Address by Jack Hammond QC, founder of Save Our Super.

Tuesday, 18 September 2018 at La Trobe University Law School, City Campus, 360 Collins Street, Melbourne, lunch-time seminar, “Australian Superannuation: Fixing the Problems”.

INTRODUCTION and DECLARATION OF INTEREST

In 2016-17, the Turnbull Government made a number of superannuation policy and legislative changes which adversely affected many Australians. Those changes were made without appropriate ‘grandfathering’ provisions even though they amounted to ‘effective retrospectivity’ (a term coined in February 2016 by the then Treasurer, Scott Morrison). ‘Grandfathering’ provisions continue to apply an old rule to certain existing situations, while a new rule will apply to all future cases.

I am a retired barrister and am adversely affected by those 2016-17 superannuation changes. That, in turn, has led me to form the superannuation community action group, Save Our Super.

The Turnbull Government, assisted and encouraged by the Grattan Institute in Melbourne has, without notice and at a single stroke, changed the superannuation rules and the rules for making those rules. They have turned superannuation from a long-term, multi-decades, retirement income system into, at best, an annual federal budget-to-budget saving proposition. That is a contradiction in terms . It is unsustainable.

Further, it is a recipe for a loss of trust and increased uncertainty for all those already in the superannuation system and those yet to start.

Save Our Super has three proposals which we believe will redress the 2016-17 superannuation policy and legislative changes and prevent a recurrence.

But first, how did we get here and in particular, without appropriate ‘grandfathering ‘ provisions? Those type of provisions have accompanied all significant adverse superannuation changes over the past 40 years.1

BACKGROUND CHRONOLOGY

| 29 November 2012 | Lucy Turnbull appointed a director of the Grattan Institute, Melbourne.2 |

| May to June 2015 | Scott Morrison, whilst Minister for Social Services in Abbott Government, makes 12 ‘tax-free superannuation’ promises.3 |

| 2014 to 2015 | Malcolm and Lucy Turnbull donate funds to Grattan Institute.4 |

| 15 September 2015 | Malcolm Turnbull replaced Abbott as Prime Minister. Scott Morrison becomes Treasurer.5 |

| 24 November 2015 | Grattan Institute publishes Report ”Super Tax Targeting” by Grattan Institute CEO John Daley and others. Dismisses need for ‘grandfathering’ provisions6 and observes ‘…that taxing earnings for those in the benefits stage may raise concerns about the government retrospectively changing the rules’. 7

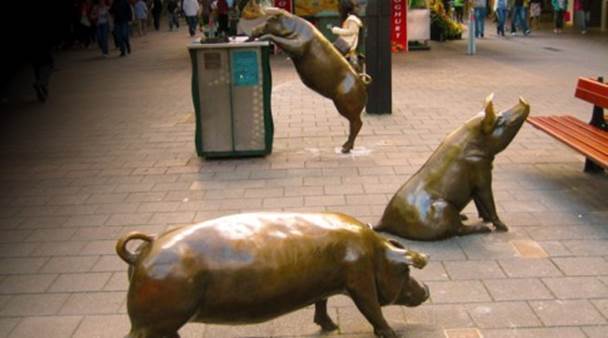

No mention of the possible consequential of loss of trust and uncertainty that retrospective changes may bring. Note that the Grattan Institute material shows, on its front page, an image of three of the bronze pigs on display in the Rundle Street Mall, Adelaide.8 We, and other self-funded superannuants, believe that the Grattan Institute’s prominent use of that image of those bronze pigs was not merely a juvenile attempt at humour. It was a none-to-subtle insulting implication that Australians whom had faithfully conformed with successive governments’ superannuation rules and had substantial superannuation savings were, nonetheless, greedy pigs with their ‘snouts in the trough’. See also 9 November 2016 entry below. |

| 2015-2016 | Malcolm and Lucy Turnbull donate further funds to Grattan Institute.9 |

| 18 February 2016 | Scott Morrison, as Treasurer, gave an address to the Self Managed Superannuation Funds 2016 National Conference in Adelaide.

Draws attention to ‘effective retrospectivity’ and its ‘great risk’ in relation to super changes. “Our opponents stated policy is to tax superannuation earnings in the retirement phase. I just want to make a reference less about our opponents on this I suppose but more to highlight the Government’s own view, about our great sensitivity to changing arrangements in the retirement phase. One of our key drivers when contemplating potential superannuation reforms is stability and certainty, especially in the retirement phase. That is good for people who are looking 30 years down the track and saying is superannuation a good idea for me? If they are going to change the rules at the other end when you are going to be living off it then it is understandable that they might get spooked out of that as an appropriate channel for their investment. That is why I fear that the approach of taxing in that retirement phase penalises Australians who have put money into superannuation under the current rules – under the deal that they thought was there. It may not be technical retrospectivity but it certainly feels that way. It is effective retrospectivity, the tax technicians and superannuation tax technicians may say differently. But when you just look at it that is the great risk.”10 |

| 3 May 2016 | Scott Morrison, as Treasurer, announces in his Budget 2016-17 Speech to Parliament a number of adverse ‘changes to better target superannuation tax concessions’ .

No ‘grandfathering’ provisions announced.11 See also, Budget Measures, Budget Paper No 2, 2016-17, 3 May 2016, Part 1, Revenue Measures, pp 24-30.12 |

| 5 September 2016 | John Daley, CEO Grattan Institute, said: “Winding back superannuation tax breaks will be an acid test of our political system. If we cannot get reform in this situation, then there is little hope for either budget repair or economic reform” (AFR 5/9/16)13 |

| 9 November 2016 | To give effect to the Budget 2016-17 superannuation changes, Scott Morrison presented the Turnbull Government’s package of 3 superannuation Bills to Parliament.

To publicly explain and justify those superannuation changes to Parliament, Scott Morrison and Kelly O’Dwyer circulated and relied in Parliament upon a 364 page “Explanatory Memorandum”. The Explanatory Memorandum states on its front page “Circulated by the authority of the Treasurer, the Hon Scott Morrison MP and Minister for Revenue and Financial Services, the Hon Kelly O’Dwyer MP.” In turn, the Explanatory Memorandum expressly refers to, and provides links to, the Grattan Institute’s 24 November 2015 Media Release and Report (see 24 November 2015 entry, above). As noted above, that Grattan Institute material shows, on its cover, an image of three of the bronze pigs on display in the Rundle Street Mall, Adelaide.14  Bronze pigs in Rundle Street Mall, Adelaide |

| 23 November 2016 | The Turnbull Government, with the support of Labor, rushed through Parliament two of its three superannuation Bills. |

| 29 November 2016 | Those two Bills were assented to on 29 November 2016 and are now law:

Superannuation ( Excess Transfer Balance Tax) Imposition Act 2016 (C’th) (No 80 of 2016);15 Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016 ) (C’th) (No 81 of 2016)16 The third superannuation Bill, the Superannuation (Objective) Bill, remains stalled in the Senate.17 |

| 1 December 2016 | Lucy Turnbull retired as a director of the Grattan Institute.18 |

| 24 August 2018 | Malcolm Turnbull resigns as Prime Minister.19 Scott Morrison becomes Prime Minister.20 |

SAVE OUR SUPER’S THREE PROPOSALS FOR THE FUTURE

Save Our Super has three proposals which we believe could redress the 2016-17 superannuation policy and legislative changes and prevent a recurrence.

First, Scott Morrison, in his new capacity as Prime Minister, should request the Treasurer, Josh Frydenberg and/or through him, the Assistant Treasurer, Stuart Robert, to revisit the Turnbull Government’s 2016-17 superannuation changes.

A discussion paper and advice from Treasury should be requested. It should include the effect of the Turnbull Government’s 2016-17 superannuation changes on superannuation fund taxes in 2017-18 and over the forward estimates.

To restore trust and reduce uncertainty in the superannuation system, the Morrison Government should introduce into Parliament legislation which will retrospectively provide appropriate ‘grandfathering’ provisions in relation to the Turnbull Government’s 2016-17 adverse superannuation changes.

Those ‘grandfathering’ provisions to be available to those significantly adversely affected and whom wish to claim that relief.

Secondly, Save Our Super proposes to create a Superannuation and Retirement Income Policy Institute, independent of government , funded, at least initially, by private donations/subscriptions.

Its role will be to advocate on behalf of those millions of superannuants and retirees whose collective voice needs to be heard.

Thirdly, Save Our Super will advocate for an amendment to the Australian Constitution, to have a similar effect in relation to superannuation and other retirement income, as does section 51 (xxxi) has in relation to the compulsory acquisition of property.

That section empowers the federal Parliament to make laws with respect to the acquisition of property on just terms from any State or person for any purpose in respect of which the Parliament has power to make laws (emphasis added).

Thus Parliament’s power to make laws in relation to superannuation and other retirement income should not be affected. However, any significant adverse change to existing situations will need to be on just terms, for example, by providing appropriate ‘grandfathering’ provisions as part of that federal law.

1. [https://saveoursuper.org.au/super-changes-grandfathering-rules-must-considered]↩

2. [https://grattan.edu.au/wp-content/uploads/2014/03/Grattan_Institute_Annual_Financial_Report_2013.pdf (pp 2-3)]↩

3. [https://saveoursuper.org.au/scott-morrison-12-superannuation-tax-free-promises]↩

4. [https://grattan.edu.au/wp-content/uploads/2015/11/Grattan-Institute-Annual-Report-on-Operations-30-June-2015.pdf (p 19)]↩

5. [https://en.wikipedia.org/wiki/First_Turnbull_Ministry]↩

6. [https://grattan.edu.au/wp-content/uploads/2015/11/832-Super-tax-targeting.pdf (p 7)]↩

7. [https://grattan.edu.au/wp-content/uploads/2015/11/832-Super-tax-targeting.pdf (pp 68-9, para 6.5)]↩

8. [https://grattan.edu.au/wp-content/uploads/2015/11/832-Super-tax-targeting.pdf (front page)]↩

9. [https://grattan.edu.au/wp-content/uploads/2016/11/Grattan-Institute-Annual-Report-on-Operations-30-June-2016.pdf (p 24)]↩

10. [Scott Morrison, Address to the SMSF 2016 National Conference, Adelaide]↩

11. [https://www.budget.gov.au/2016-17/content/speech/html/speech.htm]↩

12. [https://budget.gov.au/2016-17/content/bp2/download/BP2_consolidated.pdf]↩

13. [https://grattan.edu.au/wp-content/uploads/2017/11/Grattan-Institute-Annual-Report-2017-Web.pdf (p 6)]↩

14. [The Explanatory Memorandum refers to the Grattan Institute’s 24 November 2015 report “Super tax targeting” by John Daley and Brendan Coates: (see page 275, paragraph 14.12, footnote 2). Click on the link on footnote 2, “2 Grattan Institute, media release, ‘For fairness and a stronger Budget, it is time to target super tax breaks’, 24 November 2015, http://grattan.edu.au/for-fairness-and-a-stronger-budget-it-is-time-to-target-super-tax-breaks/”.

Click on the link at foot of that page “Read the report“. That link will take you to the Grattan Institute report “Super tax targeting “ dated 24 November 2015 by John Daley and others. The report’s front page shows the image of those bronze pigs in the Rundle Street Mall, Adelaide. Note: The Grattan Institute’s website has been updated since the publication of that document. However, the article itself and the image of the 3 pigs remain.]↩

15. [Superannuation ( Excess Transfer Balance Tax) Imposition Act 2016 (C’th) (No 80 of 2016)]↩

16. [Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016 ) (C’th) (No 81 of 2016)]↩

17. [Superannuation (Objective) Bill]↩

18. [https://grattan.edu.au/wp-content/uploads/2017/11/Grattan-Institute-Annual-Financial-Report-2017.pdf (p 3)]↩

19. [https://en.wikipedia.org/wiki/Malcolm_Turnbull]↩

20. [https://en.wikipedia.org/wiki/Scott_Morrison]↩