Important Notice (6 May 2020):

| Paul Robinson |

| change.org/SaveOurSuper |

| facebook.com/SaveOurSuperAU |

| saveoursuperau@gmail.com |

| #saveoursuperau campaign |

| #saveoursuper campaign |

| #saveoursuper AU |

A 1976 deed can’t be found … trust fails as a result!

2 December 2021By Bryce Figot, Special Counsel, and Daniel Butler, Director, DBA Lawyers

Introduction

A recent case (Mantovani v Vanta Pty Ltd (No 2) [2021] VSC 771) sheds light on the implications of lost trust deeds. Advisers who work with SMSFs (or family trusts or any form of trust established by deed) should be aware of its implications. In short, due to a lost deed, a family trust was ordered to have failed. The assets of that trust were ordered to be transferred back to the deceased’s estate of the person who had transferred them to the trust over 40 years earlier!

click here for more…

ATO focus on CGT relief may have big impact on SMSFs

26 November 2021By Shaun Backhaus, Senior Associate and Daniel Butler, Director, DBA Lawyers

Introduction

The ATO recently issued a statement noting that there has been an increased number of taxpayers mistakenly claiming capital gains tax (CGT) small business concessions (refer: ATO QC 67318).

As a result, the ATO is now actively following up those who have claimed CGT small business concessions advising them to ensure that they meet the eligibility conditions and have the necessary records to substantiate their claims and recommending their tax advisers check their past tax returns for accuracy.

click here for more…

Non-arm’s length income – A history and overview

26 August 2021By Shaun Backhaus, Senior Associate and Daniel Butler, Director, DBA Lawyers

Introduction

Non-arm’s length income (NALI) has recently become one of the hottest and most contentious topics in the superannuation industry that impacts both large APRA and self managed superannuation funds (SMSFs). This is largely due to the finalisation of the ATO’s Law Companion Ruling LCR 2021/2, which outlines the ATO’s view of the application of the new non-arm’s length expenditure (NALE) provisions.click here for more…

Reversionary pension v BDBN: which one wins?

22 August, 2019By Bryce Figot, Special Counsel, DBA Lawyers and Daniel Butler, Director

Introduction

There is a misconception that reversionary pension documentation will always apply before a binding death benefit nomination. If the SMSF deed is silent on the question, it can be entirely possible at times that the binding death benefit nomination (‘BDBN’) will apply before any reversion pension documentation. The reasoning is to do with several often overlooked laws.click here for more…

Can a surviving spouse claim their deceased spouse’s super while being executor of their estate?

1 March, 2019By Shaun Backhaus (sbackhaus@dbalawyers.com.au), Lawyer and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

Introduction

The recent case of Burgess v Burgess [2018] WASC 279 (‘Burgess’) continues a line of cases that consider the conflict that arises where a person acts as executor of a deceased estate while also receiving superannuation death benefits in their personal capacity.click here for more…

Grotesquely unreasonable and SMSF trustees paying death benefits: Re Marsella

28 February, 2019By Daniel Butler, Director (dbutler@dbalawyers.com.au) and Kimberley Noah, Lawyer, DBA Lawyers

Introduction

The decision in Re Marsella [2019] VSC 65 (‘Re Marsella’) highlights the importance of trustees of self managed superannuation funds (‘SMSFs’) exercising their discretion to pay death benefits in good faith, with real and genuine consideration and in accordance with the purpose for which their power was conferred.click here for more…

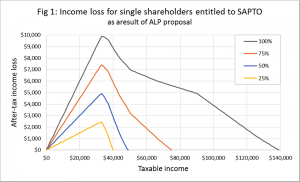

Labor’s superannuation and related proposals

15 February, 2019By Daniel Butler, Director (dbutler@dbalawyers.com.au) and Shaun Backhaus, Lawyer (sbackhaus@dbalawyers.com.au)

Introduction

The next Federal election, according to our current Prime Minister Mr Scott Morrison, will be held in May 2019 and, if the Labor Government is elected, significant change is likely. Thus, a brief ‘stock take’ of what the superannuation landscape will look like under a Labor Government is set out below.click here for more…

Total superannuation balance and limited recourse borrowing arrangements: Part 2

28 November, 2018By Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

Introduction

Under certain circumstances, an individual member’s total superannuation balance (‘TSB’) will be increased by their share of the outstanding balance of a limited recourse borrowing arrangement (‘LRBA’) that commenced on or after 1 July 2018 when the Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2018 (‘Bill’) becomes law.click here for more…

What disqualifies you from having an SMSF?

9 November, 2018By By Christian Pakpahan (cpakpahan@dbalawyers.com.au), Lawyer and Daniel Butler, Director, DBA Lawyers

Introduction

This article covers the main ways a person becomes a disqualified person, the consequences of disqualification and the options available to those who are disqualified. (We refer to a trustee in this article as covering both individual trustees of an SMSF and directors of SMSF corporate trustees.)click here for more…

Total superannuation balance and limited recourse borrowing arrangements: Part 1

20 November, 2018Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and Bryce Figot (bfigot@dbalawyers.com.au), Special Counsel, DBA Lawyers

Introduction

If the Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2018 (‘Bill’) becomes law, an individual member’s total superannuation balance (‘TSB’) may be increased by their share of the outstanding balance of a limited recourse borrowing arrangement (‘LRBA’) that commenced on or after 1 July 2018.click here for more…

The new ‘ipso facto’ regime and SMSFs

13 November, 2018By Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

Introduction

The new law pertaining to ‘ipso facto’ clauses came into operation on 1 July 2018. This article highlights the relevance of the new law for SMSFs. Note that the law in this area is complex and a detailed and careful analysis is required to properly understand how the new ‘ipso facto’ regime operates.click here for more…

Minimising lost opportunity: Payments above Account-Based Pension (‘ABP’) minimum

15 October, 2018By Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

Introduction

Significant time has passed since the introduction of the transfer balance cap (‘TBC’). During this period, many have become aware of the potential trap caused by the TBC for SMSF members who receive payments above the account-based pension (‘ABP’) minimum annual amount, and have responded by implementing various strategies to avoid this trap. This article shows that timely action can minimise any further opportunity cost resulting from the trap.click here for more…

Stocktake on recent superannuation changes – when will the Government give us a long-term vision?

17 July, 2018By Daniel Butler, Director, DBA Lawyers

Introduction

We have recently experienced substantial superannuation changes during the period of 1 July 2017 to 30 June 2018. I therefore provide a brief ‘stocktake’ of the changes introduced by the current Coalition Government. A number of these policies were adverse to many members.click here for more…

Proposed SG amnesty raises opportunities and risks

18 July, 2018By Christian Pakpahan, Lawyer and Daniel Butler, Director, DBA Lawyers

Introduction

On 24 May 2018, the government announced a 12 month superannuation guarantee (‘SG’) amnesty (‘Amnesty’) that proposes to give employers an opportunity to rectify past SG non-compliance without penalty. If the Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2018 (‘SG Bill’) is ever made law, the Amnesty period will apply from 24 May 2018 and run for a 12 month period to 23 May 2019.click here for more…

Strategies to reduce your total superannuation balance: Part 1

30 May, 2018Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and William Fettes (wfettes@dbalawyers.com.au), Senior Associate, DBA Lawyers

Introduction

An individual’s total superannuation balance (‘TSB’) determines many of their superannuation rights and entitlements, such as eligibility to contribute after-tax amounts into superannuation without an excess arising.click here for more…

Strategies to reduce your total superannuation balance: Part 2

25 June, 2018Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and William Fettes (wfettes@dbalawyers.com.au), Senior Associate, DBA Lawyers

Introduction

An individual’s total superannuation balance (‘TSB’) determines many of their superannuation rights, entitlements and obligations. Accordingly, there is a strong incentive for individuals to carefully monitor their TSB over time, particularly towards the end of a financial year (‘FY’) when most TSB thresholds are tested.click here for more…

Strategies to reduce your total superannuation balance: Part 3

14 August, 2018Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and William Fettes (wfettes@dbalawyers.com.au), Senior Associate, DBA Lawyers

Introduction

Due to the importance of total superannuation balance (‘TSB’) testing under the major superannuation reforms, fund members have a strong incentive to carefully monitor their TSB over time and plan accordingly to moderate their TSB to fall within certain key thresholds.click here for more…

Can SMSFs invest in Bitcoin?

29 May, 2018Shaun Backhaus (sbackhaus@dbalawyers.com.au), Lawyer and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

Introduction

While there are a large number of cryptocurrencies in existence (currently over 1600), this article will focus on Bitcoin for simplicity. Our comments contained here may apply to other cryptocurrencies with the same characteristics as Bitcoin.click here for more…

How the Federal Budget 2018 will impact SMSFs

15 May, 2018By Christian Pakpahan, Lawyer and Daniel Butler, Director, DBA Lawyers

Introduction

We outline below the key superannuation changes announced in the Federal Budget 2018 on 8 May 2018. Some of the proposed changes will have a substantial impact on SMSFs if they are finalised as law.click here for more…

Total superannuation balance milestones

16 May, 2018Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and William Fettes (wfettes@dbalawyers.com.au), Senior Associate, DBA Lawyers

Introduction

The total superannuation balance (‘TSB’) is one of the most important new concepts introduced as part of the major superannuation reforms that broadly came into effect on 1 July 2017. Many superannuation obligations and rights depend on a member’s TSB: broadly the total amount a person has in all Australian superannuation funds, including amounts in pension phase and accumulation phase. This article aims to highlight the main TSB milestones that individuals and advisers need to be aware of under the new super rules.click here for more…

Excess concessional contributions charge

12 February, 2018Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

Introduction

Contributions made in excess of an individual’s concessional contributions (‘CC’) cap can give rise to extra tax payable and a liability to excess CC (‘ECC’) charge for the individual. This article highlights how the ECC charge operates. Note that the law in this area is complex and a detailed and careful analysis is required to properly understand how the ECC system operates.click here for more…

Draft law aims to shut down a gap in the salary sacrifice regime

5 October, 2017By Gary Chau (gchau@dbalawyers.com.au), Lawyer, and Bryce Figot (bfigot@dbalawyers.com.au), Special Counsel, DBA Lawyers

Introduction

A salary sacrifice arrangement is still worthwhile post-30 June 2017 since some employees find it both administratively easier and tax effective for their employer to contribute more into superannuation in lieu of their future salary and wages. Unfortunately, some employees will be let down by a gap in the way our salary sacrifice regime operates, which allows employers to meet their mandated superannuation guarantee (‘SG’) obligation and overall contribute less money to an employee’s superannuation fund. However, a draft law aims to close this gap.click here for more…

Minimising lost opportunity: Payments above Account-Based Pension (‘ABP’) minimum

15 October, 2018By Joseph Cheung (jcheung@dbalawyers.com.au), Lawyer and Daniel Butler (dbutler@dbalawyers.com.au), Director, DBA Lawyers

Introduction

Significant time has passed since the introduction of the transfer balance cap (‘TBC’). During this period, many have become aware of the potential trap caused by the TBC for SMSF members who receive payments above the account-based pension (‘ABP’) minimum annual amount, and have responded by implementing various strategies to avoid this trap. This article shows that timely action can minimise any further opportunity cost resulting from the trap.click here for more…

Recent Posts

- Superannuation tax: Why the total balance threshold should be shelved

- Super tax plan ‘flawed’ and should be ditched says Centre for Independent Studies

- Labor not budging on super reforms

- SMSF Association lambasts proposed earnings calculation

- SMSF Association Submission – Better Targeted Superannuation Concessions: Consultation Paper

- Millions of young Australians could be hit by Jim Chalmers’ superannuation tax

- Ex-Treasury official Terry O’Brien slams Jim Chalmers’ super tax hike

- Better targeted superannuation concessions: consultation paper

- Legislating the objective of superannuation: Consultation paper, 20 February 2023

- A Stronger And Cleaner Economy, Powered By Super

- Politicians don’t want to meddle with super

- Budget 2022: Treasurer reassures retirees as budget super tax fight looms

- A 1976 deed can’t be found … trust fails as a result!

- ATO focus on CGT relief may have big impact on SMSFs

- Non-arm’s length income – A history and overview