Australian Financial Review

16 December 2016

Sally Patten

As many as two in five self-managed superannuation funds hold either residential or commercial property, although such investments still make up a small portion of schemes’ overall portfolios.

The proportion of self-managed funds that hold residential property rose to 22 per cent in 2016 from 19 per cent a year ago, while the proportion of schemes investing in direct commercial property, and so excluding listed property trusts, rose to 20 per cent from 18 per cent, a survey by the Financial Services Council and UBS Asset Management shows.

The research also found that self-managed super fund trustees are heavily invested in property outside super.

Of those savers who either supplement their self-managed fund income in retirement, or expect to do so, 44 per cent said this would come from property investments. The figure is far higher than the 34 per cent who said their income was or would be supplemented from share investments.

The findings underpin investors’ search for income-generating assets as they combat low interest rates, plus the attraction to property thanks to soaring prices on the eastern seaboard.

But the growing interest in houses, apartments, offices and factories may put self-managed fund returns at risk if there is a correction in the market.

Returns are also likely to be crimped by bank moves to toughen interest-only lending. This week Commonwealth Bank of Australia became the latest bank to say it would increase mortgage rates for property investors and reprice interest-only loans.

One of the biggest changes in the past year was a jump in the proportion of do-it-yourself schemes owning international shares, up from 23 per cent of funds in 2015 to 30 per cent in 2016. More funds also invested in exchange-traded funds (ETFs), which are listed products that track an underlying index.

$1.5 million the magic number

The rising popularity of both asset classes suggests trustees are becoming increasingly aware of the need to diversify their portfolios away from the highly concentrated Australian sharemarket.

Given that ETFs are low-cost products, the trend also suggests investors are becoming increasingly concerned about fees in a low-return environment.

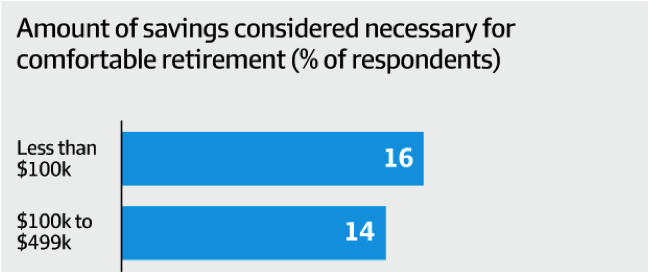

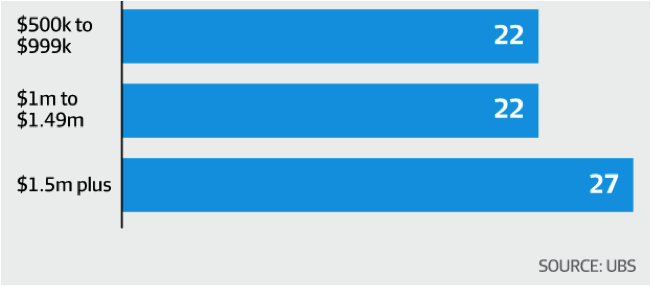

In a sign that the new restrictions on super contributions due to come into force in July will curtail the ability of retirees to rely solely on their super for income in retirement, 27 per cent of respondents said they would need $1.5 million of savings to support a comfortable retirement.

The median sum required to live a comfortable retirement was $1 million.

“How can you achieve $1 million in super savings under the restrictions that are coming in?” said Bryce Doherty, head of UBS Asset Management for Australasia.

“Reducing the non-concessional cap generates a headwind to getting to where they need to.”

From next July the amount of pre-tax money individuals can contribute to super will fall to $25,000 a year, down from $30,000 or $35,000 depending on a saver’s age. Annual post-tax contribution limits will fall to $100,000 from $180,000.

In the past year the proportion of self-managed funds using a financial adviser fell to 42 per cent from 46 per cent, while the proportion of schemes being advised by an accountant rose to 30 per cent from 25 per cent.