12 March 2020

Jim Bonham

1 Introduction

Between now and 2025 the compulsory “superannuation guarantee” (SG) contribution to superannuation is legislated to increase in steps from 9.5% of gross income to 12%.

This move is being opposed by some people, particularly the Grattan Institute (see https://grattan.edu.au/report/money-in-retirement), amplified by op-eds in the press.

Unfortunately, formal “think tank” and academic reports tend to be inaccessible to the average reader. Calculations may be opaque; and journalists often manage to make the impending increase look quite complicated and confusing.

It does not have to be so. This short note explores the immediate consequences of the legislated increase in the SG rate from 9.5% to 12% and introduces an alternative proposal to increase the SG rate to 10%, or even leave it unchanged, and drop the contribution tax entirely.

Click here to download PDF version

2 The issues

The table below lists what I perceive to be the main points of concern, and a brief comment on each. This is provided for context, not as a detailed commentary on any specific position.

| Perceived problem | Comment | |

| (a) | Retirees already have enough money so there is no need to beef up super. | Depending on investment returns, current SG contributions will only provide an initial retirement income of 14% to 25%, or so, of final employment income (depending on investment choices). |

| (b) | Increasing the SG rate will depress incomes. | The government has reportedly asked ANU to advise specifically on this issue. Gross incomes will fall by 2.23% (given assumptions detailed in the text), but there is an alternative. |

| (c) | Increasing retirees’ assets will disproportionately reduce their age pension entitlement | This reflects a problem with the structure of the age pension, not super. In any event it will take a decade or so to become significant, leaving plenty of time to fix the structural issue. |

| (d) | The budget can’t afford the cost | The cost to the government of the planned increases, per employee, is equivalent to about 0.5% of their gross income – the equivalent of a modest tax cut. |

Each of these issues is discussed in more detail below. The intention is not to provide detailed rebuttals of any specific point of view, but rather to add context to the upcoming increase, and to suggest an alternative approach.

3 How much does the SG provide?

It can be a daunting task to work out how much superannuation one will have in retirement, what its real value will be and how that might relate to one’s income needs.

Fortunately, help is available from on-line calculators such as the excellent one provided by ASIC (https://moneysmart.gov.au/how-super-works/superannuation-calculator) which also provides detailed actuarially determined estimates of long term investment returns, fees and earnings for several common investment styles, as well as estimates of inflation and wages growth (as reflected in rising living standards).

A common measure, used by the OECD for example, for assessing retirement funding systems is the replacement ratio, which is the initial income in retirement divided by the final employment income. (Obviously, this only makes sense for someone who remains in steady employment up to retirement and doesn’t apply to those with a more fractured employment history).

It is generally accepted that a replacement ratio of 70% represents good practice and, in the absence of better information, it seems to “feel” about right.

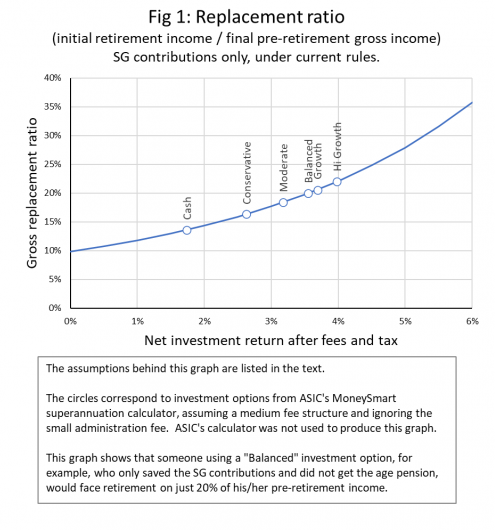

Fig 1 shows the replacement ratio expected just from current SG contributions and their compounded investment returns, assuming

- SG rate is 9.5%, taxed at 15%

- Wages growth is 3.2%

- Length of employment is 45 years

- On retirement, superannuation is converted to an allocated pension from which 5% per annum is drawn as income in the early years.

- Complications such as contribution caps are ignored.

The simple conclusion from Fig 1 is that, however the superannuation account is invested, the SG contributions alone will not provide anything like a 70% replacement ratio.

Most people will need to supplement their SG contributions substantially with further voluntary superannuation contributions, the age pension, or other investments outside superannuation, in order to live at a level anything like what they were used to.

There is thus a lot of scope to increase the SG contributions, which goes a long way toward refuting Issue 2(a).

4 How will the SG rate increase affect pre-retirement incomes?

To keep things simple, we’ll exclude from consideration those who are on a very low income, those who are subject to Division 293 tax (incomes over $250,000) and those who are already at or near the concessional contribution cap. We’ll also assume that all income derives from employment. Finally, in the interests of simplicity, we’ll assume that the increase takes place in one step rather than being staged over several years.

It is highly likely that employer bargaining power is such that increasing the SG contribution rate will not affect total income packages (i.e. gross income plus SG contributions). The calculations below assume that this is so – it is a key assumption of this paper.

Note, however, that in real life salary negotiations are not necessarily cut and dried. So, a push to restore a previous total package value might not be immediate but be buried in subsequent increments, or it might manifest as additional pressure in future negotiations.

To be able to work this through mathematically, however, we make the simplifying assumption that incomes will adjust immediately.

It’s also important to keep in mind that while a mathematical model produces precise, neat and tidy results, these are only as good as the initial assumptions – the real world is much messier. The important function of an analysis such as this one is not so much to produce precise predictions, but rather to lay bare the way in which key variables (in this instance: income, income tax, SG rate and contribution tax) all interact. Better understanding should lead to better decision making.

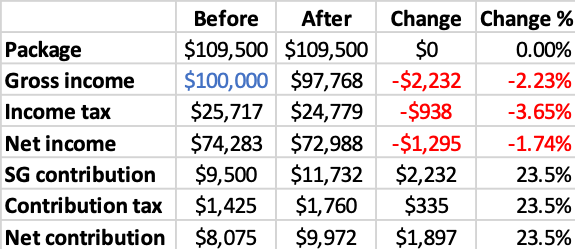

With these cautions in mind, let’s move on. Some straightforward arithmetic, illustrated in Table 1, shows that the immediate consequences of increasing the SG rate will be as follows:

- SG contributions will rise by 23.5%

- Gross incomes will fall by 2.23%

- Net SG contributions will rise by 23.5%, corresponding to 1.90% of initial gross income

- Government income tax receipts will fall by an amount which depends on income.

Table 1 shows how the numbers work out for an initial gross income of $100,000:

Table 1

- The top line reflects the assumption of no change in the total income package

- so, there must be a drop in gross income (2nd line)

- and therefore, the government’s income tax receipts will fall (3rd line)

- as will the individual’s net income (4th line).

- The SG contribution goes up by 23.5% (5th line).

- The government claws back an extra 23.5% contributions tax (6th line)

- leaving a net contribution which is also 23.5% higher than before (7th line).

In summary, the superannuation account of the individual currently earning $100,000 nets an extra $1,897 per year. In the short term, this is a zero-sum game (the savings have to be paid for): $1,295 is provided by the individual (reduced net income offset by lower income tax) and $603 is provided by the government (reduced income tax receipts offset by higher contribution tax).

In other words, the individual saves more, and the government also contributes.

Although this is a zero-sum game in the short term, that is not the case in the long term. Superannuation savings provide a massive investment resource for the nation, and a more financially secure retiree population will require less government support. There is a large net benefit to the nation from supporting and incentivising long-term saving.

Although Table 1 is worked for $100,000 initial gross income, the same 2.23% fall in gross income and 23.5% increase in net SG contribution occurs for any other initial income.

The boost to SG contributions then flows through to provide a valuable 23.5% increase in the value of SG contributions and their accumulated investment returns at any time through to retirement, and consequently the same percentage increase in both earnings and earnings tax.

A partial response to Issue 2(b), therefore, is: yes, the planned increase in SG rate will depress gross incomes by 2.23%.

5 How is the cost shared between government and individual?

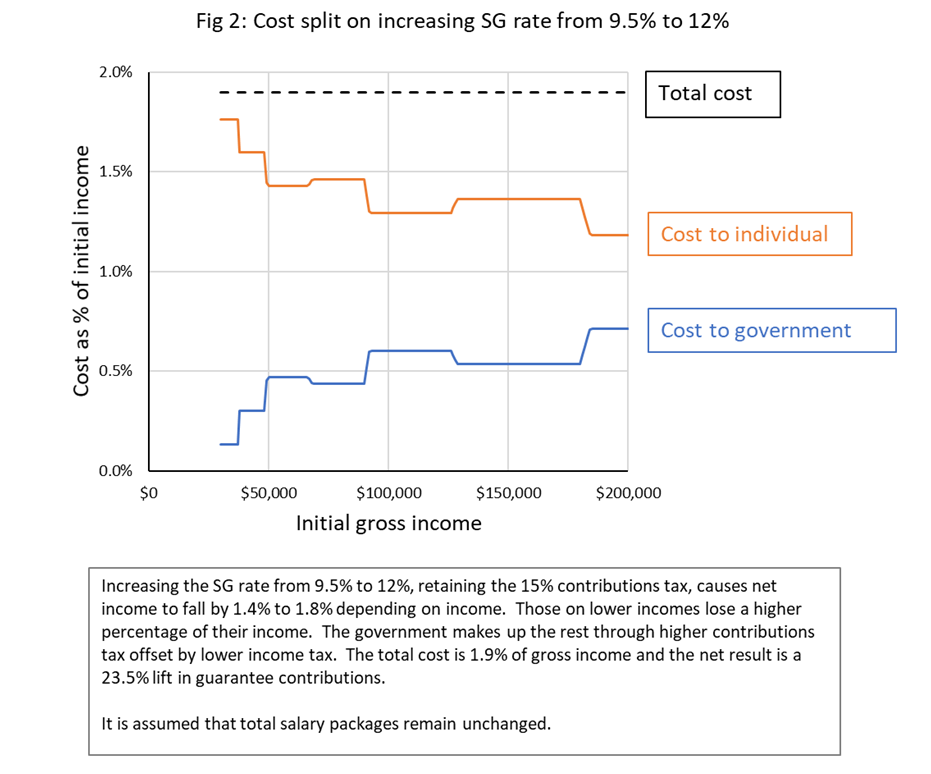

Before the increase, the net SG contribution is 8.075%, after allowing for the 15% contributions tax, so a 23.5% increase in that corresponds to 1.90% of the initial gross income. That 1.90% must be paid for, and as we have seen the cost is shared between the individual and the government.

Fig 2 shows the split for a wide range of initial incomes, the structure in the graphs reflecting the complicated structure of income tax rates.

The cost to government averages about 0.5% of gross income (for incomes between $50,000 and $180,000) and that helps put Issue 2(d) in context: it is of similar magnitude to a modest income tax reduction.

The cost should not be onerous for the government and could be funded by cancelling or reducing less important programs, or by working with greater efficiency (meant literally, not as a euphemism for sacking people which only pushes costs back to individuals).

Incidentally, the cost to government is sometimes compared to the cost of fixing other significant problems, such as Newstart. This is the wrong way to evaluate the priority of a project: it should be compared to the least important project, which can most easily be dropped, not to other important projects.

6 How quickly will the effects be felt?

The effects on net income and taxes discussed above will be immediate, but the impact on retirement income will take time to evolve – about a decade for effects to become noticeable and four decades for the complete benefit.

Superannuation operates over the very long term, which means the sooner problems are fixed the better. The current financial climate does not justify delay.

Two issues which will eventually emerge but will be insignificant for the first couple of decades are:

- Earnings taxes on superannuation investments will increase by 23.5%.

- Age pension entitlements will decrease for people on low-to-moderate-incomes.

Both benefit the government. However, the age pension needs significant modification to correct other fundamental problems:

- The asset test taper rate is unreasonably high, and this is the direct cause of the concern expressed in Issue 2 (c). The issue has been widely discussed, for example see https://saveoursuper.org.au/retirement-income-savings-trap-caused-coalitions-2017-superannuation-age-pension-changes/

- Inappropriate indexing creates inbuilt instabilities in the age pension which will make it harder to get and less generous in the future. This is a little-known but serious long-term structural deficiency. See https://saveoursuper.org.au/wp-content/uploads/Retiree-time-bombs.pdf

In short, there is plenty of time and opportunity to make sure that Issue 2(c) will not become a problem.

7 An alternative proposal

The above calculations highlight something quite bizarre about concessional superannuation contributions: the superannuation guarantee compels people to save for their retirement, but the contributions tax immediately undermines that – now you see it, now you don’t!

The system would be much neater and easier to understand if the contributions tax were abolished.

That would also make voluntary concessional contributions (up to the cap) more attractive, thus encouraging more saving, but let’s look more closely at what it would mean for compulsory SG contributions.

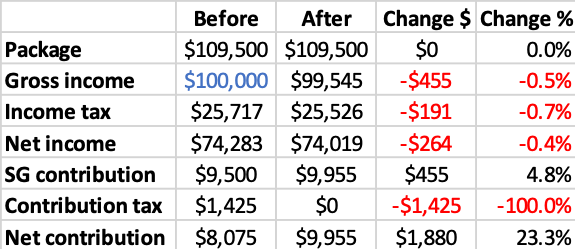

As we have seen the upcoming increase in SG rate will increase compulsory net contributions to superannuation by 23.5%, given the assumption that gross incomes are unaffected, so let’s take that as an objective and see how it would be achieved without the contributions tax.

The answer is that the SG rate then only needs to be increased to 10%, rather than 12%. Net contributions will increase by 23.3% which is almost identical to 23.5%, but the split in cost between the government and individual is changed significantly.

Table 2 shows the detailed figures for a gross income of $100,000:

Table 2

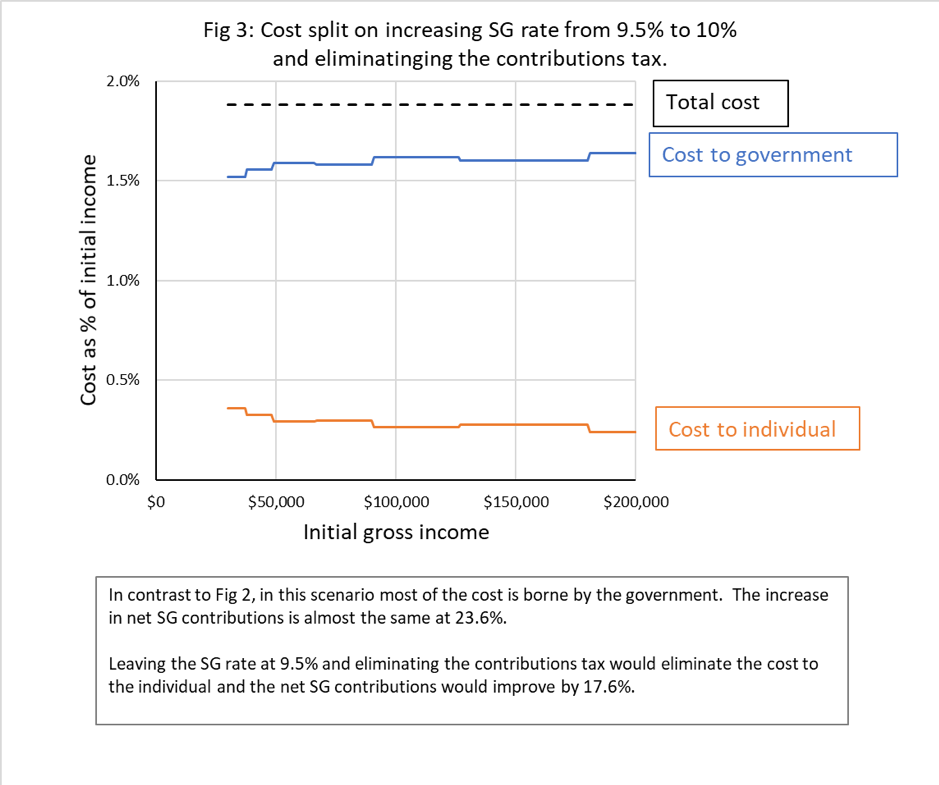

and Fig 3 shows the split in costs between government and individual for a range of gross incomes:

From the government’s point of view, this proposal is more expensive by about 1% of gross income than the increase currently legislated – it is still the equivalent of a modest tax cut across the board. Staging this change over several years would further reduce the budgetary shock.

From the individual’s point of view, the cost has reduced to about a quarter of a percent of gross income, which in normal times most people would not notice.

However, these are not normal times: the aftermath of this summer’s fires and the developing coronavirus scenario mean that many people are or will be under severe financial pressure. The government is currently working to provide significant stimulus in response. The government has also reportedly asked ANU to advise the government on whether the upcoming increase will affect incomes.

As shown above, they certainly will do so, and it is tempting to see this as a strong argument against making any increase at all.

However, it is easy in times of crisis to neglect long term issues, banking problems for future generations.

The government could find it attractive, therefore, to demonstrate a continued commitment to long term saving by dropping the contributions tax, while leaving the SG rate at 9.5% so there is no additional cost for individuals.

If that approach is followed, the boost to net SG contributions will be 17.6% instead of 23.5% – a little less, but still a sizeable improvement for the long term.

To see what that would mean, we return to Fig 1 and consider someone who chooses a “Balanced” investment option for their super. Using ASIC’s figures, that would give a replacement ratio of 20% under the current rules for the assets derived from SG contributions.

The initial retirement income would thus be 24.7% of final employment income under the current plan (23.5% improvement), or 23.5% of final employment income if the SG rate remains at 9.5% and the contributions tax is dropped (17.6% improvement). Either way, it is a significant improvement, while still leaving a considerable gap to be filled by extra voluntary saving, or the age pension, depending on the retiree’s circumstances.

8 About the author

Jim Bonham (BSc (Sydney), PhD (Qld), Dip Corp Mgt, FRACI) is a retired scientist (physical chemistry). His career spanned 7 years as an academic followed by 25 years in the pulp and paper industry, where he managed scientific research and the development of new products and processes. He has been retired for 14 years and has run an SMSF for 17 years. He will not be affected by any change to the superannuation guarantee.

***************************************************