread concern about its complexity and retrospective effect.

We expect legislation to be introduced to Parliament in the final sitting for the year starting 7 November and passed before the Parliament rises in December.

The Opposition has not yet stated its position on the legislation. It is waiting to see the Bills in their final form. However, even in the unlikely event that Labor opposes the legislation outright we expect the Government will be able to push the legislation through both the House of Representatives and the Senate with the support of the Greens, Xenophon and some independents.

With passage of the changes fairly certain, the challenge now for SMSF owners and their advisers is to understand how the new laws will work in practice and prepare for their introduction from 1 July 2017.

SMSF trustees will need to make careful decisions about the disposition of their superannuation assets before the end of this financial year.

All on the table now – we hope

The Government has now released three tranches of draft legislation, running to hundreds of pages of new tax law.

Tranche 1 dealt with the objective of superannuation – we argued the proposed purpose “to substitute for and supplement the age pension” was too limited and gave superannuation just a supporting role for the age pension rather than making it the central pillar of an effective and adequate retirement incomes system. We noted the limited objective lacked ambition and set no performance target for retirement savings

Tranche 2 dealt with the new $1.6 million transfer balance cap to apply from 1 July 2017 – we argued the cap was retrospective and, any case, too low. Independent research by Dr Ron Bewley showed the cap should be at least twice as high to provide an adequate income throughout retirement. We also proposed a 12-month period to bed down complex new legislation before penalties for exceeding the transfer balance cap apply.

Tranche 3 dealt with the new, lower non-concessional contributions rules that will replace the Government’s earlier proposal to limit total non-concessional contributions to $500,000 – we argued the transitional rules were complicated and unnecessary.

For each tranche, the Government has allowed just a few working days for organisations like SMSF Owners to digest the changes and make submissions which, as a result, have been necessarily brief. Rushing changes to such a complex system as superannuation risks mistakes being made and unintended consequences.

The full suite – three tranches – of draft superannuation legislation can be found here: http://www.treasury.gov.au/ConsultationsandReviews/Consultations

Our submissions in response to each tranche can be found here:

https://www.smsfoa.org.au/joomla.html

There’s more to the changes than first meets the eye

The draft legislation introduces not just one new superannuation balance cap, but two. It makes not just one retrospective change to the way superannuation is taxed, but two.

Two balance caps

The main focus has been on the “transfer balance cap” which applies from 1 July 2017. On that date, you can have only $1.6 million in your tax-free retirement pension account. Any excess must be transferred to an accumulation account on which the earnings are taxed.

The draft legislation revealed that a second $1.6 million cap, called the “general transfer balance cap”, will also apply to all of your superannuation accounts (many people have multiple accounts – in a self-managed fund and in mainstream superannuation funds and perhaps defined benefit schemes as well). Once you have reached the general $1.6 million cap, you can make no further non-concessional contributions.

Two tax changes

Earnings on the assets held in an accumulation account in retirement phase will be subject to a new 15% tax. Prior to the legislation taking effect, earnings on superannuation funds in the pension phase have been tax free.

The second tax change kicks in if you transfer assets from your pension account to an accumulation account to meet the $1.6 million transfer balance cap. In the accumulation fund, those assets again become liable for capital gains tax. You will be liable to capital gains tax of 15% if the asset has been held for less than one year and 10% if held for more than a year.

Prior to the legislation, capital gains tax did not apply in the pension phase.

Sensibly, the Government will allow you to reset the cost base of the assets from 1 July 2017 but that expires after 10 years when the cost base of the assets will revert to their original value. For assets that have been held for many years, the capital gains are likely to be significant and even a 10% tax on them will be substantial.

New non-concessional contribution limits

The third tranche of draft legislation sets out transitional arrangements for the change from the present system where non-concessional contributions of $180,000 a year can be rolled forward for three years.

Under the new arrangements, the annual non-concessional limit will be reduced to $100,000 and it can still be rolled forward for up to three years.

However, the transitional arrangements will limit the non-concessional contributions and bring forward periods that can be made if you are nearing the $1.6 million total superannuation balance cap. If you have $1.6 million or more in your superannuation by 1 July 2017, no further non-concessional contributions can be made.

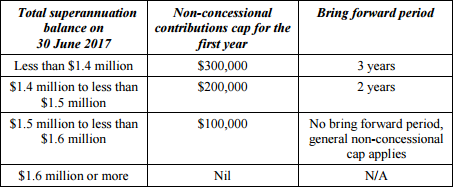

This table taken from the Explanatory Memorandum for tranche three summarises how it will work:

Heffron Super News has published a useful summary of the third tranche explaining the new non-concessional contribution rules which can be found here:

http://cdn.heffron.com.au/forms/132%20-%202016%2010%20-%20Changes%20to%20NCC.pdf

More complication

The $1.6 million transfer balance cap will be indexed in $100,000 increments based on the Consumer Price Index.

First, the indexation should be based on wages (AWOTE) rather than CPI. Superannuation is an outcome of payment for work and it would be more appropriate to use AWOTE as the indexation factor. AWOTE generally grows faster than CPI so linking the transfer balance cap to consumer prices instead will slow down increases in the transfer balance cap which may become significant over time.

Second, in another unnecessary complication, the indexation will not apply automatically to the full $1.6 million transfer balance cap. It will apply to the unused proportion of the cap.

The Government explains:

“Proportional indexation is intended to hold constant the proportion of an individual’s used and unused cap space as their personal cap increases. This is worked out by finding the individual’s highest transfer balance, comparing it to their personal transfer balance cap on that day and expressing the unused cap as a percentage. Once a proportion of cap space is utilised, it is not subject to indexation, even if the individual subsequently removes capital from their retirement phase.” – second tranche Explanatory Memorandum.

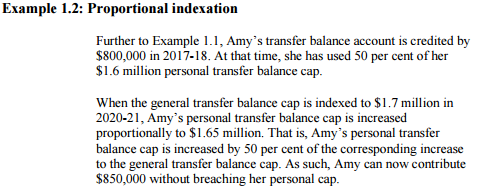

The Government gives an example of how it will work for Amy:

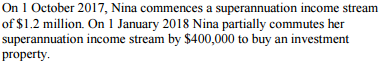

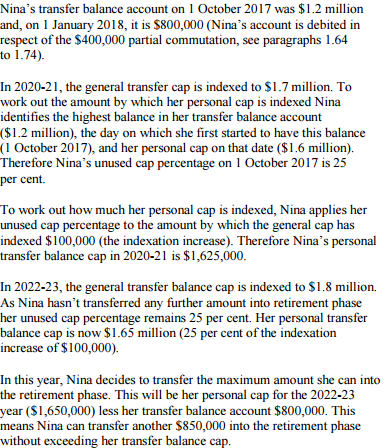

However, things get a bit more complicated for Nina:

Good luck Nina!

It would be simpler to just apply the new non-concessional rules from 1 July 2017 though at some cost to budget revenue.

All this complexity will add compliance costs for both self-managed funds and for the larger mainstream funds who will have to alter systems to cope with the new requirements. One superannuation expert has told us the increased annual cost of administration for a self-managed fund with more than $1.6 million could run to $3 – 4,000.

SMSFOA Members’ Newsletter #15 27 October 2016

Money Management – No more “simpler super”

Money Management

6 October 2016

Catherine Chivers – Manager for strategic advice at Perpetual Private.

The 2016 Budget handed down on 3 May, 2016 by Treasurer Scott Morrison foreshadowed the most sweeping changes to the superannuation landscape that the Australian financial services industry has seen in close to a decade.

In recent weeks there has been a flurry of releases from Treasury to give broader effect to the implementation of the Government’s broader reform agenda to improve the sustainability and equity of the superannuation system.

As at 30 September, 2016 there had been two tranches of draft legislation released which provided further detail on how the new rules will operate from 1 July, 2017 and beyond.

At this point, the relevant legislation still needs to pass through Parliament and receive Royal Assent in the normal manner for it to become effective law.

The key elements of the new draft legislation and some of the resulting strategic aspects advisers need to be aware of are outlined below.

What’s new

The key areas addressed in these twin legislative releases will mean that from 1 July, 2017:

- The “objective of superannuation” has been established;

- A higher spouse income threshold will apply for calculating the spouse contributions tax offsets;

- A Low Income Superannuation Tax Offset (LISTO) will apply;

- A “transfer balance” cap of $1.6 million is in effect;

- The concessional contributions cap (CCs)reduces to $25,000;

- The non-concessional contributions (NCCs) cap reduces to $100,000 per annum (or $300,000 in any three-year period where the “bring-forward” amount is triggered by those able to avail themselves of it);

- There is the ability to “catch up” on concessional contributions (note: applicable from 1 July, 2018);

- Consumers will see broader retirement income product choice available as a result of income stream product innovation; and

- The anti-detriment provision will be abolished.

The objective of superannuation

For the very first time, the objective of the superannuation system is enshrined in legislation covering a “primary” objective and “subsidiary” objectives.

Primary objective

“To provide income in retirement to substitute or supplement the Age Pension.” This is a more expansive purpose than was originally foreshadowed in the 2016 Budget, which merely outlined that the purpose of superannuation was to “supplement” the Age Pension. This primary objective also re-affirms that the purpose of superannuation as “not to allow for tax minimisation or estate planning”.

Subsidiary objectives:

- Facilitate consumption smoothing over the course of an individual’s life;

- Manage risks in retirement;

- Be invested in the best interests of superannuation fund members;

- Alleviate fiscal pressures on Government from the retirement income system; and

- Be simple, efficient and provide safeguards.

Changes to spouse contribution tax offsets – higher spouse income threshold

From 1 July, 2017, a resident individual will be entitled to a tax offset up to a maximum of $540 in an income year for contributions made to superannuation for their eligible spouse. A spouse will be eligible where the total of the spouse’s assessable income, reportable fringe benefits amounts, and reportable employer superannuation contributions for the income year is less than $40,000 (currently $13,800).

Reduced contributions tax for low income earners – via a new LISTO

From 1 July, 2017, the LISTO seeks to effectively return the tax paid on concessional contributions by a person’s superannuation fund to a person who is a low income earner. Low income earners are defined as individuals with an adjusted taxable income of $37,000 or less. The maximum amount of LISTO payable is $500 per year.

‘Total balance’ cap of $1.6 million

- Represents the maximum amount which can be transferred into a tax-free income stream for use in retirement, based on “retirement phase” assets calculated as of 30 June, 2017

- Will index in $100,000 increments in line with the consumer price index (CPI)

- The transfer balance (TB) cap will be calculated using a “transfer balance” account (TB account) which is similar in concept to an accounting general ledger. Amounts transferred into “retirement phase” (what we presently know as drawing an income stream) give rise to a credit in the account and transfers out (e.g. commutations) give rise to a debit. The TB cap is breached where an individual’s TB account is greater than their relevant TB cap

- There will be no ability to retain funds in retirement phase in excess of this amount, nor the ability to make additional NCCs once this $1.6 million total superannuation balance threshold is breached. Strict penalties apply for breaches of the TB cap, especially where these are repeated

- Instead assets will be required to be transferred back to accumulation phase or withdrawn from the superannuation environment entirely. Where assets are transferred to accumulation phase as of 30 June, 2017, a “cost-base” re-set will alleviate the initial capital gains tax (CGT) impact.

- Complex calculations will apply to the treatment of reversionary income streams for the purposes of the TB cap, however at this stage, reversionary income streams received will also be counted towards the recipients TB cap. Whether this outcome is changed in the final legislation remains to be seen

- Superannuation balances in excess of the TB cap can remain in accumulation phase indefinitely (and with no balance limit) where they will be taxed at a maximum of 15 per cent

- Fluctuations in account balances will not be taken into account when determining the available TB cap “space”. For example, where an individual’s account was valued at $1.6 million as of 1 July, 2017, and the balance subsequently declined to $1.4 million on 1 September 2017, they will not be able to add more money into an income stream (called a “retirement phase account”) as they have already fully used their available cap

- Where an individual only uses part of their TB cap, a “proportionate” approach will apply to assessing eligibility to make further contributions. For example, where an individual transfers $800,000 into a retirement phase account as of 1 July, 2017, they will have used 50 per cent of their available cap. Where the cap is later indexed to $1.8 million they will have 50 per cent of that cap left to use. That is, they will be able to transfer an additional amount of $900,000 into a retirement phase account

- Personal injury payments contributed within the 90-day window will be exempt from the TB cap

- Defined benefit schemes will also be subject to the TB cap, with complex calculations required as a result (especially in cases where an individual receives income streams from both taxed and untaxed sources)

- Modifications to the harsh TB cap are available in cases of a minor child dependant receiving their deceased parent’s benefit

- New estate planning considerations will arise as a result of the TB cap, which may require review and revision of a client’s estate planning strategy

- Will also apply to annuities used for retirement purpose. Currently annuities used for retirement purposes are treated very differently to essentially similar monies formally within the superannuation system

- Importantly, each member of a couple can have a total superannuation balance as of 1 July, 2017 of $1.6 million. There will not be a “shared” $3.2 million cap. That is, there will be zero ability for, say, one party to hold $1 million and the other $2.2 million as of 1 July, 2017 in an attempt to circumvent the new rules

Concessional contributions (CCs) cap changes

- From 1 July, 2017 the annual cap for each financial year will be $25,000 – currently the cap is $30,000/35,000 per annum

- The cap will increase in increments of $2,500 in line with average weekly ordinary time earnings (AWOTE) – currently the $30,000 cap is indexed to AWOTE in $5,000 increments

- Division 293 tax (an extra 15 per cent contributions tax) will apply to an income threshold of $250,000 per annum – currently the threshold is $300,000

- Special new rules will apply to ensure that contributions to constitutionally protected funds (CPFs) and untaxed or unfunded defined benefits count towards the CCs cap. Currently contributions to CPFs do not count towards the CCs cap, and calculating the impact of relevant contributions for those in untaxed or unfunded defined benefit interests can mean that these remain outside of the CCs cap

New annual NCC cap/revised ‘bring-forward’ rule

- Can make NCCs of $100,000 a year from 1 July, 2017, or even $300,000 under the revised “bring-forward” rule, so long as an individual is aged under 65 and their total superannuation balances (at 30 June, 2017) is under $1.6 million

- Where total balances exceed $1.6 million, no NCCs will be permitted. CCs can still be made, in the relevant way

- Where a balance is “close to” $1.6 million, an individual can only use the “bring-forward” rule to the extent that their super balance stays below $1.6 million

- Where an individual has partially used the present NCC “bring-forward” rules allowing a $540,000 NCC, they will not be able to benefit from this from 1 July, 2017. Instead, any use of the ‘bring-forward’ rule from 1 July, 2017 will be based on the new caps applying from that date

- The annual NCC cap and $1.6 million eligibility threshold will be indexed

- These revised rules will broadly apply to defined benefit and constitutionally protected schemes

‘Catch up’ concessional contributions

- This increased flexibility benefits those with varying capacity to save and those with interrupted work patterns, to allow them to provide for their own retirement and benefit from the tax concessions to the same extent as those with regular income

- Individuals aged 65 to 74 who meet the work test will also be able to avail themselves of this proposal

- Any amounts contributed in excess of the cap will be taxed at the individual’s marginal tax rate, less a 15 per cent tax offset

- From 1 July, 2018, individuals can “catch-up” on their CCs where their total superannuation balance was less than $500,000 as of 30 June in the previous financial year. Thus, in effect, the first year that an individual will be able to avail themselves of this new measure is 1 July, 2019

- This measure will mean that additional CCs can be made by using previously unutilised CCs cap amounts from the previous five years

- Unused cap amounts can be carried forward, with unused CCs cap amounts not used after five years lost

Income stream product innovation

- In a major step forward for consumer retirement product choice, the earnings tax exemption will now extend to new lifetime products to be known as “deferred products” and “group self-annuities”. Further annuities issued by life companies that represent superannuation income streams will also receive the earnings tax exemption

- Further, and as previously highlighted, the earnings tax exemption for transition-to-retirement (TTR) income streams will cease from 1 July, 2017. However, TTR income streams will not count for the purposes of the TB cap unless they are considered to be a “standard” account based pension

Farewell to the anti-detriment provision

- From 1 July, 2017 the anti-detriment (AD) benefit will cease to exist. This benefit effectively provided an uplift to any death benefit paid to that deceased member’s spouse, former spouse and children in the form of a return of contributions tax the deceased member paid during their lifetime

- For members who die on or after 1 July, 2017, their loved ones will be unable to receive the benefit. For members who pass away before this date and who were within a fund which paid the AD benefit, so long as the AD benefit is paid by 1 July, 2019, their loved ones can still receive it.

Whether the collective outcome of these measures achieve their stated policy aim of improving the sustainability of the $2.1 trillion Australian sector remains to be seen. It is certainly exciting times to be an advice practitioner helping to guide clients through an ever more-complex maze to achieve their desired retirement lifestyle goals.

Catherine Chivers is the manager for strategic advice at Perpetual Private.

Super pension transfer limits likely to create a headache

Australian Financial Review

24 October 2016

Sally Patten

So you thought that a $1.6 million superannuation pension limit would be

simple, eh?

It sounds so straightforward, if not every Coalition MP’s cup of Earl Grey tea

with a slice of lemon. Under the proposed rules, superannuants can put a

maximum of $1.6 million into a tax-free pension. Any excess must be left in an

accumulation account, where it attracts a 15 per cent earnings tax.

Sadly, nothing is elementary when it comes to retirement savings. Still, even by the super system’s

complex standards, the way in which the balance transfer cap is to be calculated looks particularly

nasty – and potentially expensive to implement.

The limit is to be indexed to inflation in increments of $100,000. So far so good, although hopefully

industry executives will be able to convince the government to base the cap on wages, given that every

other super threshold is linked to wages rather than the consumer price index. The earnings generated

by a pension, after all, are a substitute for the superannuant’s wage or salary. That is the whole point.

But back to the calculations. In order to avoid a drain on the public purse, the $1.6 million limit is to be

indexed proportionately. This means that for people who do not transfer the full $1.6 million into a

super pension in the first instance, the percentage of the limit that they have not used will be indexed.

Bear with me.

If a retiree transfers $800,000 into a pension account in July next year, when the rules are due to be

enforced, they will retain the right to contribute another 50 per cent of the $1.6 million limit at a future

date. If by the time they contribute a second tranche the limit has risen to $1.7 million, they will be able

to contribute $800,000, plus 50 per cent of the $100,000 incremental rise – or $850,000 in total. Geddit?

This effectively means that over time we will all have individual pension transfer limits, depending on

how much we put into a super pension and when.

This is not to say that the overall thrust of limiting the amount of money that can be transferred into a

tax-free pension is a poor idea. But when rules are changed there are invariably trade-offs to be made

between simplicity and revenue gains. The government has clearly gone for the cash. Let’s hope the

complexity can be managed and the rules understood.

ATO may not cope

The Australian Taxation Office has been charged with calculating all the sums, but some industry

executives have expressed concerns that the ATO may not be able to cope. It will be relying

on “SuperStream”, the electronic linking of data and payments, to get access to the necessary data, but

SuperStream is still a work-in-progress.

“SuperStream is only being implemented,” says one industry executive.

Then there is the expense.

The Australian Institute of Superannuation Trustees estimates that it will cost super funds – excluding

self-managed schemes – about $90 million to implement proportionately indexed transfer

balances. The ATO is likely to incur a greater cost to implement the necessary systems, argues the

AIST.

An alternative would be to give all superannuants access to the same incremental increases.

“The revenue at risk is small relative to the cost of tracking individual balances,” says David Haynes,

executive manager of policy and research at the AIST.

The SMSF Association also has its doubts.

“We believe that the rules in relation to indexation of any unused transfer balance cap are complex and

require individual tracking of personal transfer balance caps, in order to avoid access to small

increments in the cap. It is our view that this rule adds a level of complexity that is unnecessary for the

potential revenue risk it is seeking to avoid,” says the AIST in its October submission to Treasury.

“It creates significant cost and administration inefficiencies with little benefit to government revenue, ”

the SMSF Association adds.

So much for consumer-friendliness.

Changes to superannuation underline ill-advised policy and waste

The Australian

25 October 2016

Judith Sloan – Contributing Economics Editor – Melbourne.

I received an email from the Treasury the other day. It was dated October 14. I was being invited to make a submission on the third tranche of the superannuation changes being put forward by the government — the proposed new cap on non-concessional contributions.

Here’s the kicker: I had to have my submission in by October 21. That’s right — I (and everyone else invited to make a submission) was given one week to prepare and submit a submission. Let’s face it, this is a Clayton’s consultation. It is consultation when you don’t care what anyone says. It’s a joke.

I then looked back on previous emails from the Treasury. For the second tranche of the super package, I was given nine business days to make a submission on 220 pages of exposure drafts and explanatory memos. There are 260 paragraphs explaining the Treasury Laws Amendment (Fair and Sustainable Superannuation) 2016, though I particularly like the acknowledgment in the material that there are several areas that are actually not settled. This is sham consultation on steroids.

And don’t even get me started about the faux invitation to hear different views on the legislated definition of the purpose of super. Notwithstanding its glaring faults, the responsible minister, Kelly O’Dwyer, is not for turning, which in this case is a bad thing.

Indeed, given her parliamentary performance, it is a fair question whether she is up to the job. It was one thing to vote in favour of an amendment of the opposition criticising the government, it is another thing altogether to fail to explain the purpose of a piece of legislation she is sponsoring. The fact she couldn’t describe the impact of the change to the taxation of effective dividends really makes you wonder whether she’s in the right job. It was cringe-worthy stuff.

For purely political reasons, the government has decided it must get the super changes into law by the end of the year, with the new arrangements in place from July 1, 2017. It won’t matter how many people point out the difficulties and cost of the changes. The decision has been made.

It’s the Gillard government all over again. A policy decision is made for political reasons. No thought is given to the problems of implementation, of unintended consequences, of the disproportionate costs. Think the Gonski package and the underlying legislation. Think the National Disability Insurance Scheme and the underlying legislation. And now think superannuation and the underlying legislation.

Don’t believe the misleading information reaffirmed by the Treasurer that only 4 per cent of superannuation savers and retirees will be affected by the changes. This figure is just wrong; over time the proportion rises dramatically; and the compliance costs will apply to all super members. Every fund will be required to invest heavily to accommodate the changes and all members will bear the costs — not just those directly affected. To be sure, the government doesn’t care but the Treasurer should not be misleading the public on this matter.

There are some very serious technical problems with the draft legislation, including the curious introduction of accounting terms rather than sticking with the convention of using the language of taxation law. There are 23 new definitions introduced into just one tranche of the legislation. There are also errors in the draft legislation and the explanatory memos, of which the latter have no legal effect but are required to understand the law.

Some of the complications include the fact many superannuation investments are in life companies that are subject to different tax rules; the treatment of death benefits/reversionary pensions and whether they will be required to be cashed out; the handling of multiple accounts when one or more is a defined benefit account; and the treatment of deferred superannuation investment streams and their applicability to self-managed funds. There is also the egregious suggestion that superannuants face a 30 per cent tax penalty if they violate the transfer balance cap more than once. This is notwithstanding the fact the arrangements are so complex that advisers are very likely to make mistakes and unwittingly give their clients the wrong advice — for a high price, of course.

The process is a shambles and there is no way the government’s imposed deadline can be met. Putting the bills to the parliament this year would be highly irresponsible. But my guess is that, at a minimum, the Senate will refer all the bills to be scrutinised by committees. There is no way that the start date of the changes can remain July 1, 2017, which will mean all the make-believe budget savings will have to be recalculated.

Apart from the ill-conceived — nay, harebrained — nature of the government’s proposals, the responsible staff in the bureaucracy are far too inexperienced and lacking in knowledge to put the scheme into workable legislative effect. The fact there have been many confidential discussions going on behind closed doors (so much for transparency on the part of this government) underlines the fact the public servants are desperate to pick the brains of people who might actually know about these things — and that doesn’t include them.

There is no doubt the government needs to get on with repairing the budget. But attempting to fix the budget by implementing bad policy won’t lead to an improvement in the bottom line.

Breaking promises might all be in a day’s work for the Treasurer but he needs to be aware these costly and complex changes will fail to raise the sums of money forecast, particularly because undermining the trust in the system will inevitably lead to a higher dependence on the age pension.

The fact the government is happy to hand out more than $1 billion a year to support the parents of migrants, to spend $3bn more on childcare, to write off billions in bad VET FEE-HELP debts, to waste billions on regional boondoggles and to commit tens of billions too much to construct warships and submarines — and the list of wasteful spending goes on and on — explains why many in the community continue to fume about the super changes (and high taxes more generally).

There is really no difference between the Gillard and Turnbull governments when it comes to implementing hasty and ill-judged policies and wasting money.

Coalition’s super proposals and Labor’s policies – Update November 2016

The Coalition Government’s super proposals

Government’s second tranche super proposals:

On 27 September 2016 the Coalition Government released for public consultation the second tranche of exposure draft legislation and explanatory material to implement a number of the superannuation changes announced in Budget 2016.

Details of the Government’s second tranche is available here. Further information can be found on the Treasury website.

For public submissions on the second tranche, the Government allowed from 27 September 2016 to 10 October 2016; 13 days to consider 234 pages, 57,600 words of very complex, far-reaching proposed legislation.

O’Brien’s, Hammond QC’s and Save Our Super’s second tranche joint submission to Treasury:

On 10 October 2016, Terrence O’Brien and Jack Hammond QC, on behalf of themselves and Save Our Super lodged with Treasury their joint submission in response to the second tranche. That joint submission is available here.

Tax Institute’s second tranche submission to Treasury:

On 10 October 2016 the Tax Institute lodged its corresponding submission to Treasury. It is available here. It is also publicly available on http://www.taxinstitute.com.au/leadership/advocacy/read-submissions.

In Save Our Super’s opinion, the above submissions demonstrate that the Coalition’s proposed superannuation changes are wrong in principle and unworkable in practice.

Government’s third tranche super proposals:

On 14 October 2016 the Government released for public consultation the third tranche. Details of the Government’s third tranche are available here. The Exposure Draft Bill and Explanatory Material are available on the Treasury website. Public submissions closed on Sunday 23 October 2016; 9 days later.

O’Brien’s, Hammond QC’s and Save Our Super’s third tranche joint submission to Treasury:

On 23 October 2016, Terrence O’Brien and Jack Hammond QC, on behalf of themselves and Save Our Super lodged with Treasury their joint submission in response to the third tranche. That joint submission is available here.

The limited time allowed for submissions in response to the second and third tranches, makes a mockery of the concept of public consultation. Obviously, the Government wants to rush the superannuation changes through Parliament as soon as possible.

Second and third tranche submissions sent to Coalition

On 10 October 2016 and 24 October 2016 respectively, we wrote to Messrs Gee MP and Buchholz MP in their roles as leaders of the Coalition Backbench Committee on Economics and Finance and sent them copies of:

- Terrence O’Brien’s, Jack Hammond QC’s and Save Our Super’s joint second tranche submission and the Tax Institute’s second tranche submission: and

- Terrence O’Brien’s, Jack Hammond QC’s and Save Our Super’s joint third tranche submission.

Subsequently, we wrote to all Coalition Senators and Coalition MHRs and sent them copies of those submissions.

Labor’s super policies

On 26 June 2016, Labor dropped their 2016 election superannuation policies. Subsequently, they proposed increased superannuation taxes, despite saying in their policy released just over a year previously, that “If elected, these are the final and only changes Labor will make to the tax treatment of superannuation”. Labor has not announced any replacement superannuation policies.

Save Our Super’s position:

Save Our Super believes that all Parliamentarians should promote and support superannuation policies and legislation which contain grandfathering provisions that maintain the previous entitlements of those Australians who will be significantly affected by major rule changes to the then existing superannuation provisions.

We are convinced that, if the proposed legislation is passed by the House of Representatives, the Senate should subject it to careful scrutiny. It should refer the whole of the Government’s proposed superannuation package to a Senate Committee. The Senate Committee should invite and consider public submissions and objections. The Government’s and Treasury’s assumptions which underpin the changes should be open to public challenge. On any view, the recently released details of the measures deserve far more detailed scrutiny than has been possible to date in the unreasonably short time made available for consultation. Moreover, the fragmentation of the measures into tranches of drafting has prevented any integrated overview of how the measures fit together.

UPDATED PETITION

The Federal Coalition Government has made a number of changes to its Budget 2016 superannuation proposals. Consequently, Save Our Super has updated its earlier email petition/s to take into account those changes.

Thank you if you signed the earlier petition/s. Please support, or continue to support, Save Our Super by completing our updated petition here.

Submission on third tranche of superannuation exposure drafts

23 October 2016

SUMBISSION ON THIRD TRANCHE OF SUPERANNUATION EXPOSURE DRAFTS

Terrence O’Brien and Jack Hammond QC,

on behalf of themselves and Save Our Super

- Table of Contents

- Summary. 2

- Inadequate time for public comment 4

- Inappropriate separation of legislative packages. 4

- No statement relating tranche measures to objective(s) for superannuation. 4

- Why have annual non-concessional contribution limits?. 5

- If annual contribution limits continue, why lower them?. 7

- A significant contribution to growing complexity. 8

- Retrospectivity and effective retrospectivity in the new measures. 8

- If lowering annual contribution caps, grandfather for those close to retirement 10

- A better path forward. 13

Declaration of interests:

Terrence O’Brien is a retired public servant receiving a super pension from a defined benefit, ‘untaxed’ fund. He would be adversely affected by some of the measures in the second tranche.

Jack Hammond QC is in the process of retiring from his barrister’s practice. He would be adversely affected by some of the measures in the second tranche.

2. Summary

There are much better ways than the three tranches of measures released so far to improve the lifetime welfare and savings of lower income earners, improve retirement living standards, and improve budget outcomes. The Government should go back to the drawing board on its Budget measures.

If the proposed legislation is passed by the House of Representatives, the Senate should subject it to careful scrutiny. It should refer the whole of the Government’s proposed superannuation package to a Senate Committee. The Senate Committee should invite and consider public submissions and objections. The Government’s and Treasury’s assumptions which underpin the changes should be open to public challenge.

On any view, the recently released details of the measures deserve far more detailed scrutiny than has been possible to date in the unreasonably short time made available for consultation. Moreover, the fragmentation of the measures into tranches of drafting has prevented any integrated overview of how the measures fit together.

The third tranche Bill proposes reducing the annual concessional (ie before tax) contribution limit by 17% to $25,000 (or by 29% for those over age 50), and the annual non-concessional (ie after tax) contribution limit by 44% to $100,000.

The existing annual contribution limits were created to limit the accumulation of large super balances and have largely achieved that purpose. The number of current large super balances is small as a proportion of total super account balances: 0.5% have over $2.5 million, with most of these balances lawfully accumulated before the implementation of existing law. Those bygones are bygones, and are not a reason for further tightening restrictions on future contribution limits.

If the Government proceeds with its proposed $1.6 million general transfer balance cap (criticised in our submission on tranche two measures), that cap would make the annual non-concessional contribution cap redundant and it could be removed. Instead, the proposed reductions in contribution caps increase the obstacles to current workers ever reaching the Government’s $1.6 million cap (or any other target of their choosing), and reduce welfare by restricting savers’ flexibility to accumulate super savings as their circumstances permit.

For example, for a worker in mid-career with about $340,000 in super (the ‘sweet spot’ that maximizes the combined retirement income from a super pension and a part age pension), the proposed reduction in the non-concessional contribution limits increases the time taken to save up to the super balance cap of $1.6 million by almost 90%, to 13 years, compared to 7 years under the existing contributions cap.[i]

Consider also the living standards offered by a super balance of $1.6 million held by one person of a couple retiring today at age 65. They can expect an indexed annual retirement income of some $72,700 (from age 65 supplemented with part pension from age 82 until death or age 100, assuming an optimistic 5% nominal return net of fees and 3% inflation).[ii] This is about 90% of average weekly earnings. To retire on 90% AWE hardly seems an indecent aspiration, especially if it motivates those who are hard-working, affluent enough and thrifty enough to save hard and forgo easier options to rely on a part age pension.

To combine the general transfer balance cap with lowered annual contribution caps clearly doubles the strength of the message to savers seeking to meet their own preferred standards of retirement income. That message is: “Don’t bother”. The Government has for the first time directly prescribed what it considers a super balance sufficient for retirement ($1.6 million), and has tightened contribution restrictions to hinder reaching even that benchmark.

If alternatively, the Government did not continue with its proposed general transfer balance cap, some case for annual contribution caps would remain. If in that case the Government still wanted to lower them, it should grandfather the reductions for those close to retirement who have planned on the basis of the existing caps and have insufficient time to utilise alternative strategies. The principles for such grandfathering were established by the Asprey inquiry and have been used successfully for forty years. Continuing to utilize them would help contain the damage to trust in super and in super law-making processes.

3. Inadequate time for public comment

Many of the issues in this third tranche of material have already arisen in first and second tranches, so comments on those issues are abbreviated in this submission. Paragraph references below are to the Exposure Draft Explanatory Materials for tranche three unless otherwise noted.

Providing only 5 working days for public input on the third tranche of complex super measures shows contempt for public consultation. These are measures that deal with Australians’ life savings, and the realisation of their plans for independent retirement. The measures extensively revise the most complicated aspects of the income tax law affecting individuals, and inject considerable new complexity.

See earlier submissions for comparisons to better consultation processes used in the past.

4. Inappropriate separation of legislative packages

The compartmentalization across three tranches of draft material for comment has compounded the inadequacies of consultation and has made it difficult to identify connections and interactions among concepts. This submission seeks to touch briefly on some of those cross-cutting issues in the limits of the time available. But the compartmentalized and rushed consultation greatly increases the risk of unintended consequences and the likely need for future unsettling legislative change to repair errors.

5. No statement relating tranche measures to objective(s) for superannuation

Like the two previous tranches, the third tranche draft bill lacks any statement of rationale against the Government’s stated primary objective (“.. . to provide income in retirement that substitute or supplements the age pension”[iii] ) plus five subordinate objectives.

Our earlier submissions have argued that the Superannuation (Objective) Bill’s proposed objectives for Government policies toward superannuation are unworkable and inappropriate. Yet that proposition can be tested by applying the objectives to the current draft Bill in a statement such as will be mandatory from 1 July 2017.

We are now told that “The final Explanatory Memorandum that will accompany the Bill will provide the overarching policy context.”[iv] The lack to date of any stated policy context, four months after the announcement of the measures (and their reversal of the Government’s pre-Budget super policy positions) makes considered consultation needlessly difficult. Indeed, the whole process is like starting a construction at the top floors, and finishing up with the foundations.

The documentation asserts (para 3.3) that “The measure will improve the sustainability and integrity of the superannuation system.” No evidence is offered for either of those claims, and as our submission on tranche two measures argues, there is no sense in speaking of ‘sustainability’ in the structure of the super tax concessions: as super balances grow, the Governments tax take from contributions and accumulation grows, and the considered, well-researched and well-costed strategic decision of 2005-06 not to collect tax on most retirement income streams remains unchanged. The focus of taxation of growing commitments to life-long savings in superannuation on the contribution and accumulation phases is no more ‘unsustainable’ than the identical focus of taxation on growing sums in savings accounts, which are also untaxed in their drawdown phase.

6. Why have annual non-concessional contribution limits?

Concessional and non-concessional contribution limits were introduced to limit the accumulation of large super balances, and seem to be largely succeeding in that objective.

The explanatory material rationalises this objective oddly: “To ensure superannuation is being used for its primary purpose of saving for retirement, and not for tax minimisation, there are limits on the amount of non-concessional contributions individuals can make.” (para 3.4)

As noted in our earlier submissions, special tax treatment of super since 1915 is not a gift to super funds or savers: it exists to remove the significant disincentive to long term saving from the interaction of a progressive tax on nominal income with the provision of a generous age pension. It makes no sense to accuse citizens who lawfully follow incentives to save in super of ‘tax minimisation’ beyond some arbitrary (but apparently ever-evolving) point. In April 2016, the current contribution limits were apparently appropriately scaled to defend thrift against discouragement by income tax and the age pension. In May 2016, citizens lawfully fully utilizing those legislated limits were apparently guilty of ‘tax minimisation’. What changed?

All saving in super is in one sense ‘tax minimisation’ – that is how the incentives achieve their intended effect. Branding savers who follow lawful incentives ‘tax minimisers’ in an attempt to rationalize an otherwise unexplained tax increase does not seem a helpful guide to policy development, but rather adds to the destruction of trust in super. It reminds all super savers that today’s lawful thrift transparently encouraged by government incentives enacted through Parliament is open to excoriation as tomorrow’s ‘tax minimisation’.

While anecdotes of very large super balances still circulate, there are relatively few such balances and most of the current high balances were accumulated under previous rules (or in the absence of rules). A 2015 report by Ross Clare for the Association of Superannuation Funds of Australia suggested that there is a small proportion (around 0.5 per cent) of super savers who have very high account superannuation balances (above $2.5 million). Most large balances existing today owe their existence to former incentives that, in times past, were unbounded or much less restricted than at present.[v]

In super taxation policy, the homely adage that ‘bygones are bygones’ is particularly important. Superannuation has a uniquely long lifespan, with current retirees living off savings which began to be lawfully accumulated as long ago as the middle of the last century. Policy design for super tomorrow requires the comparison of future marginal costs and future marginal benefits of alternatives open to choice today.

It is a significant misdirection to tomorrow’s super policy to point to relatively few large super balances built on decades of savings under the less restrictive laws of the past as justification for additional restriction in future laws, when current laws already heavily restrict any future accumulation of high balances.

If the Government proceeds with the proposed $1.6 m general transfer balance account cap, it is not clear why any non-concessional contribution limits would be necessary going forward; their role today would in future be taken by the cap. These comments focus, as does the draft Bill, on the non-concessional contribution cap which bear the brunt of the Government’s new restrictions, being cut by 2 ½ times the percentage cut in concessional contribution cap. This is notwithstanding the fact that against the pre-paid consumption tax which is the most defensible benchmark for neutral treatment of long term savings, non-concessional contributions are (as their name rightly suggests) no concession at all. Indeed, against that benchmark, users of a non-concessional contribution, having paid tax at their top marginal tax on their contribution, are still over-taxed by the 15% tax on subsequent earnings within the fund.[vi]

Continuing with any annual non-concessional contribution limits merely restricts the flexibility with which individuals can adapt to their personal circumstances and maximise their super savings when they are able to, up to the limit of the cap. For example, a small business owner may envisage retiring and rolling the proceeds from selling their business into a super fund. Or another individual may receive a bequest. To reduce the rate at which they can save towards the cap would seem to serve no revenue purpose, but would reduce their welfare and potentially the total that could be saved in super. Alternative tax-efficient forms of long-term saving such as negatively-geared real estate or the principal residence would likely produce a less productive allocation of scarce capital from an economy-wide perspective.

If, nevertheless, the Government were to seek revenue from past balances lawfully saved by taxing them more heavily, there should be a very clear understanding of the effective retrospectivity of that course, with all of the costs to trust in super, legitimacy and future savings. Such retrospective measures should not be misrepresented as responding to a prospective problem.

7. If annual contribution limits continue, why lower them?

The measures propose a 44 % cut in the annual non-concessional contribution cap, and a 17% cut in the concessional contribution cap (or by 29% for those over age 50). Yet the explanatory materials claim:

By reducing the non‑concessional annual caps and restricting their use to those with balances less than the transfer balance cap, this measure will better target the tax concessions to encourage those who have aspirations to build their superannuation balance up to the limit of the transfer balance cap while retaining the flexibility to accommodate lump sum contributions from one-off events such as receiving an inheritance or selling a large asset. (para 3.4)

Contrary to this unsubstantiated claim, lowering the contributions limits sends the opposite message — discouragement — compared to simply leaving the existing limits in place. Consider the case of a super saver in Tony Negline’s ‘sweet spot’: about $340,000 in super, the amount that maximizes the combined retirement income from a super pension and a part age pension.[vii] To move from that super balance to $1.6 million by non-concessional contributions would take almost 90% longer, 13 years after the proposed cut, compared to 7 year under the existing cap.

That is a powerful message: not only is the Government for the first time prescribing a maximum to the most tax-assisted saving limit to force reallocation of lawful savings by those who have already saved a lot; it is simultaneously prescribing lowered limits in annual saving rates for those in their late-career savings phase that will prevent many not already at the cap from ever reaching it.

The combined message from tranche two and tranche three measures is that the optimum saving strategy is $340k or so in super, a part age pension, a valuable house and many other options to keep savings outside the pension asset test.

The upshot of this and the other two tranches’ measures is likely to be to increase total Government retirement income costs over time, while crimping the rise in Australians’ retirement living standards – failures of policy that apparently have not been detected within the government’s asserted analytical framework of one principal objective plus five subordinate objectives for super policy.

As SMSF adviser Daryl Dixon has noted:

There’s about 2000 people with a hell of a lot of money in super. Right?

There are at least 20 to 30 thousand with a lot of money in an owner–occupied house worth 5 to 10 million or more, and there’s no capital gains and there’s no tax on the profits of the house.[viii]

8. A significant contribution to growing complexity

By far the greatest source of complexity in the superannuation measures is the introduction of the new structure of ‘transfer balance accounts’, ‘general transfer balance caps’, ‘personal transfer balance caps’ and ‘excess transfer balance’ taxes, as detailed in our submission on the second tranche measures.

While the concepts of concessional and non-concessional contribution limits are at least familiar to savers from the present law, lowering them as proposed adds to complexity through the need to plot their interaction with the new transfer balance cap apparatus. The Explanatory Materials take some 9 pages to explain the interaction of the contribution limits with the transfer cap (pages 9 to 18).

9. Retrospectivity and effective retrospectivity in the new measures

Under present law, an individual can make $540,000 of non-concessional contributions by bringing forward 3 years’ of the current non-concessional contribution cap of $180,000. Various media commentary has advised super savers to make use of this provision before new laws take effect (if passed by Parliament) on 1 July 2017.[ix]

However it seems from the ‘transitional provisions’ of the Bill discussed at paras 3.57 to 3.66 of the draft explanatory materials that the new Bill, if passed by Parliament, would retrospectively (in the narrowest sense of the term) penalize that bring-forward, by allowing a $180,000 contribution for 2016-17, but allowing only a reduced $100,000 for each of 2017-18 and 2018-19 (assuming no indexation by the CPI of the contribution caps by 2018-19).

Precisely how the saver will be retrospectively penalized after 1 July 2017 for a lawful bring forward of non-concessional contributions made before 1 July 2017 is not clear in the time made available for consultation and with the draft explanatory material. Para 3.44 flags another area where treatment of defined benefit schemes has not yet been resolved by advisers. However, paras 3.41 to 3.43, and new material governing how the Commissioner for Taxation must (or may) respond to ‘excess’ contributions through the issue of release authorities (13 pages of material from para 10.1 to 10.68) contain illustrations of the assessment of penalty taxes under Division 293. Once again, the extraction of penalties in such a situation is a retrospective change of law in the narrowest sense.

Beyond this issue of narrow retrospectivity, there is the broader issue of ‘effective retrospectivity’ as defined by Treasurer Morrison in his address of 18 February 2016.[x] A generation of savers (those aged around 40 to 60) now enjoying peak career earnings and planning lifetime peak contributions to their super balances in the lead up to retirement would have their savings plans destroyed by the radical cuts to contribution caps (and especially the 44% cut to non-concessional contributions caps).

Many of those late career savers are too close to retirement to be able to devise alternative strategies for self-funded retirement, and will likely choose a path of more reliance on a part age pension and the construction of wealth in avenues not penalized by the age pension means test. To limit the destruction in trust in super among that savings group, the Government should grandfather its measures along the principles outlined by Justice Asprey and used over the last 40 years in other tax increases on superannuation. Application of those principles is further references below.

10. If lowering annual contribution caps, grandfather for those close to retirement

The challenges of facilitating gradual increases in super taxes while not destroying confidence in super were addressed most thoughtfully by the late Justice Kenneth Asprey, who was commissioned by the outgoing McMahon Government to report on the Australian taxation system. Asprey made his Committee’s final report to the Whitlam Government. His recommendations at first had little apparent effect, but it they drove all the major advances in Australian tax reform over the following quarter century:

The capital gains tax, the fringe benefits tax, dividend imputation, the foreign tax credit system, the goods and services tax (he called it a “broad-based value-added tax”) — all were proposed in the Asprey report.[xi]

The Asprey insights into the need to grandfather super tax increases, and his principles for how to do that while preserving necessary policy flexibility to respond to changing circumstances, are summarised in the following Box.

More recently, the Gillard Government’s Superannuation Charter Group led by Jeremy Cooper addressed concerns about the future of the super savings and the way policy changes have been made.[xii] The Charter Group reported to the second Rudd Government in July 2013 with useful proposals in the nature of a ‘superannuation constitution’ that would codify the nature of the compact between governments and savers, including:

- People should have sufficient confidence in the regulatory settings and their evolution to trust their savings to superannuation, including making voluntary contributions.

- Relevant considerations, when assessing policy against the principle of certainty, include the ability for people to plan for retirement and adjust to superannuation policy changes with confidence.

- “People should have sufficient time to alter their arrangements in response to proposed policy changes. This issue becomes more acute for those nearing or in retirement, who have fewer options and less time available to them (for example, to increase contributions or remain in the workforce longer).” [xiii] (emphahsis added)

Box: Grandfathering principles: Asprey Taxation Review, Chapter 21, 1975

Principle 1 21.9. Finally, and most importantly, it must be borne in mind that the matters with which the Committee is here dealing involve long-term commitments entered into by taxpayers on the basis of the existing taxation structure. It would be unfair to such persons if a significantly different taxation structure were to be introduced without adequate and reasonable transitional arrangements. ………

Principle 2 21.61. …..Many people, particularly those nearing retirement, have made their plans for the future on the assumption that the amounts they receive on retirement would continue to be taxed on the present basis. The legitimate expectations of such people deserve the utmost consideration. To change suddenly to a harsher basis of taxing such receipts would generate justifiable complaints that the legislation was retrospective in nature, since the amounts concerned would normally have accrued over a considerable period—possibly over the entire working life of the person concerned. …..

Principle 3 21.64. There is nonetheless a limit to the extent to which concern over such retrospectivity can be allowed to influence recommendations for a fundamental change in the tax structure. Pushed to its extreme such an argument leads to a legislative straitjacket where it is impossible to make changes to any revenue law for fear of disadvantaging those who have made their plans on the basis of the existing legislation. …..

Principle 4 21.81. …. [I]t is necessary to distinguish legitimate expectations from mere hopes. A person who is one day from retirement obviously has a legitimate expectation that his retiring allowance or superannuation benefit which may have accrued over forty years or more will be accorded the present treatment. On the other hand, it is unrealistic and unnecessary to give much weight to the expectations of the twenty-year-old as to the tax treatment of his ultimate retirement benefits.

Principle 5 21.82. In theory the approach might be that only amounts which can be regarded as accruing after the date of the legislation should be subject to the new treatment. This would prevent radically different treatment of the man who retires one day after that date and the man who retires one day before. It would also largely remove any complaints about retroactivity in the new legislation ….

These Charter Group suggestions would also appear to support the use of grandfathering in the case of the Government’s proposed restriction on non-concessional contributions.

Since at least 1994, concessional contributions caps have specifically recognized that capacity to save rose later in workers’ careers, so caps for those over 50 were substantially higher than for those under 35.[xiv] For an over-50 in 1994, the annual concessional contribution limit was $62,200, and had been indexed to over $105,000 by the time of its abolition under the Costello simplification reforms of 2006. These earlier high caps of course help explain why some very high super balances still exist today.

Treasurer Swan’s 2009-10 Budget lowered the annual concessional contributions cap from $50,000 to $25,000 for those under 50. But for those aged 50 and over for the 2009-10, 2010-11 and 2011-12 financial years, the cap was lowered from $100,000 to $50,000 per annum.

The 2009-2010 Budget papers noted:

‘Grandfathering’ arrangements were applied to certain members with defined benefit interests as at 12 May 2009 whose notional taxed contributions would otherwise exceed the reduced cap. Similar arrangements were applied when the concessional contributions cap was first introduced. [xv]

Similarly, regulatory changes that affected savers’ planning for retirement late in their working careers were phased in to spare those closest to retirement and to give advance notice to those further from retirement to make adjustments to their financial affairs. An example was the 1997-1998 Budget confirmation of phased increases in the preservation age from 55 to 60 by 2025..[xvi]

A further illustration of recent relevance from the intersection of superannuation and the aged pension is the grandfathering of existing account-based superannuation pensions outside the aged pension income test, rather than deeming them as income counted against the test from 1 January 2015 as part of the revisions to that test.[xvii]

Further details showing how grandfathering adverse changes to superannuation and related retirement income parameters has been used over the last 40 years are contained in Terrence O’Brien’s paper for the Centre for Independent Studies, Grandfathering super tax increases.[xviii]

11. A better path forward

There are much better ways than the three tranches of measures released so far to improve the lifetime welfare and savings of lower income earners, such as illustrated in papers for the CIS by Simon Cowan and Michael Potter[xix]. A sensible selection from and development of those ideas would improve self-sufficiency and thrift, improve superannuation outcomes, improve retirement living standards, and improve budget outcomes. The Government should go back to the drawing board on its Budget measures.

If the proposed legislation is passed by the House of Representatives, the Senate should subject it to careful scrutiny. It should refer the whole of the Government’s proposed superannuation package to a Senate Committee. The Senate Committee should invite and consider public submissions and objections. The Government’s and Treasury’s assumptions which underpin the changes should be open to public challenge.

On any view, the recently released details of the measures deserve far more detailed scrutiny than has been possible to date in the unreasonably short time made available for consultation. Moreover, the fragmentation of the measures into tranches of drafting has prevented any integrated overview of how the measures fit together.

[i] Tony Negline, Saving or slaving: find the sweet spot for super, The Australian, 4 October 2016.

[ii] Trish Power, Crunching the numbers: a $1.6 million retirement, SuperGuide, 23 May 2016.

[iii] Scott Morrison and Kelly O’Dwyer, Superannuation reforms: first tranche of Exposure Drafts , 7 September 2016

[iv] The Treasury, Superannuation reform package – tranche three, online Consultation Hub, accessed 21 October 2016.

[v] Ross Clare, Superannuation and high account balances, Association of Superannuation Funds of Australia, April 2015.

[vi] Ken Henry et al, Australia’s Future Tax System: Report to the Treasurer, Part Two; Detailed analysis, Volume 1, Box A2-1p 97

[vii] Tony Negline, Saving or slaving: find the sweet spot for super, The Australian, 4 October 2016.

[viii] Daryl Dixon and Nerida Cole on Nightlife with Tony Delroy, ABC, 12 July 2016.

Election over: now they want to take more of your Super and Labor may allow it

[ix] See, for one example, Will Hamillton of Hamilton Wealth Management, Six most common questions on superannuation, The Australian, 1 October 2016.

[x] Scott Morrison, Address to the SMSF 2016 National Conference, Adelaide, 18 February 2016

[xi] Ross Gittins, A light on the hill for our future tax reformers, The Age 15 June 2009.

[xii] Jeremy Cooper, A Super Charter: Fewer Changes, Better Outcomes: A report to the Treasurer and Minister Assisting for Financial Services and Superannuation, Canberra, 5 July 2013.

[xiv] AMP, Submission on Concessional Contributions Caps for Individuals Aged 50 and Over, March 2011.

[xv] Australian Government, Budget 2009-10, Budget Paper No 2, part 1, Revenue Measures, Canberra 12 May 2009.

[xvi] Trish Power, Accessing super: Preservation age now 56 years (since July 2015),

MLC Super Guide, 5 July 2015.

[xvii] Liam Shorte, Age pension changes: keeping your super grandfathered, Intelligent Investor, 26 August 2014.

[xviii] Terrence O’Brien, Grandfathering super tax increases, Centre for Independent Studies, Policy, Vol. 32 No. 3 (Spring, 2016), pp3-12.

[xix] Michael Potter, Don’t increase the super guarantee, Centre for Independent Studies, Policy, Vol. 32 No. 3 (Spring, 2016), pp27-36,

Budget 2016 Proposals and Opposition’s Policies – Update 18 October 2016

Government’s second and third tranches of proposed superannuation changes

UPDATE: